- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

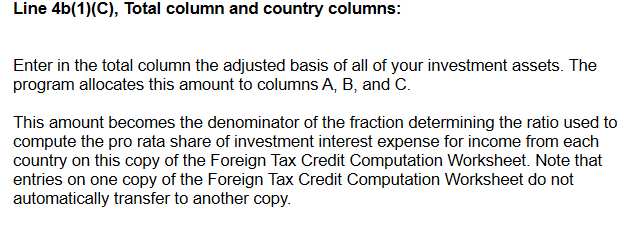

That entry has to do with investment interest expense. You allocate investment interest expense to foreign income based on the ratio of the basis of your foreign investment assets to the basis of your total investment assets. The 4 (b)(1)(c) entry will be the basis of your total assets, which would have to be greater than 1, assuming you have investment assets. In other words, if you had an investment portfolio in mutual funds equal to $100,000 and $10,000 of it was invested in foreign assets, $100,000 would be the entry in line 4(b)(1)(c). In this case, 10% of your investment interest would be applied to your foreign income.

I suggest you look on your broker statement associated with your foreign income. It may list the basis of your foreign assets that is used to allocate the foreign income.

From TurboTax:

**Mark the post that answers your question by clicking on "Mark as Best Answer"