- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

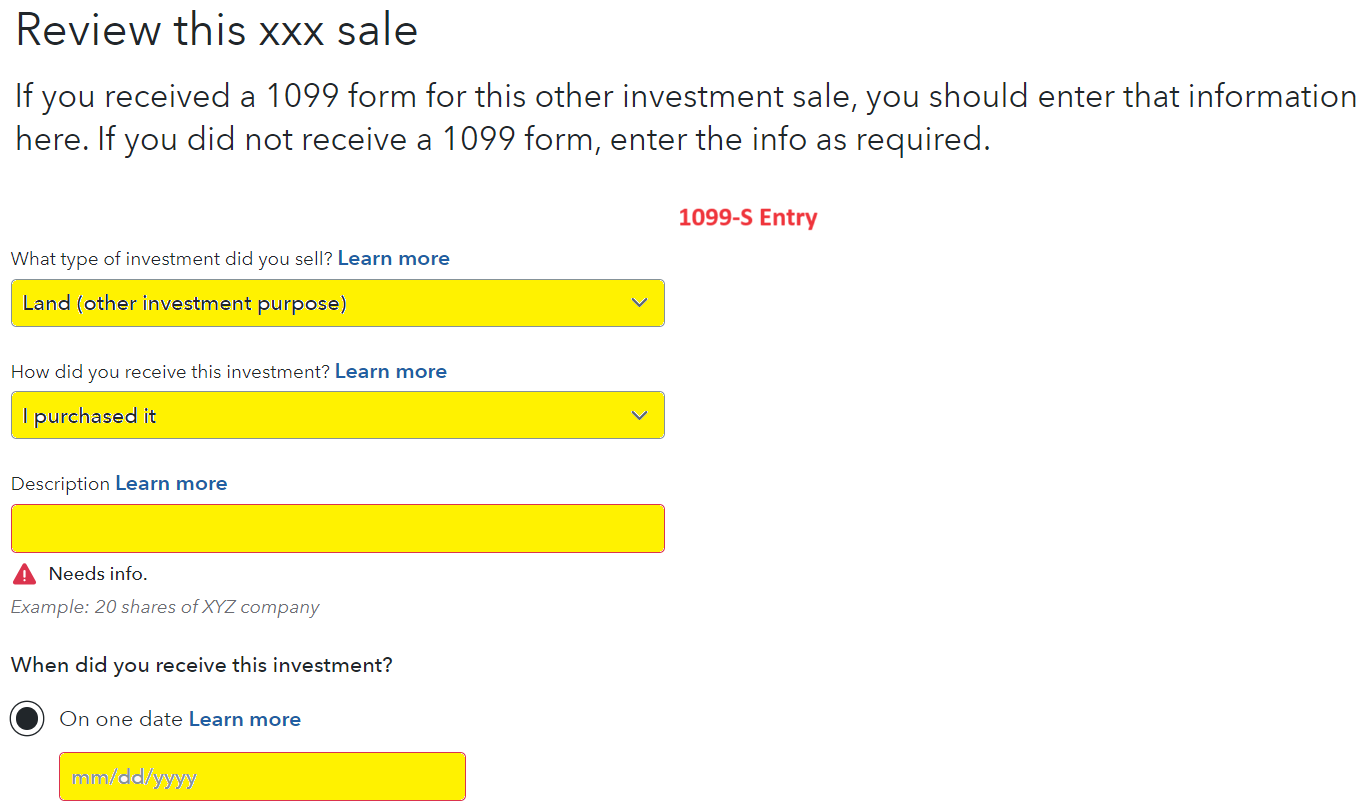

Yes, these improvements would be added to your cost basis for the sale of the land. Land is considered investment property if it is not part of a home sale. Land sales are reported by using the following instruction.

- Wages & Income, then scroll down to Investment Income and select Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B)

- Respond "yes" to Did you sell any investments? You'll then be asked Did you get a 1099-B or brokerage statement? answer "no."

- Enter one sale at a time

- Enter Land Sale Information

- Continue to follow the prompts to complete your sale

- See the image below for assistance.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 25, 2024

8:26 AM