- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Where do I enter after-tax HSA contributions not reflected on my W2?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter after-tax HSA contributions not reflected on my W2?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter after-tax HSA contributions not reflected on my W2?

As stated above, you do need to continue through the interview.

- Go back and select edit for that 1099-SA

- (or enter the 1099-SA and report distributions if you have not already done so)

- When you get to the "Here's what we have so far" screen, the HSA should be listed and you should select the blue Done button

- "Did you inherit this HSA?" select "No"

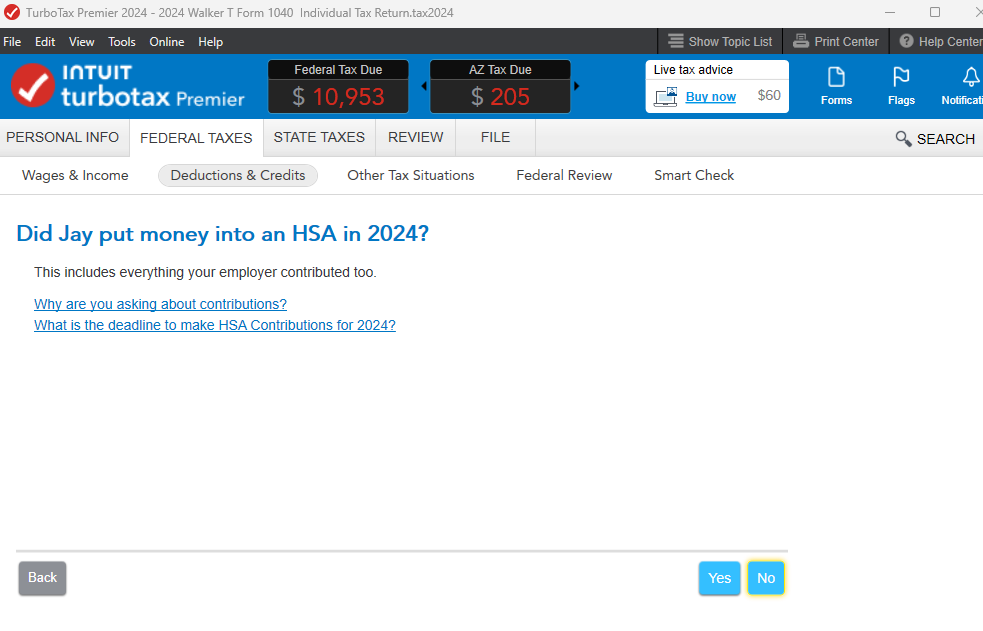

- "Did you put money into an HSA in 2024?" select "Yes"

- The next screen will look as posted in the thread above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter after-tax HSA contributions not reflected on my W2?

Keep going through the questions. After you enter your 1099-SA and the amount you spent for medical expenses, you get a screen asking if you inherited the HSA. After that you get the screen shown below, where you can enter your direct after-tax contributions.

If you are using the desktop TurboTax software, make sure your software is updated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter after-tax HSA contributions not reflected on my W2?

As stated above, you do need to continue through the interview.

- Go back and select edit for that 1099-SA

- (or enter the 1099-SA and report distributions if you have not already done so)

- When you get to the "Here's what we have so far" screen, the HSA should be listed and you should select the blue Done button

- "Did you inherit this HSA?" select "No"

- "Did you put money into an HSA in 2024?" select "Yes"

- The next screen will look as posted in the thread above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter after-tax HSA contributions not reflected on my W2?

The above screen does not show up. I completed my taxes and then had my wife contribute the additional after tax contribution to HSA. Turbotax does not show the screen where I can enter the after-tax contribution. Should I directly enter it in Form 8889?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter after-tax HSA contributions not reflected on my W2?

Which screen "above" are you referring to?

No matter who contributes to your HSA (note: your spouse could have her own, which is separate from yours), you must report these contributions in the HSA interview on the screen entitled "Let's enter [name]'s HSA contribution", which is the screen shot on rjs' post above.

On this screen, the second line is normally "Any contributions you personally made". Despite the wording, this is where you would enter contributions from your spouse (or from anyone else in the world, for that matter).

Please do NOT enter it directly in the 8889.

1. Making overrides in Forms mode may cancel your Tax Accuracy Guarantee.

2. Making overrides in Forms mode may prevent you from e-filing.

3. Even many tax professionals don't know how to enter values on the 8889 without making errors.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter after-tax HSA contributions not reflected on my W2?

"Which screen "above" are you referring to?"

I am referring to "the screen entitled "Let's enter [name]'s HSA contribution", which is the screen shot on rjs' post above." I am unable to reach it. I did make a change to the worksheet for line 2, Form 8889. It works. That seems to be the only way out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter after-tax HSA contributions not reflected on my W2?

In the HSA interview, the first page may say 'Your HSA Summary' if you've been there before. Choose Edit.

You are then asked about 1099-SA distributions. Keep going, and you'll come to the question on contributions you made.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter after-tax HSA contributions not reflected on my W2?

I tried it now and it seems to take me to the screen about our non-taxable contributions with the number that I had manually entered in Form 8889 pre-filled in the field! I am pretty sure I took this path earlier and it didn't take me to the proper screen. I am now wondering whether entering it manually caused Turbotax to take a different path and display the appropriate screen.

Thanks, anyway!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17603785484

New Member

mdaig

New Member

raspice

New Member

appreciative

Level 1

mbraggessentials

Level 1