- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- TurboTax is incorrectly combining mortgage loan principal from multiple 1098 forms due to a mortgage service transfer (California). How do I fix this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is incorrectly combining mortgage loan principal from multiple 1098 forms due to a mortgage service transfer (California). How do I fix this?

I am going to go out on a limb and guess that in an audit the IRS is not going to accept TurboTax had a software bug as a valid reason for inaccurately reporting the correct values on the 1098.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is incorrectly combining mortgage loan principal from multiple 1098 forms due to a mortgage service transfer (California). How do I fix this?

Even if at the end IRS accepts the software error claims, imagine the efforts & hassles we will be invest in defending the case, is it cheaper to pay a live tax accountant $300 to do the tax instead of paying $30 to TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is incorrectly combining mortgage loan principal from multiple 1098 forms due to a mortgage service transfer (California). How do I fix this?

Has anyone received an answer from TurboTax as to when this bug will be fixed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is incorrectly combining mortgage loan principal from multiple 1098 forms due to a mortgage service transfer (California). How do I fix this?

I did and the said they could not replicate the issue.

I just went ahead and entered $0 for the second (latest) 1098 and enter $0 again when it said there was an error. When I got the forms downloaded everything looked fine and I’m comfortable it is accurate so I went ahead and submitted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is incorrectly combining mortgage loan principal from multiple 1098 forms due to a mortgage service transfer (California). How do I fix this?

No acknowledgement from them that this is even a bug, they seem to be taking the tact that it ignoring your answer to the interest cap question is a "feature". I ended up giving up and just filling in this section of the worksheet myself. Once I corrected the answer in the "Tax and Interest Deductions Worksheet" to correctly state that no my interest deduction should not be limited it cleared the smart check error for the Limited Int/Points value which was only getting flagged as required because the answer to the yes/no question was getting incorrectly translated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is incorrectly combining mortgage loan principal from multiple 1098 forms due to a mortgage service transfer (California). How do I fix this?

There is a workaround for this.

For desktop versions:

- In Forms view, locate and click on Tax & Int Wks on the left from the forms list

- On the form, scroll to Mortgage Interest Limited Smart Worksheet

- Click on NO to the right of the question, Does your mortgage interest need to be limited

For online versions:

- Under Deductions & Credits, expand the menu for Your Home

- Click Start/Revisit next to Mortgage Interest and Refinancing (Form 1098)

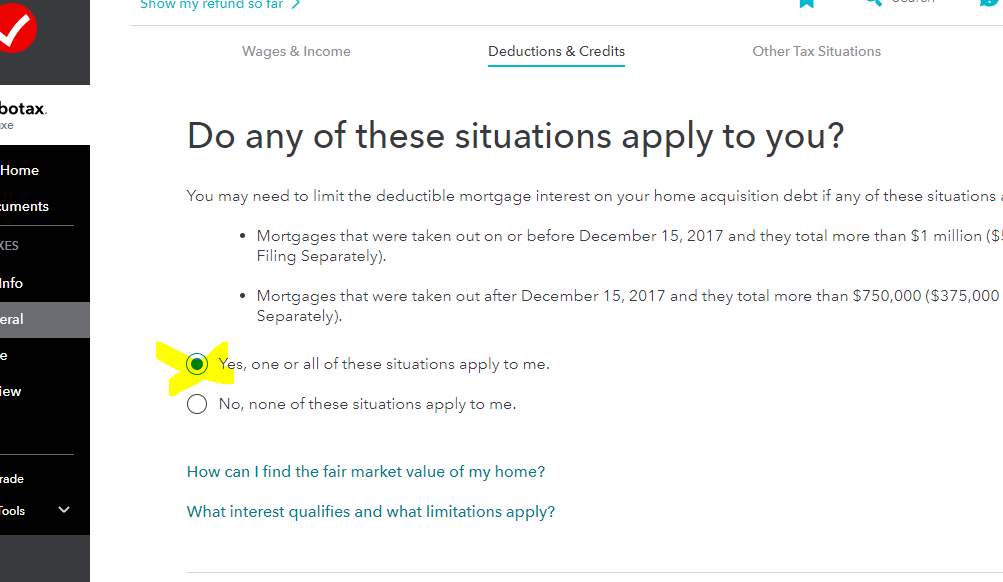

- Click through until you get to a screen that says Do any of these situations apply to you? Mark Yes.

- On the next screen, take out the zero.

- Click back and choose No.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is incorrectly combining mortgage loan principal from multiple 1098 forms due to a mortgage service transfer (California). How do I fix this?

