- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Where do you enter foreign income in turbo tax self employed online?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you enter foreign income in turbo tax self employed online?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you enter foreign income in turbo tax self employed online?

If your self-employment income is foreign income then please first enter your income and expenses in the self-employment section:

- Login to your TurboTax Account

- Click on the Search box on the top and type “self-employed”

- Click on “Jump to self-employed”

- Continue through the questions

- "How much of your work took place within the United States?" screen answer "None of this work took place within the United States"

To enter the information in the foreign section:

- Click on the Search box on the top and type “foreign income”

- Click on “Jump to foreign income”

- Choose “A Form 1099-MISC or other self-employment income” and click “Continue”.

- On the "Enter Your Gross Profit From Foreign Self-Employment" screen enter your gross profit

- TurboTax will walk you through the questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you enter foreign income in turbo tax self employed online?

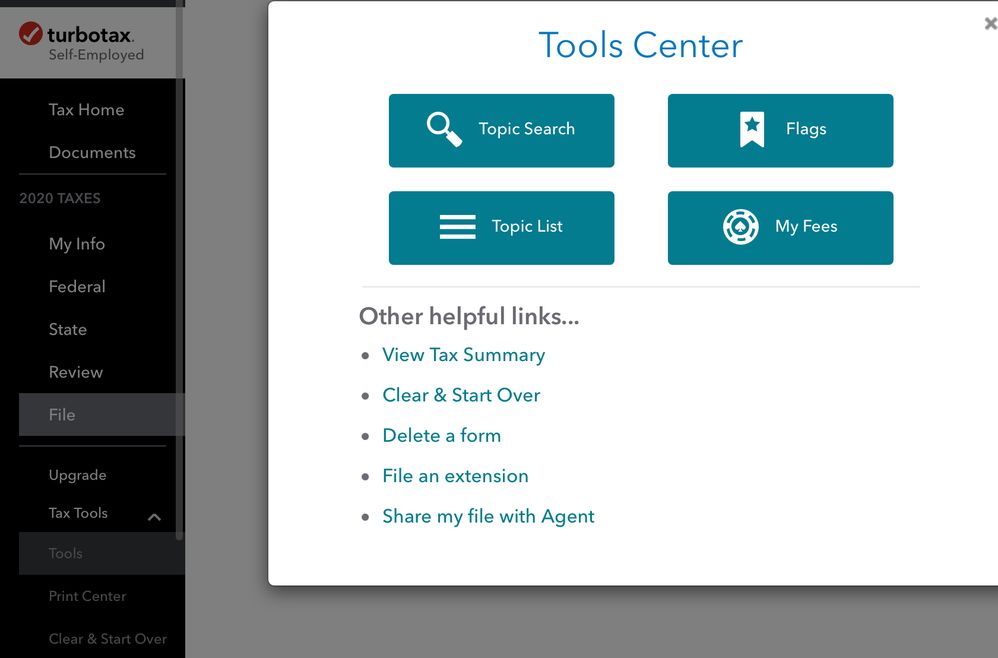

That’s what the online help says. But that search searches the help. It does no search forms or places to enter data.. It’s misleading and out of date. I found it under Tax Tools/Tools.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you enter foreign income in turbo tax self employed online?

You need to enter the words exactly as mentioned above otherwise the jump button won't come up.

Other options to get to the Foreign income section:

- Login to your TurboTax Account

- Click "Federal" from the left side of your screen

- Scroll down to “Foreign Earned Income and Exclusion” and click “Start”

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you enter foreign income in turbo tax self employed online?

Hi,

I. tried this and I didn't see the question "How much of your work took place within the United States?" in the self-employment interview. Are there particular steps or answers I need to put in for that to appear?

Vlad

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you enter foreign income in turbo tax self employed online?

Here is what I would suggest to enter:

You would first enter your foreign self-employment income under Schedule C. Here are the steps:

In TurboTax online,

- After sign into your account, select Pick up where you left off

- To your right upper corner, in the search box, type in schedule c

- Follow prompts

To allow the program to exclude the foreign self-employed income, you would then enter info under Foreign Income by following these steps:

- At the right upper corner, in the search box, type in foreign income and Enter

- Select Jump to foreign income

- Next screen, Did You Make Any Money Outside the United States? answer Yes

- On the screen, What Form(s) Was Foreign Income Reported On ? select A Form 1099-MISC or other self-employment income

- Follow prompts

The foreign earned income exclusion applies to your self-employment income and reduces the income tax. However, it does not exclude the self-employment SE taxes. By following the steps above, the program will exclude your self-employment income but will still calculate the SE tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you enter foreign income in turbo tax self employed online?

None of this article is helpful for 2022 returns, FYI.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you enter foreign income in turbo tax self employed online?

To enter Foreign Income in TurboTax Online, you can follow these steps:

- Wage and Income

- Scroll Down to Less Common Income, Click Start next to Foreign Earned Income and Exclusion

- Answer Yes to "Did you make any money outside the United States?"

- Check all that apply to the type of Foreign Income you have

- Complete the remainder of the interview questions

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you enter foreign income in turbo tax self employed online?

ahoy! first thanks to you and all the others who have contributed to this thread.

what is still unclear to me, particularly for tax year 2022, is whether we need to enter the self-employment income earned outside the USA in both the usual Self-Employment Schedule C and the Foreign Earned Income and Exclusion section? that seems to be the case made in a few of the answers here, though others not. with the current 2022 version it seems like you do you need to enter that income in both sections to get the exclusion to work, though the help for the section Foreign Earned Income and Exclusion states:

This is where you should report any foreign earned income that you have not already reported in other areas (such as your W-2, or 1099-INT, or 1099-DIV).

does that include Schedule C income as well?

thanks in advance for any help and again for all the other answers!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you enter foreign income in turbo tax self employed online?

ahoy visitors from the future!

after a little more focused digging (thanks to the hints from this thread!) i was able to find what i believe is the answer to my clarification question i just recently posted above:

as explained there you have to be careful how you select the answer to the question "What Form(s) Was Foreign Income Reported On?" in the Foreign Earned Income and Exclusion section: if you select "A Form 1099-MISC or other self-employment income" that will correctly look for the original income in a Schedule C and not double the income incorrectly. but check the above mentioned thread for the specifics and to give credit where credit is due 🙂

thanks again for the help here to everyone involved!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

test5831

Returning Member

aashish98432

Returning Member

Micky2025

Returning Member

user17557136899

Returning Member

thisblows

Returning Member