- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- where on tax return to improvements to land input? Adjust the cost basis?

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where on tax return to improvements to land input? Adjust the cost basis?

posted

March 25, 2024

7:48 AM

last updated

March 25, 2024

7:48 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

3 Replies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where on tax return to improvements to land input? Adjust the cost basis?

Are you renting this land? What kind of improvements?

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 25, 2024

7:59 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where on tax return to improvements to land input? Adjust the cost basis?

no rental. we added bulkhead and pier. decided not to built and sold the lot.

March 25, 2024

8:18 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where on tax return to improvements to land input? Adjust the cost basis?

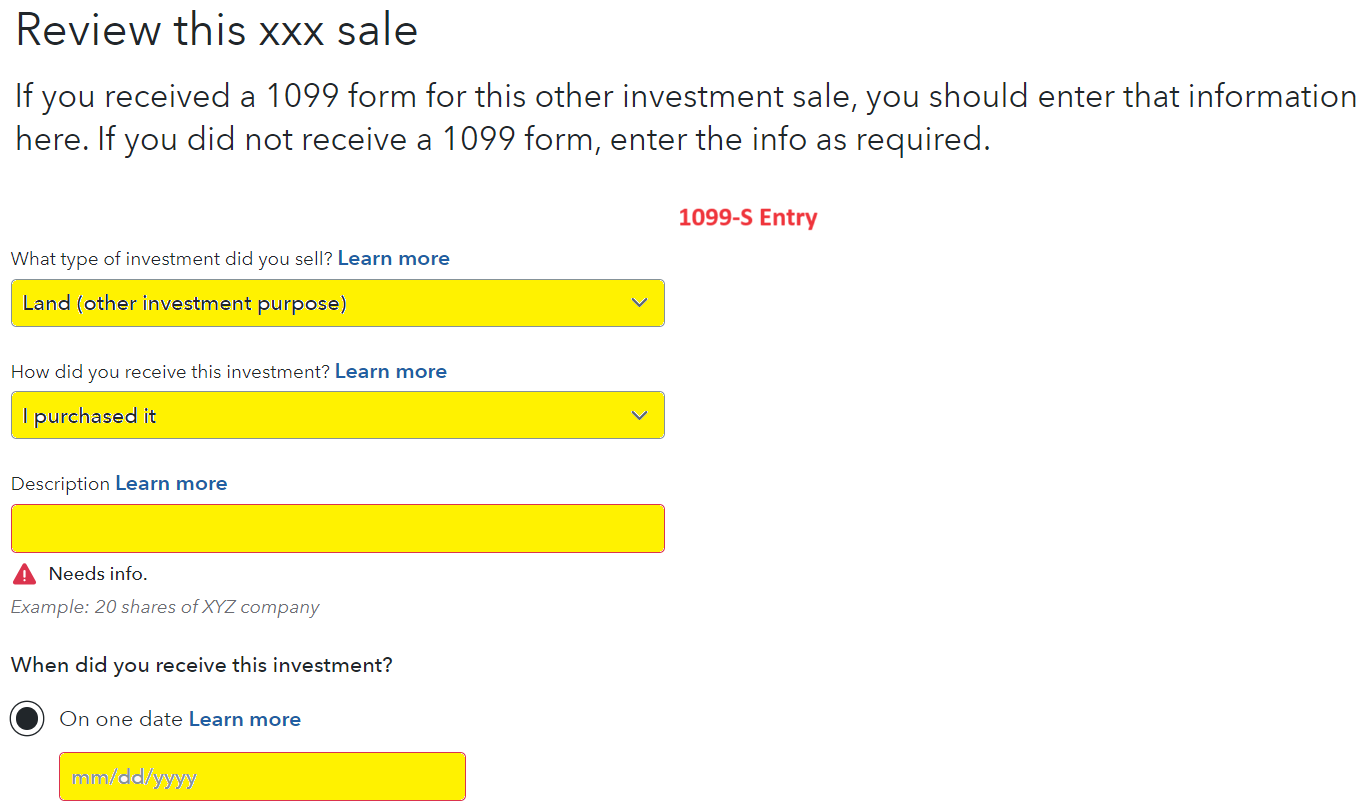

Yes, these improvements would be added to your cost basis for the sale of the land. Land is considered investment property if it is not part of a home sale. Land sales are reported by using the following instruction.

- Wages & Income, then scroll down to Investment Income and select Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B)

- Respond "yes" to Did you sell any investments? You'll then be asked Did you get a 1099-B or brokerage statement? answer "no."

- Enter one sale at a time

- Enter Land Sale Information

- Continue to follow the prompts to complete your sale

- See the image below for assistance.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 25, 2024

8:26 AM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

seewise-media

New Member

sbsvwa

Level 3

mason-jennifer-a

New Member

lmh06420

New Member

msanthony721

New Member