- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

No you do not need to have the bank reissue the 1099-INT. Each of you should report your share on your own individual returns.

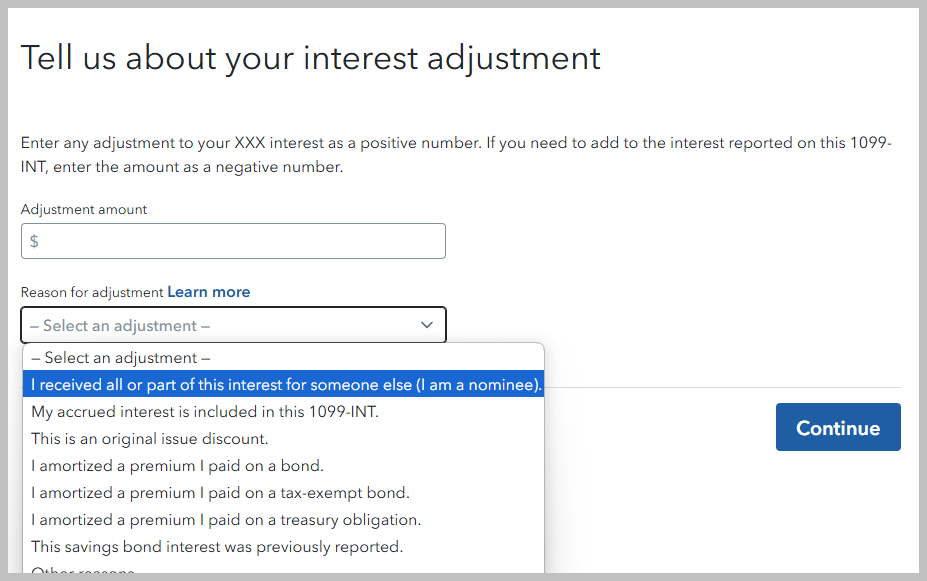

You can use the nominee selection to show the full interest and then adjust the amount so the IRS will connect the 1099-INT to your returns. Pay close attention to the screen so that you enter a positive number to reduce the total interest.

Open your TurboTax Return:

- Search (upper right) > Type 1099int > Click the Jump to.. link

- Continue selecting Enter a different way > select Interest > Select Type it myself

- Enter Bank name and interest amount (full amount from the 1099-INT > Continue

- Select 'I need to adjust the interest reported on my form.' Continue

- Enter the amount that belongs to your son > Select 'I received all or part of this interest for ......'

- Continue to finish the process. You will be taxed on only half of the interest.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

January 28, 2025

5:57 AM