- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- That is now on Schedule 1 (Line 29). When you enter your...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I deduct the self employment health insurance premiums on the 2018 forms?

My husband and I are self employed in an S corp. I used to deduct health insurance premiums as an adjustment to income on page 1. On the 2018 form that section no longer exists. How do I take this deduction for 2018?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I deduct the self employment health insurance premiums on the 2018 forms?

That is now on Schedule 1 (Line 29).

When you enter your K-1 form the corporation, it will ask you about health insurance, and you need to check that box and answer the followup questions, including re-entering Box 5 of your W-2 from the corporation.

Of course, this assumes that the corporation paid for the insurance, and that payment was added to Box 1 of your W-2.

As a side note, even though you may qualify for the "Self Employed Health Insurance deduction", you are not self employed. You are employees of the corporation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I deduct the self employment health insurance premiums on the 2018 forms?

That is now on Schedule 1 (Line 29).

When you enter your K-1 form the corporation, it will ask you about health insurance, and you need to check that box and answer the followup questions, including re-entering Box 5 of your W-2 from the corporation.

Of course, this assumes that the corporation paid for the insurance, and that payment was added to Box 1 of your W-2.

As a side note, even though you may qualify for the "Self Employed Health Insurance deduction", you are not self employed. You are employees of the corporation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I deduct the self employment health insurance premiums on the 2018 forms?

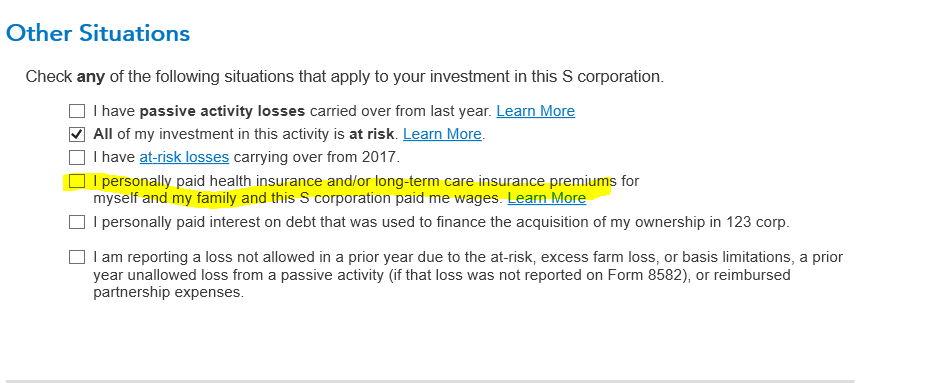

Just a heads up the check box is in the other situations slide as you navigate through the K-1 entry.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jgilmer78

Returning Member

zenmster

Level 3

dkatz71

New Member

v8899

Returning Member

user17558084446

New Member