- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099 int

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 int

My mother passed in 2023, filed her final return ok. All documents of her passing were given to the bank, a 1310 was filed with her last return, and the Estate was formed for her final return. Her bank account was closed at the beginning of March 2024, having her as primary on the account, which my son and I as secondary...was told at that time all interest income would be split between my son and myself as the accout funds were split and deposited to our accounts..her account was closed. Today 1/27/25, I received a 1099 int in her name under her social. I have contacted the bank and asked them to void that 1099 int and reissue to myself (easier this way) but they gave me a very difficult time. What is the best way to take care of this situation please??? Thanks very much in advance!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 int

This is income in respect of a decedent, income that would have been included on her final return if it was received in the year of her death. Since you filed her final return, and because you and your son received the income as beneficiary, you can each report the income you received on your individual tax returns. See Income in Respect of a Decedent

You can enter as Miscellaneous Income with "1099INT IRD with her name and last four of social" (or something similar).

If you determine the amount of income tax you paid on the amount, you can deduct under Other Deductible Expenses- Estate tax deduction not reported on an estate K-1.

I am sorry for your loss.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 int

Thank you very much! This 1099 Int came well after her death, but because the account was still in her name, is that why it came for 2024 even though we had asked the bank to declare this on our information? Since we both were on the account as well, shouldn't I try to make the bank redo the form to void her 1099int and have it resent on my social and my son's social? Don't I have the right to ask for this? I do think your suggestion is good, but I always try to avoid raising problems on my return since I do not want the IRS raising an issue...Thank you!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 int

No you do not need to have the bank reissue the 1099-INT. Each of you should report your share on your own individual returns.

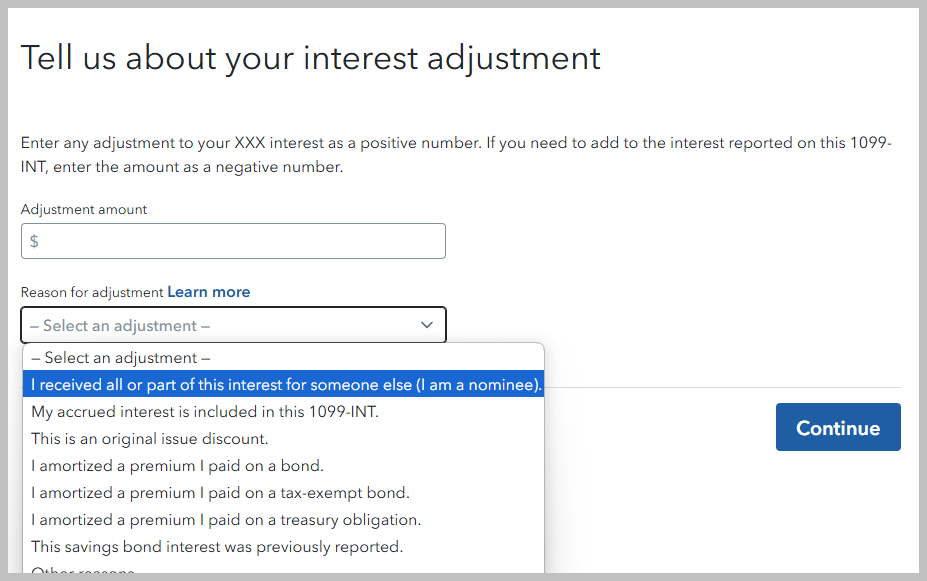

You can use the nominee selection to show the full interest and then adjust the amount so the IRS will connect the 1099-INT to your returns. Pay close attention to the screen so that you enter a positive number to reduce the total interest.

Open your TurboTax Return:

- Search (upper right) > Type 1099int > Click the Jump to.. link

- Continue selecting Enter a different way > select Interest > Select Type it myself

- Enter Bank name and interest amount (full amount from the 1099-INT > Continue

- Select 'I need to adjust the interest reported on my form.' Continue

- Enter the amount that belongs to your son > Select 'I received all or part of this interest for ......'

- Continue to finish the process. You will be taxed on only half of the interest.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 int

A sincere thank you for your response!!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

canoyk

New Member

user17709588398

New Member

brett-voice

New Member

ivod

New Member

Davesilb

Level 2