- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1040 5a and 5b rollover entry

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040 5a and 5b rollover entry

In 2023, I rolled over money from my traditional 401k into a Roth IRA. The 1099-R, Box 7 reflected Code G- Direct rollover and rollover contribution. The amount was reflected in 1040 line 5b and was a taxable event.

However, in 2024, when I again rolled over money from my traditional 401k into the same Roth IRA (with Box 7 code G on the 1099-R), it was reflected in 1040 line 5a and is now showing up as a non-taxable event.

Is there a bug/glitch in the TurboTax Deluxe software for 2024?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040 5a and 5b rollover entry

Once the 1099-R is entered, there are interview questions that follow. I think these questions have changed from last season.

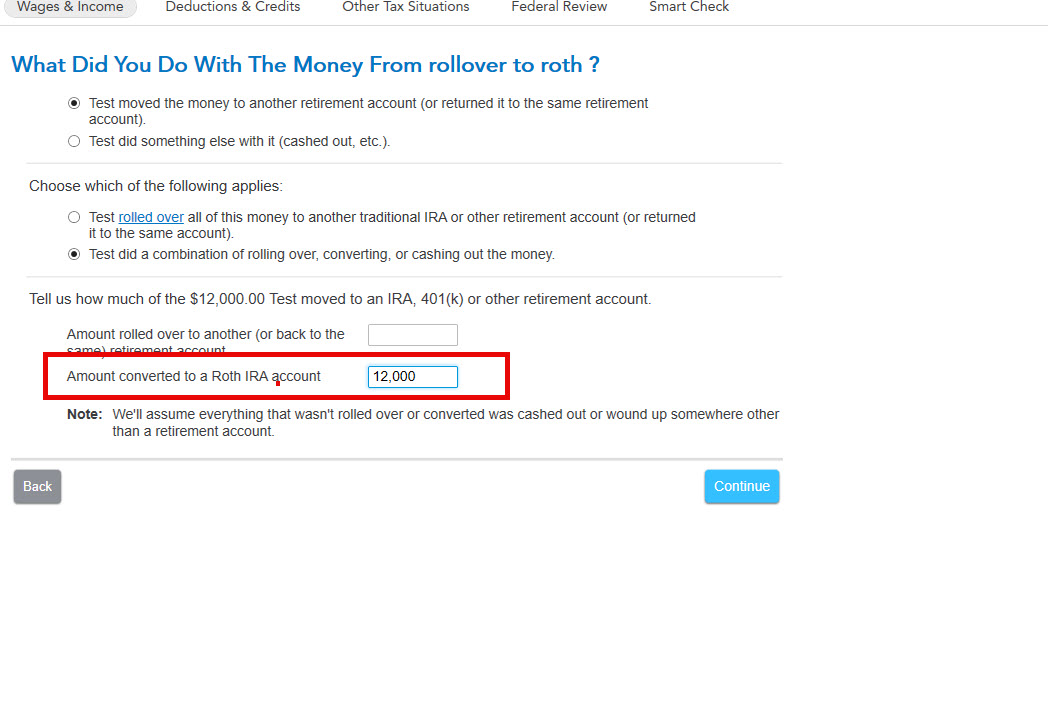

When you get to the "What Did You Do With The Money From this 1099-R" select "I moved the money to another retirement account (or returned it to the same retirement account)"

This causes an new drop-down question "Choose which of the following applies"

Select "I did a combination of rolling over, converting, or cashing out the money"

This causes another drop-down asking "Tell us how much of the XXX.XX you moved to an IRA, 401(k) or other retirement account"

Enter the amount in the box for Roth

The amount will be listed on your 1040 line 5b

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

HNKDZ

Returning Member

CWP2023

Level 1

brokewnribs20

New Member

jsefler

New Member

johnba1

New Member