- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099-R Pension is a Qualified plan. 1099 R form Box number 7 is typed 7. Shouldnt it be Q for qualified?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Pension is a Qualified plan. 1099 R form Box number 7 is typed 7. Shouldnt it be Q for qualified?

1099-R Pension is a Qualified plan. 1099 R form Box number 7 is typed 7. Shouldn't it be Q for qualified?

Gosh after five years, I have been entering into turbo tax the number that is typed in box number 7 as 7. Thats what is typed in the form. This year, I realized doesn't it need to be marked Q?

7 means normal distribution. I am so confused now and wondering if this is wrong or correct? Please help explain. Why is it a normal distribution when it is qualified? So confusing. Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Pension is a Qualified plan. 1099 R form Box number 7 is typed 7. Shouldnt it be Q for qualified?

The correct code is 7. A qualified pension means it was funded with before tax money.

This means you did not pay taxes on this money when you invested it. While invested, this money will grow tax-deferred. No taxes will be owed on gains within the account each year and therefore you will not get a 1099 form each year. Qualified plans receive this special tax treatment because they were designed with retirement in mind.

Q – Qualified distribution from a Roth IRA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Pension is a Qualified plan. 1099 R form Box number 7 is typed 7. Shouldnt it be Q for qualified?

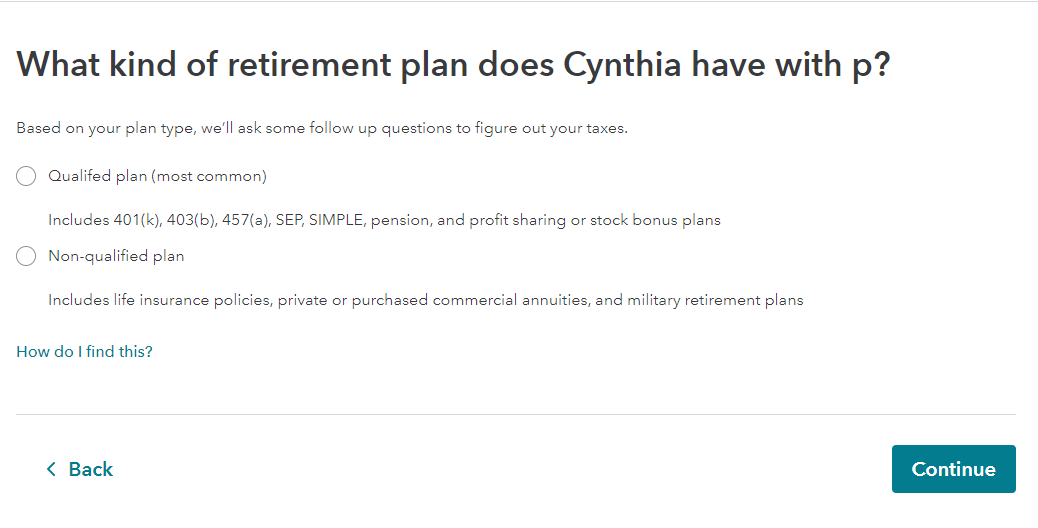

leeloo is correct. You have been doing it right for five years and didn't even know it. After you posted the information from the 1099-R you progressed through the interview. There was an opportunity to classify your plan as Qualified or Non-qualified. This is where you confirmed the plan status.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Pension is a Qualified plan. 1099 R form Box number 7 is typed 7. Shouldnt it be Q for qualified?

Thank you so much for your thoughtful reply!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Pension is a Qualified plan. 1099 R form Box number 7 is typed 7. Shouldnt it be Q for qualified?

Box 7 of your Form 1099-R should be coded as a "7". This is correct!

Per the instructions for Form 1099-R:

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 591/2; (b) for a Roth IRA conversion if the participant is at least age 591/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for reporting income from a failed life insurance contract under section 7702(g) and (h). This would be for a qualified plan.

Use Code Q: for a distribution from a Roth IRA if you know that the participant meets the 5-year holding period and: • The participant has reached age 591/2, • The participant died, or • The participant is disabled. Note. If any other code, such as 8 or P, applies, use Code J. None R—Recharacterized IRA contribution made for 2022.

Enter your Form 1099-R into TurboTax as it is shown and TurboTax will properly enter your pension distribution on your tax return.

Click here for information on entering your Form 1099-R in TurboTax.

Click here for instructions for Form 1099-R.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Pension is a Qualified plan. 1099 R form Box number 7 is typed 7. Shouldnt it be Q for qualified?

What code is in box 7 doesn't really have that much to do with being a qualified plan or not. On the screen asking if it's a qualified or unqualified plan, the small print provides examples of each. Chances are, one of those examples applies to you, so you can make the correct selection.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

2399139722

New Member

ilenearg

Level 2

Hypatia

Level 1

coachmmiller

New Member

Kh52

Level 2