- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Thereappears to be a bug when it comes to HELOC Interest

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thereappears to be a bug when it comes to HELOC Interest

I had a HELOC in 2024 (1098 Box 3 Origination Date 07/28/23). The balance on 1/1/24 was $274,000 (1098 Box 2). Ending balance before it was paid off was $296,000 (paid off in July 2024). Total Interest in 2024 on the HELOC was $12,800 (1098 Box 1). Acquisition Date (1098 Box 11) is blank . Of the total HELOC Balance, ONLY $40,000 was used on the home secured by the loan - the rest was used to modify a new (different) home I purchased and moved into in May 2024. TurboTax is claiming the entire $12,800 is deductible, however shouldn't only $1,729 be deductible ($40,000/$296,000 * $12,800 = $1,729)? How do I get TT to calculate and input the correct deductible amount?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thereappears to be a bug when it comes to HELOC Interest

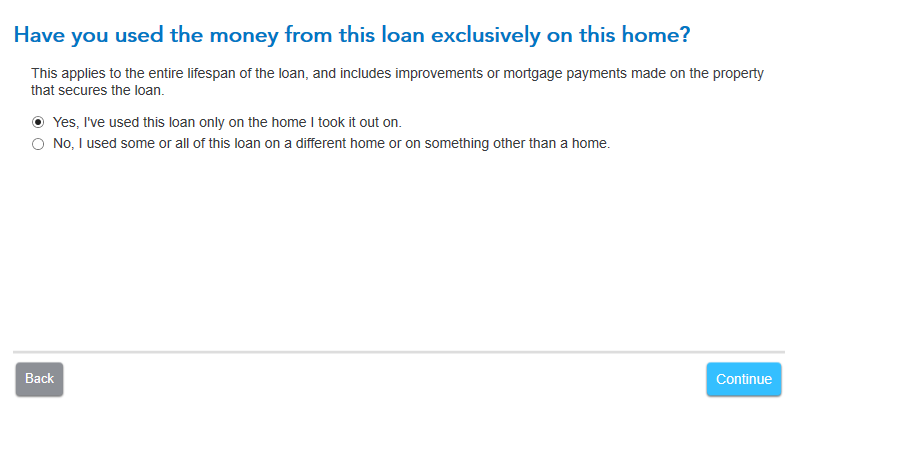

As you walk through the questions after you enter your 1098, you will come to a question that says Have you used the money from this loan exclusively on this home. Here you will select No, I used some or all of this loan on a different home or on something other than a home.

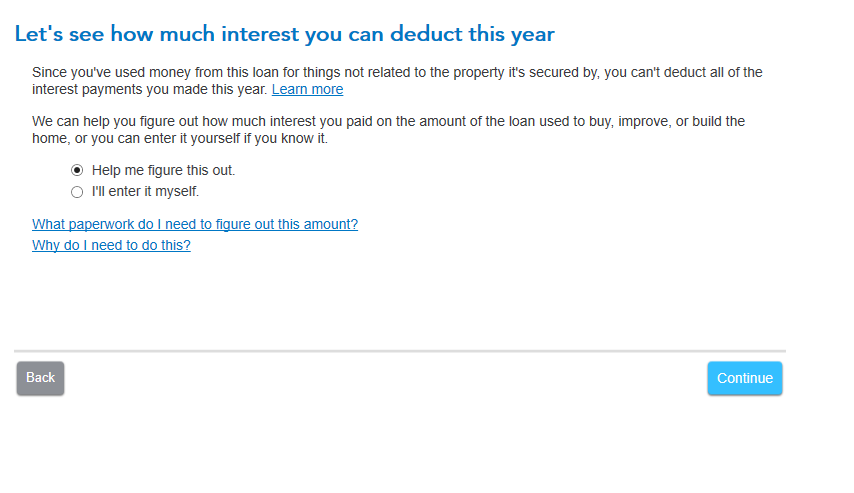

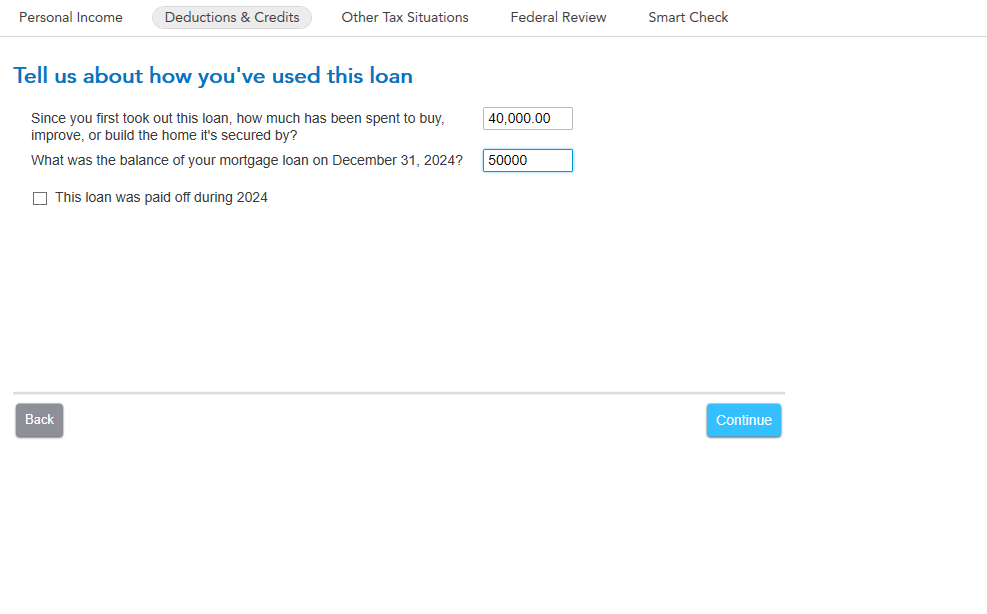

On the next screen select, help me figure this out then enter the amount you spent ON the home and the balance.

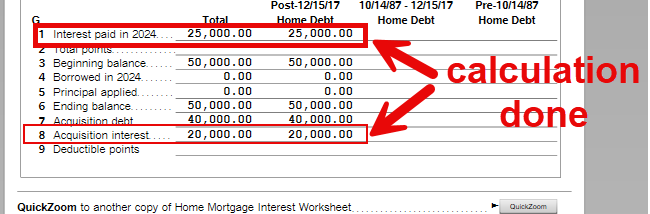

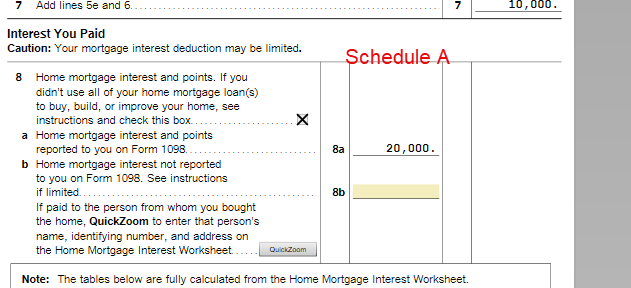

Then TurboTax will do the calculation. Be sure you enter the amount spent ON the home and not the amount spent on other things.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rroop1

New Member

Sunnywinds

New Member

Opus 17

Level 15

devries92

Level 1

Trojan99

Returning Member