- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- why did turbotax not give me the max $2000 tax credit for heat pump

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why did turbotax not give me the max $2000 tax credit for heat pump

We spent $19,000 for the heat pump

Our tax liability in > $11,000

TurboTax Home and Business 2024 is only giving $1748

30% * 19,000 = $5700 - well north of the $2000 cap

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why did turbotax not give me the max $2000 tax credit for heat pump

Your tax liability minus credits. You don't get credit against the SE tax. The SE tax is form 1040 line 21.

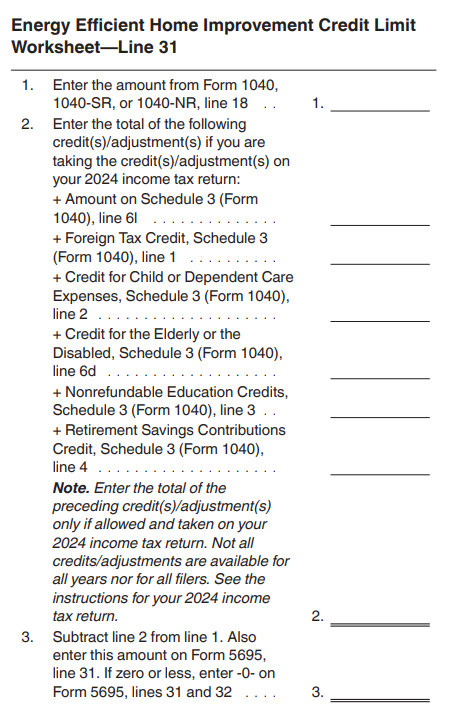

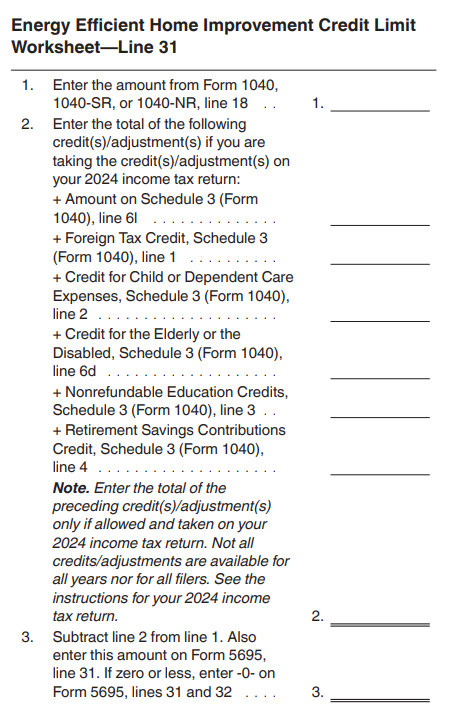

Form 5695 Line 31 has a worksheet on page 7 of Instructions for Form 5695. It begins with your tax from 1040 line 18. You can see child care, education, foreign tax credit, retirement and more comes into play.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why did turbotax not give me the max $2000 tax credit for heat pump

Look at Form 5695 to see how the credit was calculated. Your credit amount is on Line 29e and Line 31 will show any tax liability limitations. What does your Form 5695 show for those 2 lines?

You may want to delete that form and re-enter the credit information again.

How to delete forms in TurboTax Online

How to delete forms in TurboTax Desktop

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why did turbotax not give me the max $2000 tax credit for heat pump

Oh - I see. Line 29e is $2000, but line 31 is $1748. I guess that's because the balance of our tax liability is self-employment tax for my wife?

Thanks,

Paul

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why did turbotax not give me the max $2000 tax credit for heat pump

Your tax liability minus credits. You don't get credit against the SE tax. The SE tax is form 1040 line 21.

Form 5695 Line 31 has a worksheet on page 7 of Instructions for Form 5695. It begins with your tax from 1040 line 18. You can see child care, education, foreign tax credit, retirement and more comes into play.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jigga27

New Member

Sbmccor1963

New Member

thereseozi

Level 2

johntheretiree

Level 2

user17525953115

New Member