in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- what is line 4.b in Foreign Tax Credit Computation Worksheet mean?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what is line 4.b in Foreign Tax Credit Computation Worksheet mean?

I have this peculiar issue, I had faced last year when using Turbotax.

I created Form 1116 to get credit for the foreign tax paid. Turbo tax automatically generates the 'Foreign Tax Credit Computation Worksheet' but during the final review , flags and prompts me ( the tax payer) to enter the value for the item 4.b.(1).c i.e.value for the item "Adjusted basis of total investment assets"

I have given a screenshot of this worksheet. If I enter the value 0 for this item, it says that value has to be more than 0 and accepts the value '1'. Not sure what exactly this mean and what is to be entered here?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what is line 4.b in Foreign Tax Credit Computation Worksheet mean?

That entry has to do with investment interest expense. You allocate investment interest expense to foreign income based on the ratio of the basis of your foreign investment assets to the basis of your total investment assets. The 4 (b)(1)(c) entry will be the basis of your total assets, which would have to be greater than 1, assuming you have investment assets. In other words, if you had an investment portfolio in mutual funds equal to $100,000 and $10,000 of it was invested in foreign assets, $100,000 would be the entry in line 4(b)(1)(c). In this case, 10% of your investment interest would be applied to your foreign income.

I suggest you look on your broker statement associated with your foreign income. It may list the basis of your foreign assets that is used to allocate the foreign income.

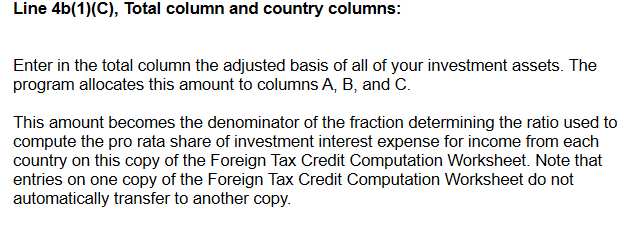

From TurboTax:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

joeylawell1234

New Member

girigiri

Level 3

Blue Storm

Returning Member

mc510

Level 2

zalmyT

Returning Member