- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Which R&D-related expenses need to be capitalized?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which R&D-related expenses need to be capitalized?

I am confused about which R&D expenses need to be expensed vs capitalized. I know that for example wages, supplies and equipements should be capitalized, but how about the following?

1) Payroll Taxes related to R&D employees

2) Lab Rent (I would imagine not but I am not sure, since rent is already "amortized" in a sense, it's not like you are buying a piece of equipment)

3) Health benefits related to $&D employees

Thanks for any insights you can provide!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which R&D-related expenses need to be capitalized?

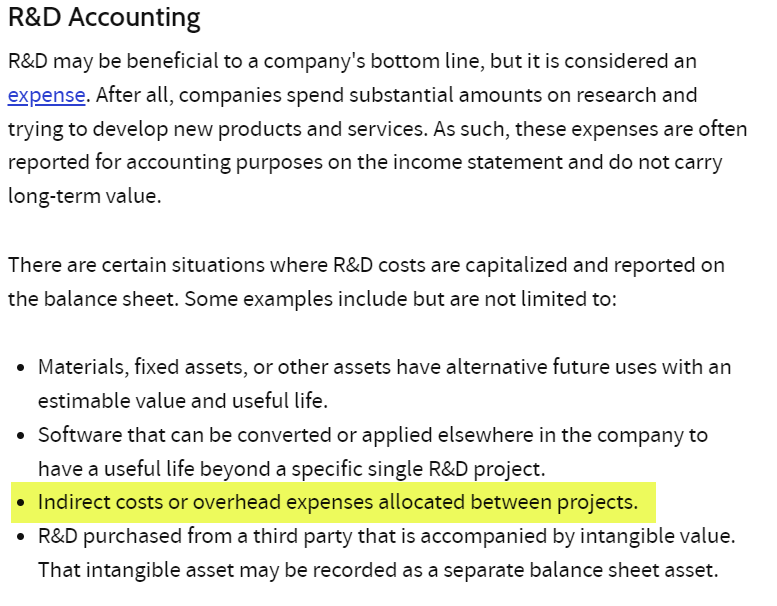

The question you ask can be very subjective as what is and what is not an R&D cost. There really is no absolute definition of which "indirect" expenses are considered part of Research and Development. Direct expenses for R&D are normally easily identified. Indirect not so much. The following is extracted from Investopedia's definition of R&D (complete article linked below):

Other allocations have to be determined in house in most cases. Which employees work for which department? Which employees work for multiple departments? How do we allocate time and expense of utilities and such? As I alluded to, a lot of the indirect costs to be included is subjective.

Research and Development Defined

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17558933183

New Member

Mbenci318

New Member

user17558084446

New Member

Idealsol

New Member

sonia-yu

New Member