- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 2022 Turbo Tax Premier, California State fails to deduct 2022 estimate taxes paid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbo Tax Premier, California State fails to deduct 2022 estimate taxes paid.

I started using 2022 TurboTax Premier on Dec 1, 2022, and I noticed that when I entered the 2022 Estimate tax payments for California, my state Tax due did not change at all.

Looks like there is a bug or the program is not ready yet. They are not deducting the State estimate tax payments from the total amount of tax due to the state of California.

When is 2022 Turbo Tax going to be ready for the California State?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbo Tax Premier, California State fails to deduct 2022 estimate taxes paid.

That seems like a pretty basic function as it's in each year and hasn't changed. Maybe you entered the estimates in the wrong place? And after you first add them on the federal side you need to start the state over for it to update. Which means you might need to delete state ad add it in again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbo Tax Premier, California State fails to deduct 2022 estimate taxes paid.

The program is not fully functional and state programs are not yet available. The IRS will not process returns until late in January so don’t rush the completion of your return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbo Tax Premier, California State fails to deduct 2022 estimate taxes paid.

@fg2001gf - there are probably A LOT of bugs in TT for the time being. this happens every year. You'll note a lof of forms state they are not ready to file. Everything will be cleaned up by the tile the IRS and CA permit filing for 2022; that will be in late January,

Lesson LEarned: do NOT be in a rush to file. We find those are the ones that need to fi,le amendments. THat is a PAIN; amendments are taking the IRS six months or longer to process!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbo Tax Premier, California State fails to deduct 2022 estimate taxes paid.

NCPerson, Bsch4477,

That is not the point! I never file early. I'm just reporting yet another bug.

Also, I use Turbo Tax to adjust my last payment of the 2022 Estimate Taxes due before January 15, 2023.

Not good if the program has a bug like this. 😝🤬

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbo Tax Premier, California State fails to deduct 2022 estimate taxes paid.

Yeah....I know that's an issue form folks who get and use the program early (meaning before mid-late-January)

TTX doesn't "implement" the new year's changes until much later than people expect.....many times not until well into January. This is how TTX has operated for more than 20 years, and I don't expect them to change it in the future (but who knows....miracles happen)

_________________________________

In Desktop software only

For Federal taxes: For the next year's estimates and predictions, I find it much better to just use the "What If" form from the previous year's (2021) Desktop software, and then check the box at the top of the column to use the next year's tax settings. This is usually close enough.

For State taxes: Since state forms aren't normally ready in December (Again using desktop software) you would have to do a Save-AS of the prior year's file to a "Test2022" file name in the 2021 software . Make the changes you expect for 2022 in that 2021 file, and see what happens in the state section.

(This can also work most years for Federal, BUT with all the EIP/Child Credit changes between 2021 and 2022, I'm not sure how far off the result might be this time)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbo Tax Premier, California State fails to deduct 2022 estimate taxes paid.

Until the form is operational there are no bugs to report ... it is just an incomplete section of the program so reporting these "bugs" is not needed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbo Tax Premier, California State fails to deduct 2022 estimate taxes paid.

@fg2001gf - it's not a bug; this is usually the case for many forms as the State and the IRS has not released the FINAL forms - note that the form is highlighed as "DO NOT FILE" in the upper right corner, indicating it is not the final.

Does the CA form state 'DO NOT FILE" on it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbo Tax Premier, California State fails to deduct 2022 estimate taxes paid.

That seems like a pretty basic function as it's in each year and hasn't changed. Maybe you entered the estimates in the wrong place? And after you first add them on the federal side you need to start the state over for it to update. Which means you might need to delete state ad add it in again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbo Tax Premier, California State fails to deduct 2022 estimate taxes paid.

Yes, it is a pretty basic function and it worked fine every year except this time.

I sure did not enter the state estimate tax in the wrong place, it even showed a message for the total state estimate tax paid for the year, but it just did not detract the amount from the state tax owed.

Maybe I picked the wrong state?

I'll check again, I'm sure it has to be something pretty basic. 🤣🤷♂️

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbo Tax Premier, California State fails to deduct 2022 estimate taxes paid.

It's probably the wrong state. That's common. Let me know if you figure it out. I haven't bought my Turbo Tax yet and I'm in CA too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbo Tax Premier, California State fails to deduct 2022 estimate taxes paid.

Hello,

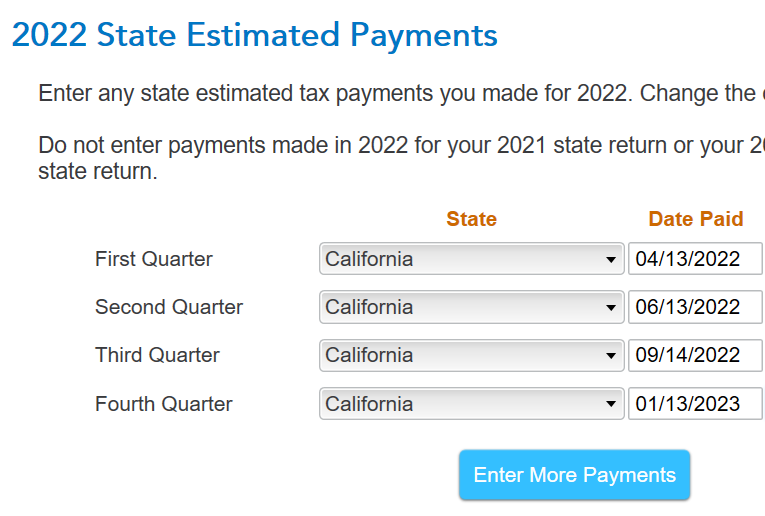

I think I just made the wrong assumption.

I thought it was going to fill the slots by default with the state that I selected for the State Turbo Tax program which is California.

But I actually had to fill up California in each payment slot showing below. 🤣😎

That fixed my issue.

Sorry, my mistake this time. 😒

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbo Tax Premier, California State fails to deduct 2022 estimate taxes paid.

In Federal return I entered 4 quarterly MA Estimated Taxes paid in the amount of $370 per quarter which equals $1,480 (Quarter 1,2,3 paid on time in 2022 and Quarter Q4 MA tax paid 1/15/23).

In addition, the Federal Other Deductions automatically includes 2021 MA Estimate Tax Paid in January 2022 for $370.

The MA State Tax Return only shows $1,110 MA Est. Tax Paid ($370*3) when it should show the amounts entered in the Federal Other Deductions module of $1,480 ($370 * 4)

Can I override the MA Tax Return to show $1,480 Estimated tax paid during 2022 to equal $1,480?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbo Tax Premier, California State fails to deduct 2022 estimate taxes paid.

No. You need to figure out what is wrong. You either picked the wrong state on one of them or left one out. Go back and check them all again. Then start the state return over for it to update.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbo Tax Premier, California State fails to deduct 2022 estimate taxes paid.

Go back and check the state you selected for each of those 4 Quarterly 2022 payments. Sometimes a cursor slip will select a state adjacent to MA. (also double check each date)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 Turbo Tax Premier, California State fails to deduct 2022 estimate taxes paid.

I re-confirmed the MA Estimated Tax was entered correctly in the Federal Other Deductions module.

When I went back through the MA State Income Tax Return through the review/update process the

MA amounts were now correct and matched what I was expecting.

Problem Solved.

Thank you for you patience.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

davegoldfarb

New Member

1099erGirl

Level 3

lasgal

New Member

KarenL

Employee Tax Expert

skibum11

Returning Member