- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099-INT: TurboTax can't get my 1099-INT, and it won't let me enter it manually.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-INT: TurboTax can't get my 1099-INT, and it won't let me enter it manually.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-INT: TurboTax can't get my 1099-INT, and it won't let me enter it manually.

If you don't have a 1099-INT just choose the option 'I'll enter it myself'

To report interest income received -

- Click on Federal Taxes (Personal using Home & Business)

- Click on Wages and Income (Personal Income using Home & Business)

- Click on I'll choose what I work on

- Under Interest and Dividends

- On Interest on 1099-INT, click on the start or update button

Or enter interest income in the Search box locate in the upper right of the program screen. Click on Jump to interest income

When you file your taxes, you don’t need to attach copies of the 1099-INT forms you receive, but you do need to report the information from the forms on your tax return. That’s because each bank, financial institution or other entity that pays you at least $10 of interest during the year must:

- prepare a 1099-INT,

- send you a copy by January 31, and

- file a copy with the IRS.

The IRS uses the information on the 1099-INT to ensure you report the correct amount of interest income on your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-INT: TurboTax can't get my 1099-INT, and it won't let me enter it manually.

I am trying to enter my interest income manually but the program will not let me do it. I already have the bank listed but can't enter interest income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-INT: TurboTax can't get my 1099-INT, and it won't let me enter it manually.

Form 1099-INT will be under Wages and Income and then Investments and savings.

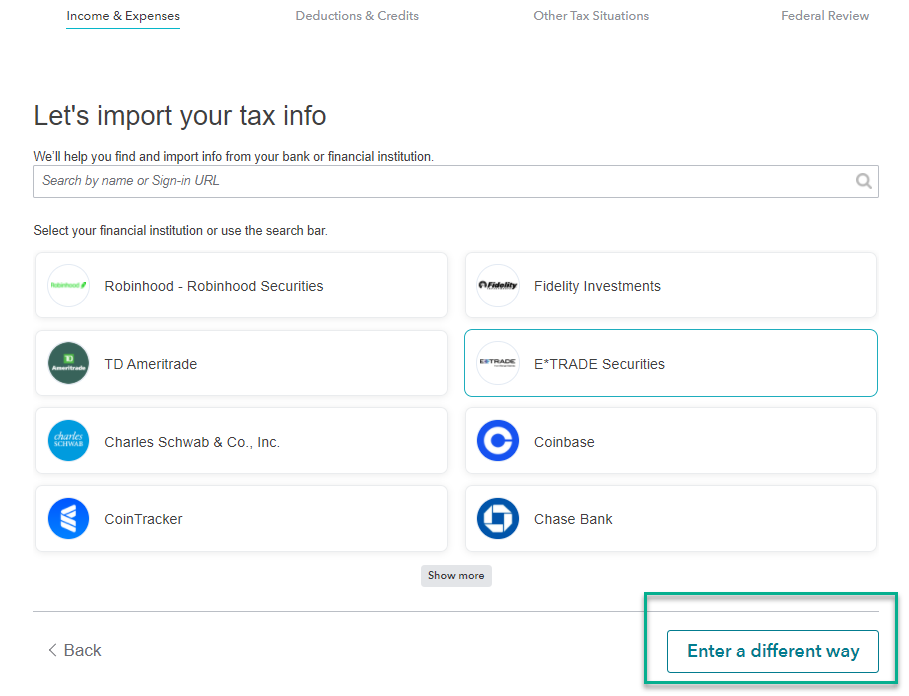

If the import does not work, please look down to the lower right and select Enter a different way, as shown below. You might need to scroll down to see it.

Then, click on the box that says 1099-INT and on the next screen click on the box that says Type it in myself.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Lukas1994

Level 2

DennisK1986

Level 2

garne2t2

Level 1

flin92

New Member

user17519734590

New Member