- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Why turbo tax adds 1099-Sa box 1 and W-2 Box 12 numbers?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why turbo tax adds 1099-Sa box 1 and W-2 Box 12 numbers?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why turbo tax adds 1099-Sa box 1 and W-2 Box 12 numbers?

TurboTax should not be adding your distribution as a contribution. Was the 1099-SA for a distribution used on qualified medical expenses with a distribution code of 1? If so, enter it this way:

- Go to Federal > Wages & Income > Less Common Income > 1099-SA, HSA, MSA and click Start/Revisit.

- Make sure you have HSA selected.

- Enter your withdrawals from your HSA by answering Yes to Did you use your HSA to pay for anything in 2021?

- Enter your 1099-SA

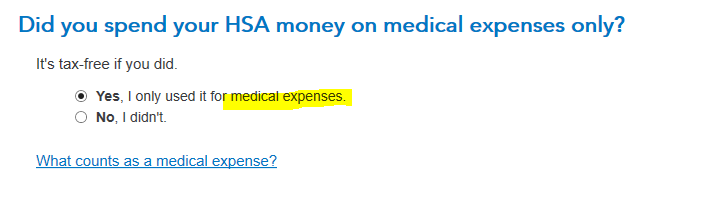

- Answer Did you spend your HSA money on medical expenses only?

When asked about your contributions to your HSA, the employer amount from Box 12 of your W-2 will already be in there. Do not enter any additional contributions unless you made them out-of-pocket. If you had any other contributions, like a rollover from a retirement account, that will count against your contribution limit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why turbo tax adds 1099-Sa box 1 and W-2 Box 12 numbers?

Thank you. This is what I had done and I redid it again. But the message I get shows I made extra contribution equal to what shows on my W-2. This is not right.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why turbo tax adds 1099-Sa box 1 and W-2 Box 12 numbers?

The 1099-SA income is only added to your w2 income if it was not used on medical expenses. Do you have the information entered anywhere else in your return besides the W2 contribution? The 1099-SA is for distribution and is only taxable income when not used for medical bills.

Here is an example of what your entries should look like as @RaifH described above

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why turbo tax adds 1099-Sa box 1 and W-2 Box 12 numbers?

Thank you for the additional explanation. That is EXACTLY how I have filled the info. ad this is the message I get

"you contributed $XXXX (this is equal to amount in W-2) more to your HSAs than you were allowed....."

I am not sure what is missing here??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why turbo tax adds 1099-Sa box 1 and W-2 Box 12 numbers?

Under "Your HSA Summary" it shows the entire amount from W-2 box 12 as "Taxable employer Contribution"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why turbo tax adds 1099-Sa box 1 and W-2 Box 12 numbers?

The amount of a normal distribution (code '1') on a 1099-SA has nothing to do with excess contributions to your HSA.

From your description (the entire code W amount is made taxable), it sounds like you never showed any HDHP coverage. Did you finish your HSA interview?

What type of HDHP coverage did you have in 2021?

What was the code W amount in box 12 of your W-2?

Did you carry over any excess HSA contributions from 2020?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why turbo tax adds 1099-Sa box 1 and W-2 Box 12 numbers?

Bill

Thanks for your response.

My SHA contribution from w-2 is 7180. My carry over from last year (which I believe is an error I missed, but it is what it is) is 1500. my distribution is 6868. code is W in box 12 and 1 in 1099-SA. when I finish everything it tells me I exceeded for 8680 which is the total for 7180+1500.

I have answered all questions as indicated in previous responses.

any idea??!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why turbo tax adds 1099-Sa box 1 and W-2 Box 12 numbers?

see above

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why turbo tax adds 1099-Sa box 1 and W-2 Box 12 numbers?

If I understand you correctly, the code W amount on your W-2 was $7,180. You carried over $1,500 in excess contributions from the previous year. And TurboTax reported that you had an excess of $8,680. Is that all correct?

