- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099-Misc Box 3

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Misc Box 3

Where do I go to click on Federal

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Misc Box 3

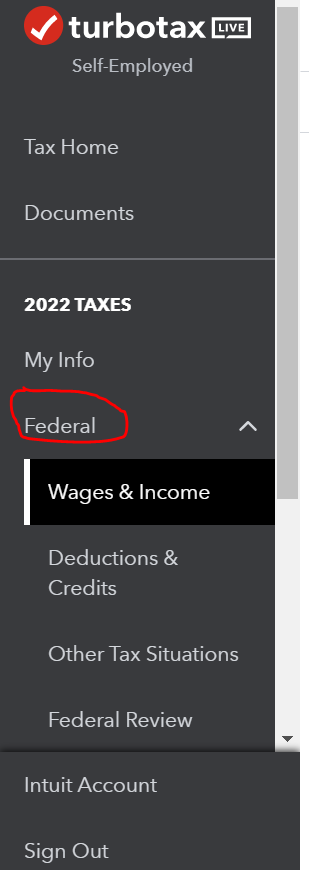

You will see Federal on your left menu bar when you are working on your tax entries in TurboTax:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Misc Box 3

see I dont see that I see the Tax Home and Documents but i dont have 2022 Taxes, My info, or Federal

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Misc Box 3

It's important to know what the money was for. If you are using TurboTax CD/Download or Desktop version, you can enter your Form 1099-MISC, box 3 as follows:

- Click the Personal Tab > Scroll to Other Common Income > Select Income from Form 1099-MISC > Select income type

- If this income did not involve your services like a main job, be sure to answer 'No', if it did then select 'Yes'

- Likewise answer based on whether it involved an intent to earn money

- Using the 'Learn More' links may be helpful

- You can also use the Search box (upper right) then type 1099misc > click Jump to....

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Misc Box 3

Thanks this work perfectly. The software has updated and includes 2022 and that option worked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Misc Box 3

I am using TurboTax Home & Business. On the final review, I have an error message-"Form 1099MISC worksheet: A link to Schedule C should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked". I went back to this area and the box is not checked. If I remove the link, I get TWO error messages. What's going on??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Misc Box 3

TurboTax is working to resolve the issue. Workaround: If the income was from self-employment you can enter it as a 1099-NEC or other cash income and you can file with no error. Form 1099-MISC and Form 1099-NEC go to the same place on Schedule C, so there will be no difference on your tax return. If you would rather wait until it is fixed, you can sign up for notifications through this link.

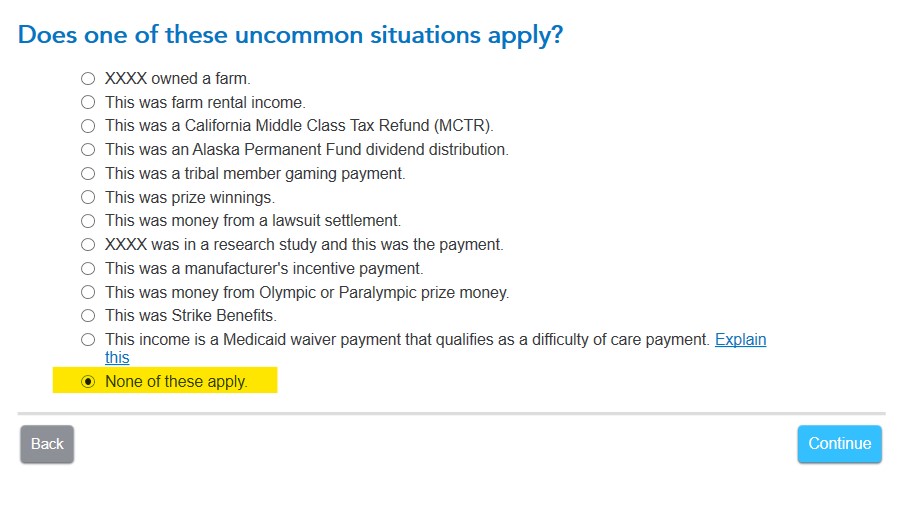

If the income is not from self-employment, you should go back and edit your entries so the income is not linked to any Schedule C. If the income is from something other than self-employment, mark the appropriate box in the ''uncommon situations'' follow-up question. If you choose None of these apply, make sure you answer the 3 follow-up questions properly. Depending on your answers there, the income may be considered self-employment. And if it is self-employment, you will either need to use the workaround above or wait until the issue is fully resolved.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Misc Box 3

I also received a 1099-Misc for solar battery incentive and followed the directions but it’s still triggering a schedule c and TurboTax is asking me to fix errors such as principal business code, accounting method, etc. How do I fix this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Misc Box 3

Enter the 1099-Misc (or click Edit at the 1099-Misc summary screen)

On the next screen Describe what the payment was for

On the next screen select "none of these apply"

On the next screen select "No it didn't involve work like my main job"

On the next screen select "I got it in 2022" ONLY (even if you get/got it in other years, this is a necessary workaround for the no intent to earn money situation)

On the next screen select No, it didn't involve intent to earn money

TT will put the amount on line 8z of Schedule 1 as other income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Misc Box 3

When going through Smart Check, it found these errors: Schedule C - Principal Business Code must be entered; Accounting Method must be entered; Required to File 1099 must be entered. Can I leave these blank and continue to file electronically?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Misc Box 3

Q. Can I leave these blank and continue to file electronically?

A. Probably not. TT will quickly tell you.

But, you will be filing the income as self employment and paying self employment tax as well as income tax. If you don't think this income is "self employment", you need to revise how you entered it and shift where TT is placing the income on the forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Misc Box 3

No. A Schedule C is for a self-employed person. I think your 1099-Misc is attached to a Schedule C.

You will want to delete Schedule C from your return and then ensure your 1099-Misc is correctly entered under Other Income.

To delete the Schedule C:

1) Open your tax return.

2) Go to the left side of the screen and click on Tax Tools, then Tools

3) From the pop-up Tools Center menu, select Delete a form

4) Scroll to find Form Schedule C and Delete it.

5) Scroll to the bottom of the list and hit the button to Continue My Return

How do I view and delete forms in TurboTax Online?

How do I delete a tax form in the TurboTax CD/Download software?

After you delete the form, ensure your 1099-Misc is entered as Other Income, as referenced in the above post by Hal_Al.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Misc Box 3

I had the same problem and couldn't get away from the Schedule C. I entered my 1099-Misc where it showed 1099-Misc. I then deleted it from there and entered it under Less Common Income, Other Income. Once the Schedule C is brought up it will not go away unless you not just delete where you originally put the income but select Edit and physically delete any info you had put in. The software has a memory of everything you entered including the name of the income source so you have to delete everything. Very frustrating but I called a representative on the HELP tab and she got it straightened out.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

harringtonjennyd

New Member

pmm41

Level 2

user17729493494

New Member

Avayatech

New Member

shoeselfee

New Member