- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099-INT Amount Shown in Wages & Income is Wrong - WAY TOO HIGH

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-INT Amount Shown in Wages & Income is Wrong - WAY TOO HIGH

Hi. I encountered this error earlier in the tax season. I reported it to TurboTax and I've been waiting to see if it got fixed. It's been a couple of update cycles and the issue is still there so I wanted to give others a heads up.

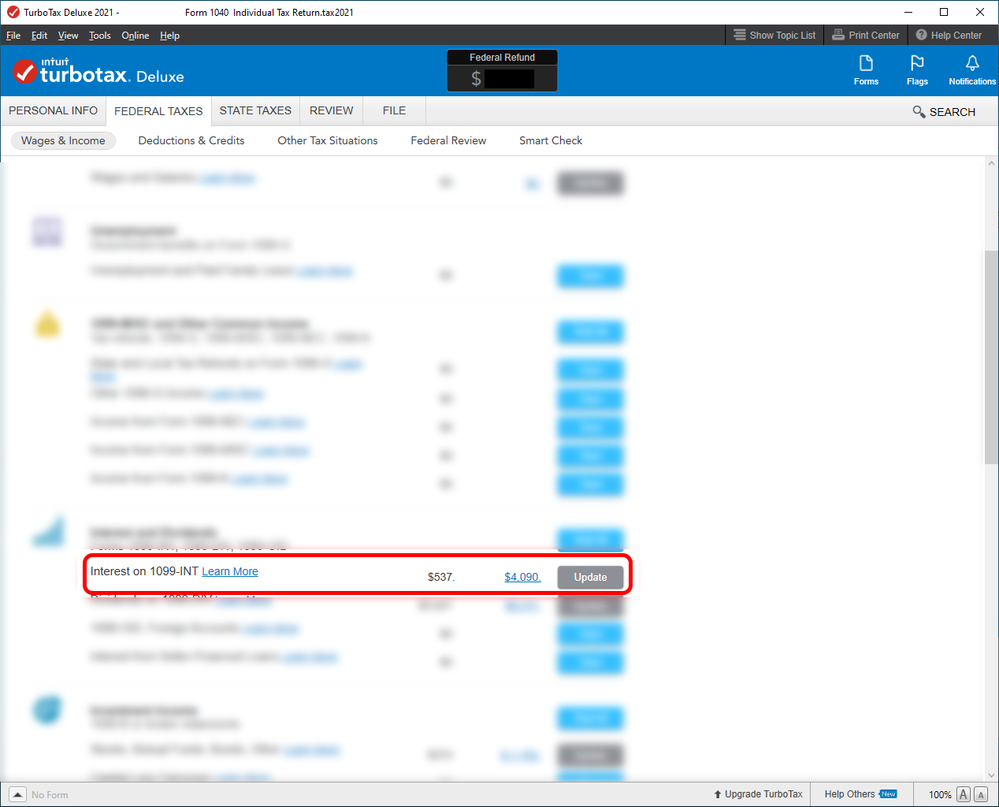

The 1099-INT amount shown in Wages & Income has always just been that. However, this year, I saw a really large amount as shown in this screenshot:

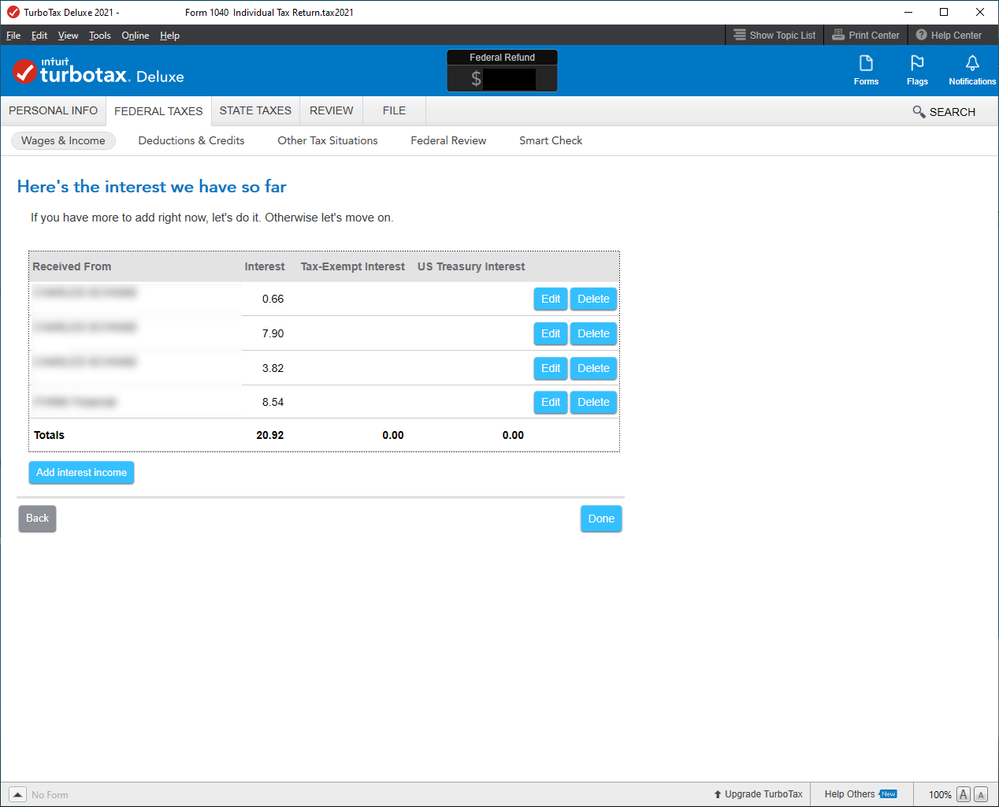

The $4,090 is way too much and doesn't match the details as shown in the following screenshot when I click Update:

The $20.92 is what I expected to see on the first screenshot.

It took a little digging but by looking at the resulting forms in a PDF file, I figured out that it is including interest that I earned from a K-1 in the 1099-INT section. I'm pretty sure this is incorrect. I believe I've had this situation before and the interest was never lumped together.

The good news is that the underlying generated forms look good. It's just confusing to see this without explanation. I hope this helps clear up anyone else's confusion that might have this same situation.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-INT Amount Shown in Wages & Income is Wrong - WAY TOO HIGH

The program is correct ... the interest passed thru on the K-1 form DOES go to the Sch B with all the other interest. The K-1 form is just a consolidated reporting form that reports many kinds of income and deductions that are entered all over the return as they need to be.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-INT Amount Shown in Wages & Income is Wrong - WAY TOO HIGH

Hi, Critter(-3).

I agree that the interest is shown in the right place in the IRS forms (i.e., Schedule B). However, I have had K-1s before and I never remember the interest being shown in the 1099-INT section of TurboTax. As far as I can remember, the details for the 1099-INT always matched the total.

Unfortunately, I normally uninstall the prior year's version of TurboTax before installing the new one so I can't go back to confirm :(

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-INT Amount Shown in Wages & Income is Wrong - WAY TOO HIGH

There is never a need to uninstall the prior year program to install the next year unless you are out of memory. I have 5 years of programs on my computer without an issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-INT Amount Shown in Wages & Income is Wrong - WAY TOO HIGH

Hi, Critter(-3).

Yes, of course. I understand. It's not a system limitation but, rather, a mental management challenge for me. At one time, I had a bunch (5-7 years) of TurboTax versions installed and it was distracting and confusing.

I have the CDs so maybe I'll find an old year and install it to see how bad my memory is getting.

FWIW, I do have a gripe that TurboTax and TurboTax Business editions both use the same file extension on Windows (e.g., "tax2021"). This means that one cannot double click on a file and have it open the right program. Rather, one must open the program and point to the right file. If anyone from TurboTax is following this thread, please fix this.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mytaxabc

Level 2

g456nb

Level 1

jzollinger-zolli

Level 1

lad20

Level 2

user17570167794

New Member