- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

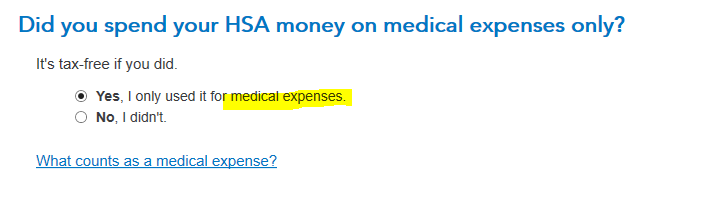

The 1099-SA income is only added to your w2 income if it was not used on medical expenses. Do you have the information entered anywhere else in your return besides the W2 contribution? The 1099-SA is for distribution and is only taxable income when not used for medical bills.

Here is an example of what your entries should look like as @RaifH described above

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 11, 2022

10:16 AM