- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- why is HSA deduction $0 even I paid

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why is HSA deduction $0 even I paid

Hi,

I made HSA contribution from the company but the company did not match the money.

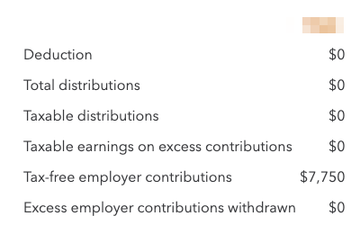

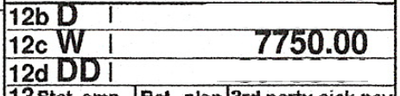

In my thought in TurboTax, it took $7750 from W2 12c and treated it as an employer's contribution.

I am not sure whether $0 deduction is right and if not, how to correct this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why is HSA deduction $0 even I paid

The amount in your W-2 with code W is your tax free contribution. This amount was not included in your Box 1 income. The program is calculating correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why is HSA deduction $0 even I paid

That is correct. There is nothing that you have to correct.

The HSA contributions shown in box 12 of your W-2 with code W are called employer contributions, even though the amount was deducted from your pay. That amount is not included in your wages in box 1 of the W-2, so it is already deducted from the income that you report. You can't deduct it again on your tax return, so you do not get any additional deduction on the tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why is HSA deduction $0 even I paid

- The amount in your W-2 with code W is your tax free contribution. This amount was not included in your Box 1 income. So that is in place of a deduction that you would see elsewhere in your return. The program is calculating correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why is HSA deduction $0 even I paid

another way to put it is that your gross wages were reduced by your HSA contributions and thus box 1 only shows the net. This is the way you get the tax deduction for your contributions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why is HSA deduction $0 even I paid

I'm confused. If the W amount was not included in Box 1 income, then why when I subtract Box 5 from Box 1 it only equates to the D amount for 401K?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why is HSA deduction $0 even I paid

The deduction for the HSA is already accounted for in the wages in box 1. It’s not documented separately on the W_2 like your retirement contribution.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cramanitax

Level 3

dafeliks

New Member

chloelancaster97

New Member

Rprincessy

New Member

asrogers

New Member