- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099-R Split

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Split

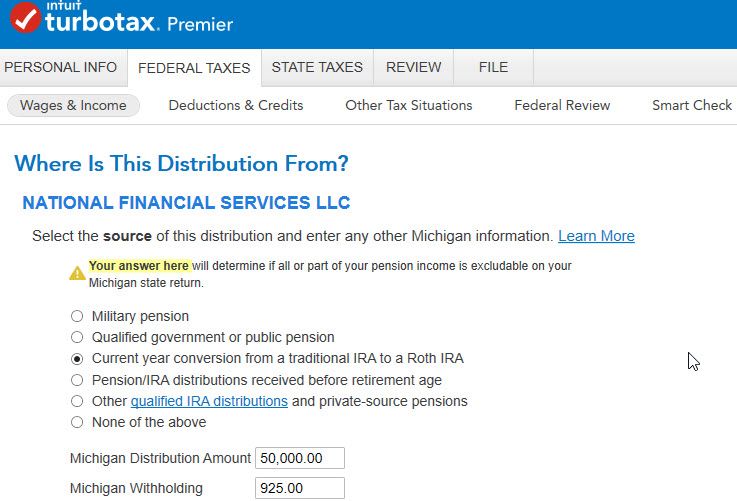

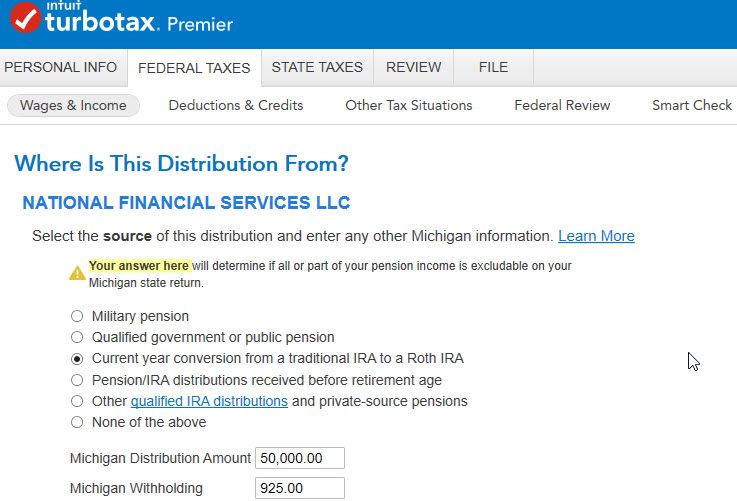

Code C: (Current year conversion from IRA to Roth IRA)

I am working on the 1099-R section of the federal return. I do not understand how to fill this out. The 1099-R shows $50K removed form the IRA. $20K went into a savings account. $30K was conversion into a Roth. What do I put down for Michigan conversion amount? 20K, 30K or 50K?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Split

Please enter $50,000 as the MI distribution amount and 30,000 as the MI conversion amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Split

But there is only one line to to enter the distribution value on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Split

Please enter $50,000 as the MI distribution amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

leiawang89

New Member

rmdflr

New Member

rlheest

Level 1

kerschner1022

New Member

Nicki9

Level 1