- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Where do I enter sale of my 2nd home?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale of my 2nd home?

Thanks @Irene2805. TT 2020 Premier works as you describe.

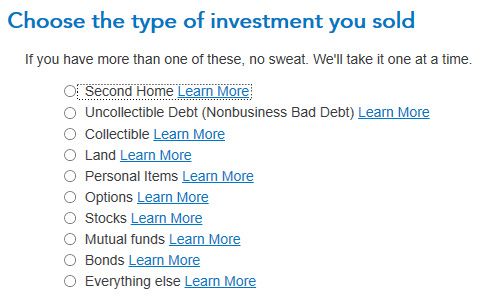

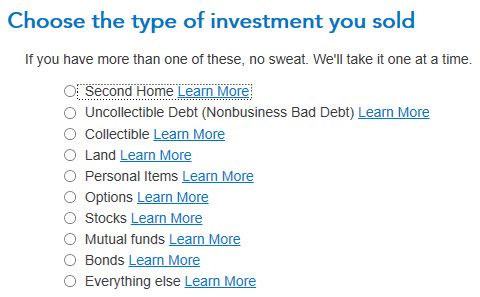

However, and for me this is the key point, it is totally non-obvious how to handle a second home sale, which is not even mentioned on any of the screens! Contrast this with TT 2019, where Second Home was an option (see below) and the software walked you through the transaction.

So I guess my question is: Did TurboTax intend to transition to this much-less-helpful approach? Or have they simply made a mistake in assembling this year's software?

From TT 2019 (screen no longer available in TT 2020):

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale of my 2nd home?

In TurboTax Desktop Premier I was able to report a sale of a second home as a personal loss not deductible from ordinary income.

- If you go into the Wages and Income section of your return,

- scroll down to investment Income.

- Select Stocks, Mutual, Other

- Did you get a 1099-B, no

- Tell us about this sale.

- At the screen, Select any less common adjustments that apply, Any loss from this sale is not deductible... is an option.

- This is personal use property (like a vacation home) is an option.

IRS Publication 544 under Personal-use property states:

Loss from the sale or exchange of property held for personal use is not deductible.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale of my 2nd home?

** Edit ** not licensed so can't provide tax guidance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale of my 2nd home?

You would enter the sale of your 2nd home on Form 8949 and then to Schedule D as personal property as long as it has never been an income producing rental property or a business property.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale of my 2nd home?

thanks! Wouldn't have known how to keep it from giving me an erroneous loss.. It certainly would have helped if TT asked me the questions, because filling out the section "Select any less common adjustments..." was really not intuitive... Especially if you did not know that the sale from a second home used only for personal reasons was not deductible. thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale of my 2nd home?

I feel bad about asking the same question repeatedly but, since none of the 'experts' have answered it, I'll take one final shot.

Were the Second Home interview questions (as found in TT 2019) intentionally left out of TT 2020? As @Dianaboston says, while it's not exactly impossible to get it right this year, it's a whole heckuva lot harder....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale of my 2nd home?

The ability to report the sale was not left out of the TurboTax software. In TurboTax Desktop Premier I was able to report a sale of a second home.

- If you go into the Wages and Income section of your return,

- scroll down to Investment Income.

- Select Stocks, Mutual, Other

- Did you get a 1099-B, no

- Tell us about this sale.

- If you are recording a loss on the sale, at the screen, Select any less common adjustments that apply, Any loss from this sale is not deductible... is an option.

- This is personal use property (like a vacation home) is an option.

IRS Publication 544 under Personal-use property states:

Personal-use property

Report gain on the sale or exchange of property held for personal use (such as your home) on Form 8949 and Schedule D (Form 1040 or 1040-SR), as applicable. Loss from the sale or exchange of property held for personal use is not deductible. But if you had a loss from the sale or exchange of real estate held for personal use for which you received a Form 1099-S, report the transaction on Form 8949 and Schedule D, as applicable, even though the loss is not deductible.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale of my 2nd home?

