- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 2022 overpayment applied to 2023

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 overpayment applied to 2023

If I apply my 2022 overpayment to my 2023 taxes, does Turbotax take that amount into account when it calculates my quarterly estimates for 2023?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 overpayment applied to 2023

Yes, If you do choose to apply your refund to next year's taxes, the refund amount will apply to the first estimated payment until all of the refund has been used.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 overpayment applied to 2023

Yes, If you do choose to apply your refund to next year's taxes, the refund amount will apply to the first estimated payment until all of the refund has been used.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 overpayment applied to 2023

Yes, overpayment refunds applied to the next year are incorporated in the estimated quarterly payment for 2023.

- Open your return.

- Enter apply federal refund to next year in the Search box.

- Click on Jump to apply federal refund to next year.

- Proceed through interview screens.

The amount applied to next years taxes will be shown on Form 1040 Line 36.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 overpayment applied to 2023

i do not see a jump to link

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 overpayment applied to 2023

@cjwmin wrote:

i do not see a jump to link

To add, change or delete a current year federal tax refund to next year's taxes before you file your tax return -

- Click on Federal Taxes (Personal using Home and Business)

- Click on Other Tax Situations

- Under Additional Tax Payments

- On Apply Refund to Next Year, click on the start or update button

Or type in apply federal refund to next year in the Search box located in the upper right of the program screen and press Enter. Click on Jump to apply federal refund to next year

The amount applied to next years taxes will be shown on Form 1040 Line 36

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 overpayment applied to 2023

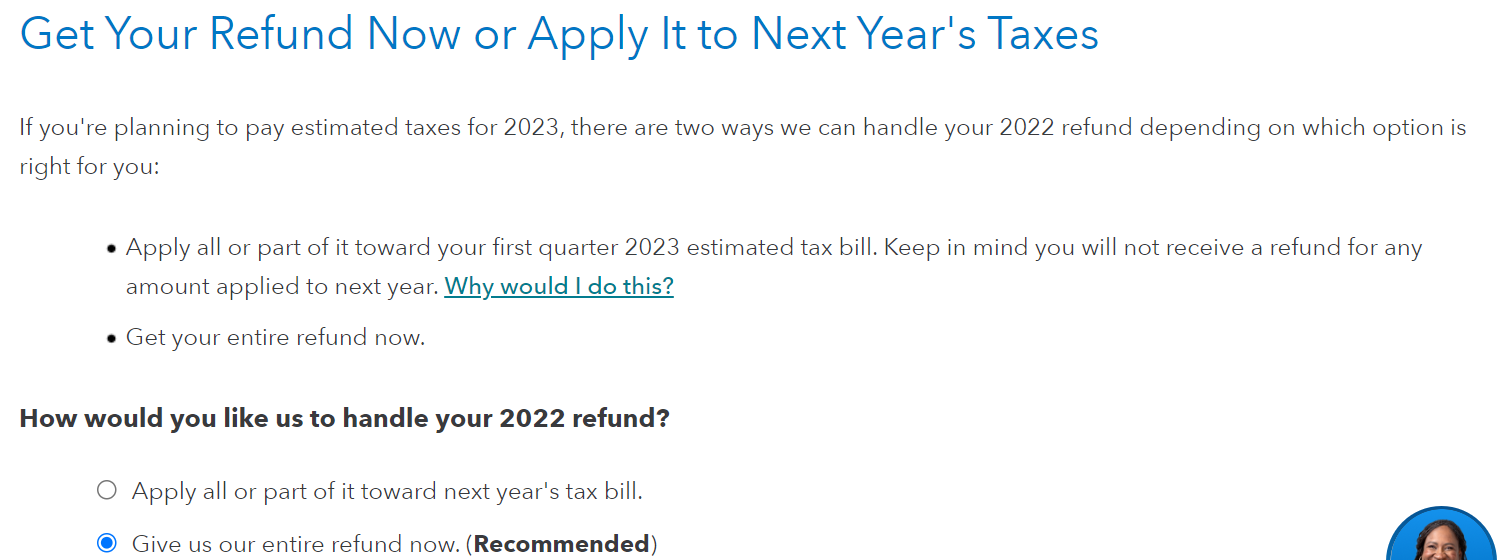

To apply your refund to next tax year, please follow these steps:

- Open your return.

- Under Federal Taxes, tap Other Tax Situations.

- Tap Additional Tax Payments

- Click on apply Refund to Next Year.

See the screenshot below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

aaronkeno

New Member

mackinnondm

New Member

emver

New Member

db129

Level 1

TaxHerton123

Level 1