- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Taxed twice on RSU

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxed twice on RSU

I received vested RSUs twice in 2024. For both times, I selected sell to cover taxes on vesting day and some shares were sold to cover the taxes. I received a 1099-B for these transactions. However, it seems like TurboTax is taxing me again on the total RSU amount from my W-2 box 14 as income even though I have not sell most of the vested RSU. My taxes owed went up substantially (over $20K) after inputting my W-2 information. Is this expected or am I missing something?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxed twice on RSU

The restricted stock units (RSU's) are taxable income and as such the value of them is included in your salary wages (box 1), social security wages (box 3) and Medicare wages (box 5) on your W-2 form. Since you have to pay social security and Medicare taxes on the income, and also income taxes, some of the shares are sometimes sold by the company to pay those taxes. They are paid in by the company.

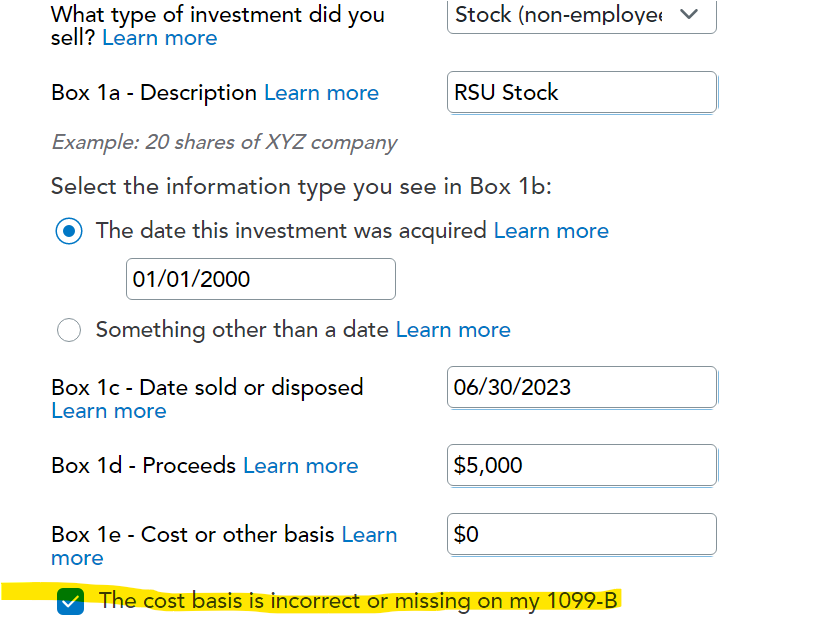

You need to report the sale of those shares to report any resulting gain or loss, but the gain or loss is minimal since you buy and sell them almost immediately. So, the gain on sale when you report the Form 1099-B in TurboTax should be minimal. Often, the Form 1099-B will report a minimal amount for the cost basis as you may have paid little or nothing to acquire the shares. However, the income reported on your W-2 form needs to be included in the cost basis of the shares sold, so you may need to adjust the cost basis reported on the Form 1099-B to compensate for that.

A simple way to determine the cost basis of your RSU shares sold is to divide the income for the RSU's as reported on your W-2 form, plus any additional money you may have spent to acquire them, by the number of shares acquired. That will give you the cost of the shares that you can then multiply by the number of shares sold to arrive at their cost basis.

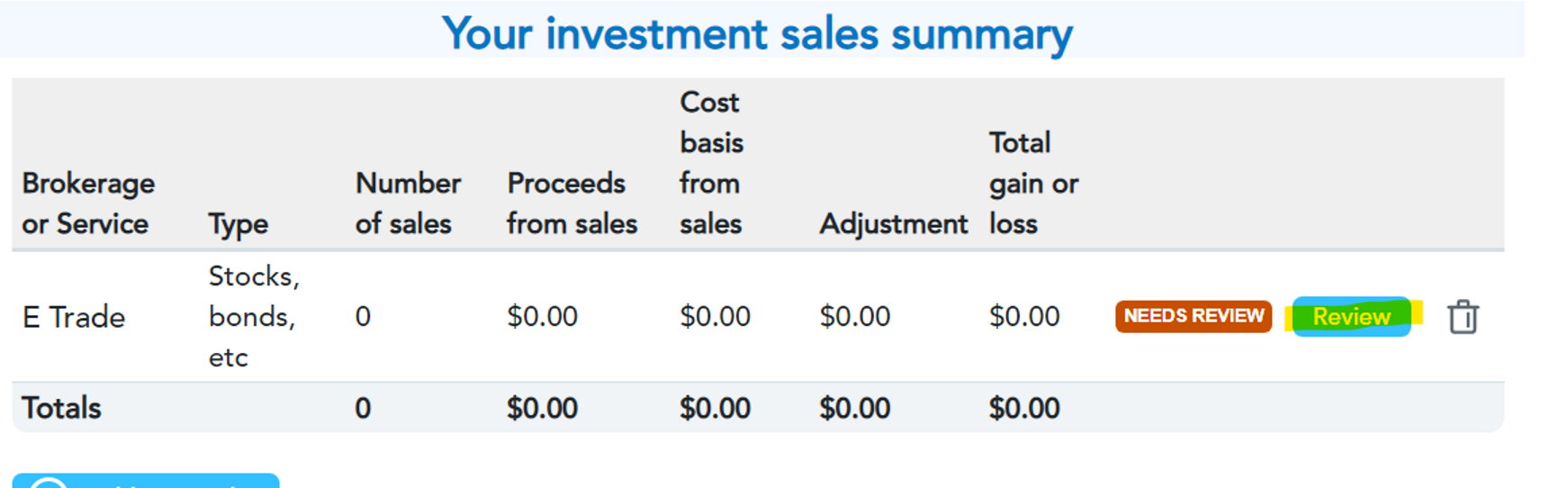

You need to edit that entry in the Investment Income section of TurboTax, then Stocks, cryptocurrency, Bonds, Mutual Funds, Other. Find the investment sale you need to edit in the Your Investment Sales summary and click on the Review tab:

On the stock sale screen, indicate that the cost basis is missing or incorrect and you will have an opportunity to enter the correct cost basis.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

peteysue07

New Member

tidwell-monique74

New Member

Bruno_Mesquita

New Member

Lukas1994

Level 2

jrmcateer305

New Member