- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099-NEC Received for Lawsuit Settlement Missing Information Error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Received for Lawsuit Settlement Missing Information Error

I received a 1099-NEC for an injury settlement.

When I fill out the information correctly, including that it's from a lawsuit and does not include any back wages, I get a message saying information is missing. I've included all the information on the 1099. I can't override this and I get a warning that the form will be deleted if I don't complete the missing information.

Dozens of other people appear to be running into the same issue. What is the solution? Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Received for Lawsuit Settlement Missing Information Error

We are aware of this experience and I would like to take a deeper look at this. However, I need a diagnostic file which is a copy of your tax return that has all of your personal information removed. You can send one to us by following the directions below:

- Sign into your online account.

- Locate the Tax Tools on the left-hand side of the screen.

- A drop-down will appear. Select Tools

- On the pop-up screen, click on “Share my file with agent.”

- This will generate a message that a diagnostic file gets sanitized and transmitted to us.

- Please provide the Token Number that was generated in the response.

@territerese

[Edited 02/14/22| 4:54pm PDT]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Received for Lawsuit Settlement Missing Information Error

Thank you for your time. That's the procedure I followed. Once you input the data from the 1099, it asks if any of these "uncommon" things apply. One of the choices is that the payment was for a lawsuit. When you check that box, it asks if any of the payment was for lost wages. Mine was not, so I answered "no".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Received for Lawsuit Settlement Missing Information Error

Token No. 1098460

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Received for Lawsuit Settlement Missing Information Error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC Received for Lawsuit Settlement Missing Information Error

To enter your 1099 NEC please follow these steps:

- Open TurboTax.

- "Pick up where I left off."

- In the left black panel, select Tax Tools > Tools > "Delete A form."

4. Delete form 1099--NEC Worksheet.

5. Continue > Sign out of TurboTax.

6. Sign back in.

7. "Pick up where I left off."

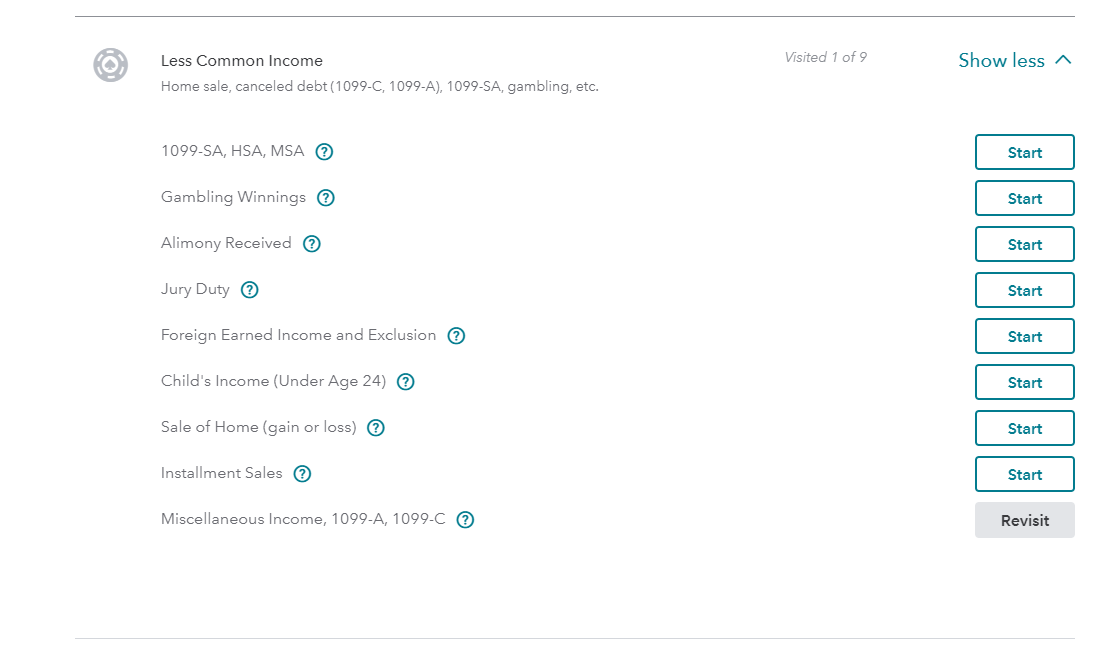

8. Wages & Income > Less Common Income > Miscellaneous Income, 1099-A,

1099C > "Start / Revisit."

9. "Other reportable income," > "Start / Revisit.

10. "On the screen, " Any Other Taxable Income?" answer "Yes."

11. Enter the 1099-NEC.

@ territerese

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ARJ428

Returning Member

DonnaTahoe1

New Member

sandyreynolds

Level 1

darichmond23

New Member

williams105

New Member