Thanks! I think what is left out is not the ability to enter the data, but the questions that TT apparently used to ask in previous versions to guide you. Yes, the ability is still there, but if you didn’t know the sale was not deductible, you wouldn’t know to access that section “Select any less common adjustments...” (like me!).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale of my 2nd home?

Wow. Just wow.

As I posted above, this screen from TT 2019 is missing in TT 2020. Notice the Second Home radio button? (And this screen is not in some obscure spot - it used to come up whenever you had an investment sale without a 1099-B.)

So again, was it intentionally omitted this year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale of my 2nd home?

You can enter your second home sale by following the instructions below including an image.

As you go through the sale of your second home, there is a dropdown to select 'second home' (see the image below). Also you likely did select the correct box to enter the sale after you select Stocks, Mutual Funds, Bonds, Other (1099-B), be sure you selected the 'Other' box (see image below).

The second home sale can be entered into TurboTax CD or Desktop version by following the steps below.

- Open your TurboTax account > Select the Personal tab then Personal Income > I'll choose what I want to work on

- Scroll to Investment Income > Select Stocks, Mutual Funds, Bonds, Other > Start or Update

- Add or Edit your sale that is NOT reported on a Form 1099-B > Select to enter a summary of each sale (you only have one)

- Enter the Total Proceeds > Cost Basis (includes any capital improvements while you owned the property)

- Enter the holding period - if you owned the property for more than one year the it is long term, one year or less is short term

- Continue to finish your sale.

The gain from the sale will be fully taxable because a second home is not eligible for the home sale exclusion. See the image below for assistance. Whether you specifically select Second Home is not relevant for the tax return itself.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale of my 2nd home?

@DianeW777: Thanks for finally sort-of-answering my question.

The upshot as I understand it: TT Online (above the thick black line in the previous post) walks you through the sale of investments like a second home. TT Desktop (below the thick black line) leaves you to fend for yourself.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale of my 2nd home?

You're welcome. You might look at it that way, however personal items, including a second home are an investment sale like many things reported on the tax return. The desktop version allows you to enter the information in one area for any personal use property sales when gain is the result of the sale..

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale of my 2nd home?

So you're saying the lack of guidance is a feature not a bug? And (since the 'feature' was introduced this year) that you think Desktop customers (but not Online customers) prefer it this way?

If so, I guess we'll have to agree to disagree....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale of my 2nd home?

Is there a way to correct the Best Answer at the top of this thread? As written, it only applies to TT Online....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sale of my 2nd home?

The first screenshot above is from TurboTax Online; the second screenshot is from TurboTax Desktop. You enter the same information into TurboTax, the screens just look different. The calculations are also the same. You need to enter the same information to calculate the gain or loss no matter which version you are using. The key data you need to calculate the gain or loss on the sale of capital assets (stocks, bonds, homes, cars, coins, etc) are sales price, basis, and your holding period. Both versions will ask the same questions to determine how the gain or loss is reported.

When you sell a capital asset, the difference between its cost basis and the selling price results in a capital gain or loss.

- A capital gain is when your asset's sales price exceeds its cost basis (in other words, you made money). Capital gains must be reported on your tax return.

- A capital loss is when you sell the asset for less than its cost basis. Capital losses from investments can be deducted, but not those from personal-use assets, such as your home or personal vehicle.

Your total capital gains for the year minus your total capital losses results in either a net capital gain or a net capital loss.

- Short term capital gains (gains on assets held one year or less) are taxed as ordinary income.

- Long term capital gains (gains on assets held more than one year) are taxed at a more favorable rate than ordinary income.

- Net losses are deductible, but only up to a maximum of $3,000 ($1,500 if married filing separately). Any capital losses you couldn't deduct this year can be carried forward and deducted on future tax returns. This is called a capital loss carryover. @fhughson

Related Information:

- Where do I enter a capital gain or loss?

- How is a capital gain or loss calculated?

- What is the definition of cost basis?

- What is a capital gain or loss?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sam992116

Level 4

sam992116

Level 4

jlfarley13

New Member

Spetty1450

New Member

user17546016839

New Member