Your work around fixes the federal tax. My mortgage interest deduction is not limited (my principal is less then $750k). However the California adjustment is still incorrect. My mortgage was acquired in June 2019. I have 2 1098s. California adjustment is limiting my mortgage interest deduction because it thinks I have 2 mortgages...

definitely a software flaw as I’ve read a dozen or more posts with the same problem.

help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is incorrectly combining mortgage loan principal from multiple 1098 forms due to a mortgage service transfer (California). How do I fix this?

Hi, any updates on this?

We are in the same situation - two 1098 forms for 2019, loan servicer was transferred in April 2019. When federal info is transferred to the California, it appears that I have two loan balances at the beginning of the year, when there was actually only one. Please help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is incorrectly combining mortgage loan principal from multiple 1098 forms due to a mortgage service transfer (California). How do I fix this?

this is really stupid. How could the they don't test this common case...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is incorrectly combining mortgage loan principal from multiple 1098 forms due to a mortgage service transfer (California). How do I fix this?

The limit on the amount of interest has changed under the Tax Cuts & Jobs Act. The interest deduction pre-TCJA has been available to qualified mortgage debt up to $1 million ($500,000 married filing separately).

Through 2025, the TCJA has lowered the amount of qualified mortgage debt to $750,000. For qualified mortgage debt incurred on or before December 15, 2017, the $1 million limit remains in place, thus "grandfathering" existing mortgage debt.

For desktop versions:

- In Forms view, locate and click on Tax & Int Wks on the left from the forms list

- On the form, scroll to Mortgage Interest Limited Smart Worksheet

- Click on NO to the right of the question, Does your mortgage interest need to be limited

For online versions, after entering the 1098 interest information, continue through the screens and TurboTax will ask you if the interest needs to be limited.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is incorrectly combining mortgage loan principal from multiple 1098 forms due to a mortgage service transfer (California). How do I fix this?

I am planning to do the same workaround. By entering 0 as the outstanding balance for the second mortgage, turbo tax seem to give the right results and avoids double counting them as two distinct mortgages. Does anyone know of a better solution?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is incorrectly combining mortgage loan principal from multiple 1098 forms due to a mortgage service transfer (California). How do I fix this?

I have the same situation: received two 1098s because the loan was transferred to another lender this year. On my NY return it's showing double the mortgage principal. I've tried every suggestion here. I spoke with a TT Live Advisor today and he told me to use the desktop version next year so I can edit the fields in the actual forms. He also said it didn't really matter to have it wrong since I am taking standard deduction. Neither statement is very confidence inspiring. I don't like fudging the 1098 numbers and don't like having my mortgage schedule wrong. FIX THE BUG.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is incorrectly combining mortgage loan principal from multiple 1098 forms due to a mortgage service transfer (California). How do I fix this?

There is no screen that comes up asking if the loan was paid off or transferred so it continues to double up the 1098 loans

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is incorrectly combining mortgage loan principal from multiple 1098 forms due to a mortgage service transfer (California). How do I fix this?

If you are working in the Desktop version, you can try the following as provided by jmcglass.

- Click on the View link on the top menu bar

- Click on Forms

- Locate and click on 'Tax & Int Wks' on the left-hand side of the screen (under Forms in My Return)

- On the form, scroll down to the 'Mortgage Interest Limited Smart Worksheet'

- Click on the 'No' box, to the right of the question 'Does your mortgage interest need to be limited.'

If you are working in the online version, please go back to deductions and credits and mortgage interest.

Click through until you get to a screen that says "Do any of these situations apply to you? Mark yes on the next screen, take out the zero, click back and choose "No".

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is incorrectly combining mortgage loan principal from multiple 1098 forms due to a mortgage service transfer (California). How do I fix this?

Sorry to resurrect this old thread, but it seems many are again dealing with this bug which occurs when trying to include data from 2 1098s which correspond to a single property before and after refinancing. Moreover, this issue has rather major repercussions as it is not at all clear how (in future years) the refinanced mortgage (which would have been initiated after 2017) can be stipulated to subject to the pre-2017 deductibility limits.

Finally, the solution (online version) provided last year in this thread does not appear to work any more. I cannot "click through" to any screen which allows me to select whether interest needs to be limited. I really would like to avoid incorrectly putting "$0" for the Box 2 of the new mortgage even if it means Schedule A is eventually correct - this seems like an easily fixed issue which has been a problem for over a year.

Thanks!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mjbarak

Level 1

taxius

Returning Member

waldo00

Returning Member

Bruce05

Level 2

dbergman

Returning Member