- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Vehicle lease end and purchase Schedule C

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle lease end and purchase Schedule C

When business use vehicle lease ended, I then purchased the vehicle. I am baffled how to enter this in Turbotax Home and Business. Do I record the vehicle as stop use, with date of lease end, and then 'add vehicle' and record the same vehicle as a used vehicle 'new' purchase?

Also, can I then use standard mileage, since it is first year of owned vehicle?

Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle lease end and purchase Schedule C

Yes, you will need to enter the transaction as taking the leased vehicle out of service.

Next, you will enter the same vehicle a second time, but now as a purchased used vehicle.

Here is a link to another thread on this topic.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle lease end and purchase Schedule C

Perfect! Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle lease end and purchase Schedule C

I purchase my leased business vehicle and then traded for a new business vehicle that I paid cash for? Please advise how to enter these transactions in Turbo Tax? I use the vehicles 70% for business. How much 179 deduction can I take on the new vehicle (as long as it does not create negative income). Is it 70% of the purchase price? Turbo Tax gives me a number that is less than that amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle lease end and purchase Schedule C

Ok, watch very carefully. 1st things 1st

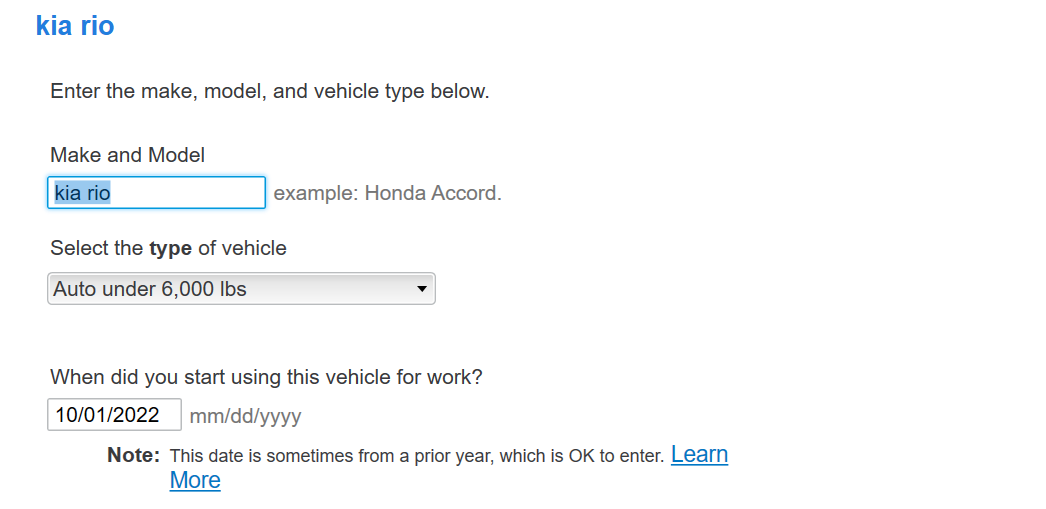

Under business expenses/ Cars, truck and other vehicle expenses. Next screen Vehicle summary. see here

In the 1st vehicle which was your 1st leased vehicle, you'll go through the input and enter all your vehicle expenses for the lease. As you go through the input, you'll want to indicate that it's a leased vehicle like this

On the second line, you'll input all the vehicle expense information as if this was a new vehicle because you bought this leased vehicle.

On the 3rd line, you'll record the purchase of the new vehicle which trade in your old vehicle for. It is in this screenin which you'll record the amount you paid for it as well as the Section 179 depreciation as follows:

Here you'll say I own the vehicle

Hit continue, continue etc. till you get to this screen and select yes, I'd like to see if my actual expenses give me a bigger deduction

Hit continue, continue etc. till you get to this screen, I purchased this vehicle new

Keep going till this screen where you'll indicate that the vehicle was part of a trade in

Hit enter, enter till you get to this screen

And then the next screen

On this screen, you would only put in 70% of the total purchase price and then

Do you want to take the Special Depreciation Allowance

Finally, because you put the new vehicle in service only in October of 2022, your Section 179 depreciation is only taking 25% of that 70%. And "NOT" the whole 70%.

Good Luck!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle lease end and purchase Schedule C

The amount of the purchase of the new vehicle was $22,199 - 70.01% of that number is $15,542 not the $13,442 that is shown on the Turbo Tax page.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle lease end and purchase Schedule C

You were supposed to input 70% of the purchase price of the vehicle here

And because you only started using it 10/01/2022, it should have taken 25% of that 70%

Please double check your input entries again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

scatkins

Level 2

user17545861291

Level 2

Binoy1279

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

RE-Semi-pro

New Member

justine626

Level 1