- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Where do you find the amount you paid for health insurance premiums? What are premiums?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you find the amount you paid for health insurance premiums? What are premiums?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you find the amount you paid for health insurance premiums? What are premiums?

The health insurance premium is the amount that you pay for your health insurance. If you are paying for your health insurance through your job, then you should be able to see the amount that is deducted from each paycheck on your check stub.

Generally, when health insurance premiums are paid through payroll deductions, that money comes out of your paycheck pre-tax. This means that you will not pay income tax on the money used to pay for your health insurance. That also means that you cannot enter the amount into your tax return as a deduction because it was not taxed initially.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you find the amount you paid for health insurance premiums? What are premiums?

I don't have a paycheck stub, it's all direct deposit. Does it say "premiums" on the stub or would it be called something else? I don't really use or understand health insurance, i just have it so i don't get the fine every year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you find the amount you paid for health insurance premiums? What are premiums?

It might say anything. Probably says insurance or your health plan name. Ask your employer. It might be on your W2 in box 12 or 14.

Why do you need it? It takes a lot of medical and insurance to be deductible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you find the amount you paid for health insurance premiums? What are premiums?

The Shared Responsibility Payment tax was eliminated in tax year 2019 so there is no longer a penalty if you do not have health insurance.

Since you had insurance through your employer, you have nothing to deduct for health insurance premiums.

@rvakid

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you find the amount you paid for health insurance premiums? What are premiums?

hmm...ok. I might just skip it and pay the fine. No one at my work knows either. I don't want to write down the wrong thing.

Do i need a lot of medical and insurance to have a deductible? Not sure what this means?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you find the amount you paid for health insurance premiums? What are premiums?

I heard it was eliminated but i had to pay $750 last year because i had no coverage for 2020, I might just pay it again because i can't figure out what to answer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you find the amount you paid for health insurance premiums? What are premiums?

Even though health insurance coverage is not mandatory for federal tax purposes, but some states still require it. If you happen to leave in one those states, if you are not covered, you need to pay a penalty. It sounds like the $750 you paid last year was for your state.

If you are covered on your job, select We all had health insurance coverage all year when you reach the screen About Your Health Insurance.

You should not pay the penalty if you are covered.

Here are the states that have an individual health insurance mandate:

- California

- The District of Columbia

- Massachusetts

- New Jersey

- Rhode Island

- Vermont

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you find the amount you paid for health insurance premiums? What are premiums?

@rvakid wrote:I heard it was eliminated but i had to pay $750 last year because i had no coverage for 2020, I might just pay it again because i can't figure out what to answer.

If you had health insurance, why would you want to pay a $750 penalty for not having health insurance? It would likely cost you less if you just had your tax return prepared by a tax professional.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you find the amount you paid for health insurance premiums? What are premiums?

I didn't have insurance fo 2020, so i had to pay that year. I had insurance last year so i don't want to pay this year but i might have to because I don't know where to find the information about premiums. I don't understand taxes and benefits and stuff like that and just fill out something on the forms so I usually have to pay taxes in some way...I probably should have a professional do it because I don't really understand most of the questions or answers on this site but it's very expensive where i live.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you find the amount you paid for health insurance premiums? What are premiums?

OK, I'll go back and see if that option is available. I remember it just had the months for coverage and when I checked them all it asked to see proof of premiums and then I got confused.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you find the amount you paid for health insurance premiums? What are premiums?

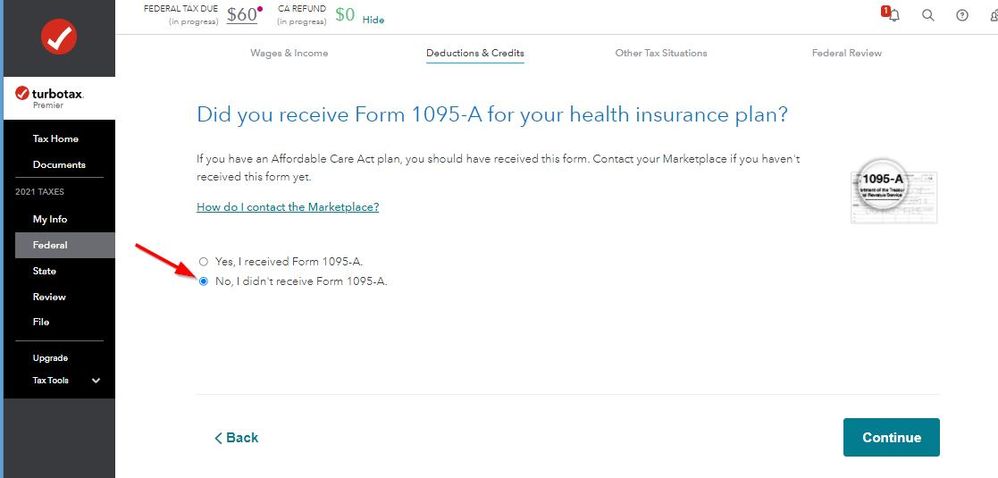

Did you get a 1095A or 1095B or 1095C form for your health insurance? You only have to enter a 1095A.

It is now listed under Deductions instead of a separate tab.

To enter your Health Ins........

Federal Taxes (Personal using Home and Business)

Deductions and Credits

Scroll down to Medical

On Affordable Care Act (Form 1095-A), click the start or update button

If you didn't have health Ins through the Marketplace or get a 1095A just say no you didn't have a covered plan and skip the rest.

You only need to enter 1095A, not 1095B or C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you find the amount you paid for health insurance premiums? What are premiums?

You have private job insurance not ACA Obamacare. On this first screen say NO you didn't get form 1095-A. Then Continue.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cherrera5

New Member

amy

New Member

agilebill4dinfo

New Member

nicoledobrin

New Member

iqayyum68

New Member