- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 2024 NY estimated taxes I paid -- how to enter on Turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2024 NY estimated taxes I paid -- how to enter on Turbotax

I paid NY taxes as specified by TurboTax last year. How do I enter these payments on my NY State 2024 tax return?

It is not obvious how I might enter the fact that I made these payments. It seems not possible on EasyStep. Is their a way to enter it on Forms?

Thanks very much

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2024 NY estimated taxes I paid -- how to enter on Turbotax

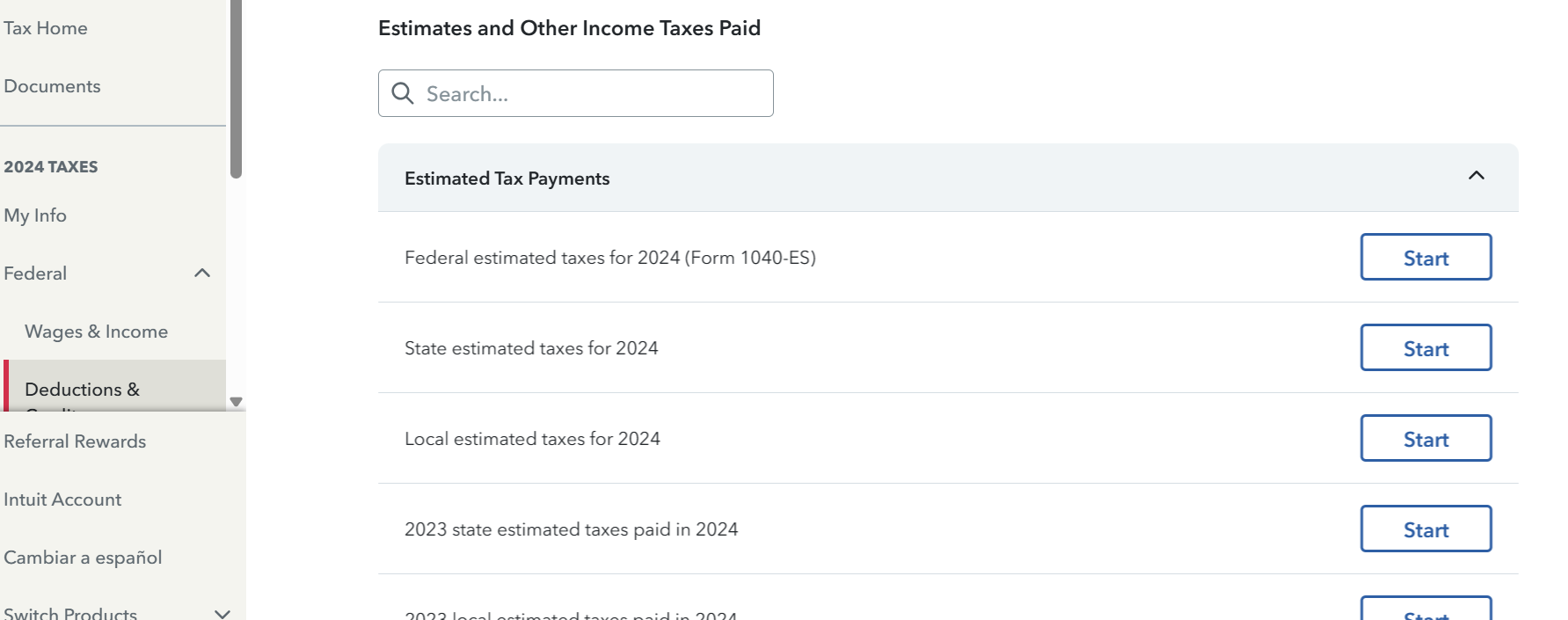

Enter any Federal/Local/State tax payments made into the TurboTax program and it will be routed to the correct tax form. See image below.

Add/Edit/Delete Federal/State/Local Tax Payments:

- Open your return (if not already open).

- Enter "state tax payments" in the Search box.

- Click on "jump to state tax payments" link.

- Enter you Estimates and Other Income Taxes Paid information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2024 NY estimated taxes I paid -- how to enter on Turbotax

To enter Federal or State Estimated Taxes Paid, including a state estimated payment made in January for the prior year, go to

Federal on left or at top (Personal for Home & Business)

Deductions and Credits

Then scroll way down to Estimates and Other Taxes Paid

Estimated - click the Start or Update button

You enter state estimated payments under the federal side (because they can be a federal itemized Deduction). THEN after you finish filling out the estimates under Federal you need to click on the State Tab at the top and start the state return over for it to update.

You have to pick the right state from the drop down box and enter the right payment dates.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rodiy2k21

Returning Member

elgato81

Level 2

Th3turb0man

Level 1

mschipani87

New Member

tkrmnlv11

New Member