You did not tell me what type of HDHP coverage you had in 2021. Family? Self-only? I am going to assume Family from the numbers you are using.

I will repeat what I said above. The fact that your excess in 2021 is the sum of all your contributions and your carryover indicates that you did not finish the HSA interview and tell TurboTax what your HSA coverage was.

- So, what was your coverage (Self-only or Family)?

- In which months did you have this coverage (and no other like Medicare)?

- May I assume that you can't be claimed as a dependent on another return?

- Can you do a screenshot of the Summary page at the end of the HSA interview (redacting any personally identifiable information) and post it here?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why turbo tax adds 1099-Sa box 1 and W-2 Box 12 numbers?

Bill

I appreciate you responding to my case.

the answer is yes. you have the numbers correct.

yes, I have a family HDHP

and yes, I finished the interview multiple times. I get to the point where it tells me "You may want to withdraw money from your HSAs" and even chose being taxed for it.

that is what is bothering me. I have not paid extra and should this carry overs to next year. similar to 1500 from last year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why turbo tax adds 1099-Sa box 1 and W-2 Box 12 numbers?

My questions to you above:

- So, what was your coverage (Self-only or Family)? You answered Family

- In which months did you have this coverage (and no other like Medicare)?

- May I assume that you can't be claimed as a dependent on another return?

- Can you do a screenshot of the Summary page at the end of the HSA interview (redacting any personally identifiable information) and post it here?

@Ashi

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why turbo tax adds 1099-Sa box 1 and W-2 Box 12 numbers?

- So, what was your coverage (Self-only or Family)? You answered Family

- In which months did you have this coverage (and no other like Medicare)? Entire year and no Medicare

- May I assume that you can't be claimed as a dependent on another return? correct

- Can you do a screenshot of the Summary page at the end of the HSA interview (redacting any personally identifiable information) and post it here

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why turbo tax adds 1099-Sa box 1 and W-2 Box 12 numbers?

OK, the first thing I see is that "The fact that your excess in 2021 is the sum of all your contributions and your carryover ", in your case, that was not true and you didn't notice it.

You (the primary taxpayer) has $7,160 in taxable employer contributions BUT you also have $20 tax-free employer contributions. And your spouse has $200 in taxable employer contributions, but let's look at the primary first.

The fact that you had $20 in tax-free employer contributions means that you did indicate that you had HDHP coverage (or else this would have been zero).

So we have two possibilities:

1. You have a large carryover of excess contributions from 2020

2. You told TurboTax that you had overfunded your HSA in 2020

So, did you have excess contributions to your HSA in 2020? If so, how much? Did you withdraw that excess in early 2021, or did you carry this over to 2021? Look at your 2020 return for form 5329. Is there an amount on line 48? This is the excess your carried to 2021.

Alternatively, if you did have an excess in 2021 but you withdrew it all, you "cured" the excess (as if you never had it). So when you saw the question in the HSA interview asking if you had "overfunded" your HSA in 2020, if you cured the excess for 2020, then you should have answered NO. Did you answer YES and enter an amount of the original excess?

Do you recognize either of these situations?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why turbo tax adds 1099-Sa box 1 and W-2 Box 12 numbers?

Thanks a lot for the response.

The excess carry over from last year is 1500. it is shown on the image I posted in the previous message. That is an error because my wife was on her own plan and I was on the family plan. most likely I did not answer one of the questions correctly and hence the 1500.

coming to this year. my contribution is 7160 and hers is 200. for 2 months she was on her own HDHP plan and the rest of the year on the family plan.

The $20 pops up after I enter her HDHP detail. When I enter my own info for being the entire year on HDHP nothing shows up.

I did not contribute $8660 extra this year and all the money was spent on medical. I really do not want this to carry over.

Appreciate your patience and help in answering my question.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

latdriklatdrik

New Member

pswgroup33gmail

New Member

natemagee

New Member

ssommers

New Member

laamericana2000

New Member