in Events

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Tax experts: Please help me with the QBI deduction for rental proprites

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax experts: Please help me with the QBI deduction for rental proprites

Suppose I have three rental properties.

The first two properties generated positive gains in 2020 and the 3rd one had the loss.

Can I put the first two profitable rental properties in one entity/enterprise and apply QBI deduction (199A) on it, and leave 3rd property alone (no QBI deduction)? or I have to put all of three rental properties in one entity no matter whether each of them is profitable or loss?

Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax experts: Please help me with the QBI deduction for rental proprites

It depends. If you believe one of the rental properties is somehow different and doesn't rise to the level of a trade or business as defined next, then you can make a decision to exclude one property. However, if you are making the decision to increase your qualified business income deduction (QBID) without foundation, then you should include all or none. See the information in the Revenue Procedure next.

Rental real estate does not always rise to the level necessary for the qualified business income deduction (QBID). The second notice, produced by the IRS, defines more clearly about the safe harbor on page 5 of Revenue Procedure 2019-38 and helps you to understand the required record keeping to qualify for QBID.

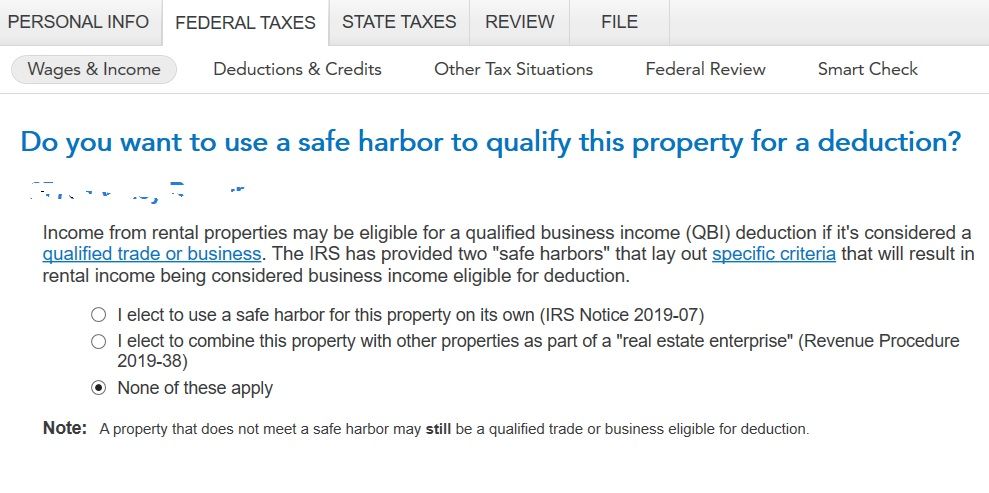

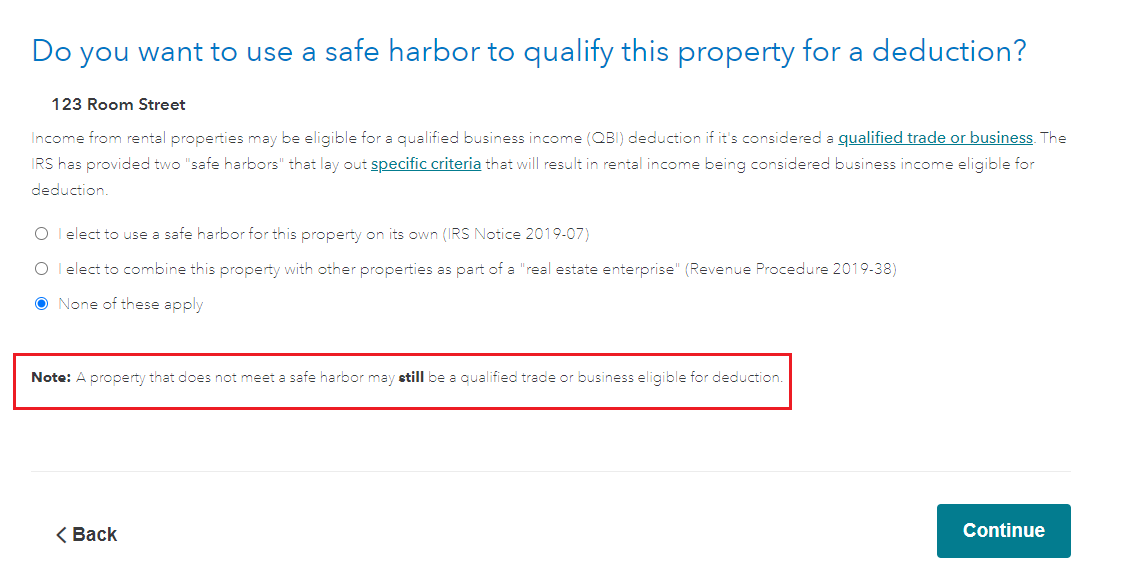

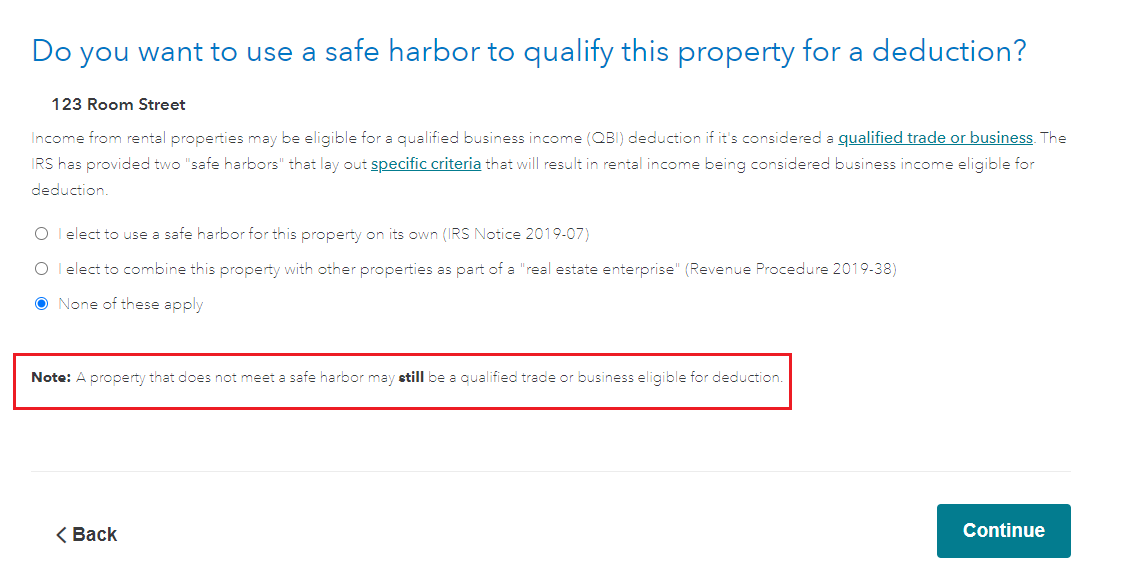

- Select to Edit or Review beside each rental property > Scroll to LESS COMMON SITUATIONS > Select QBI

- You see the aggregation screen if you indicated that your taxable income might exceed certain levels. Otherwise, the "aggregation" screen does not appear. (It's not necessary to aggregate)

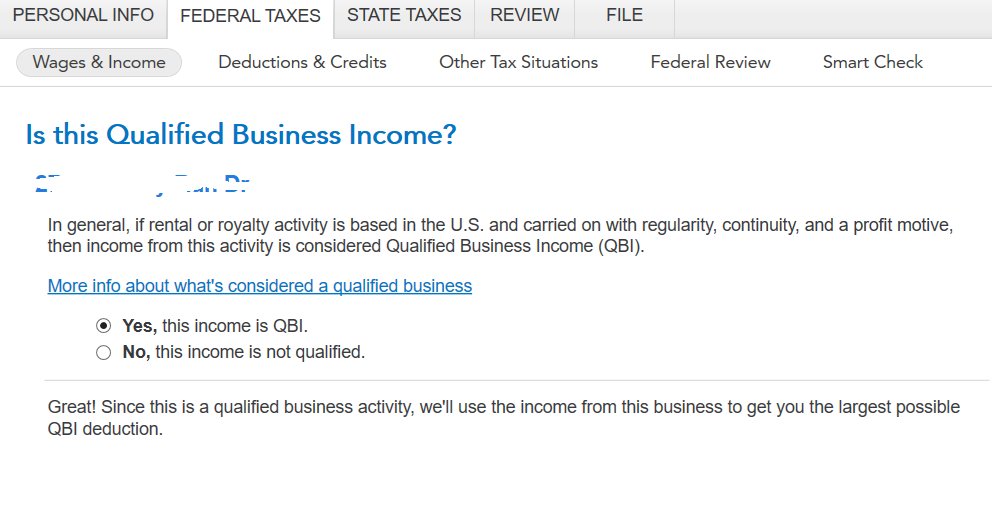

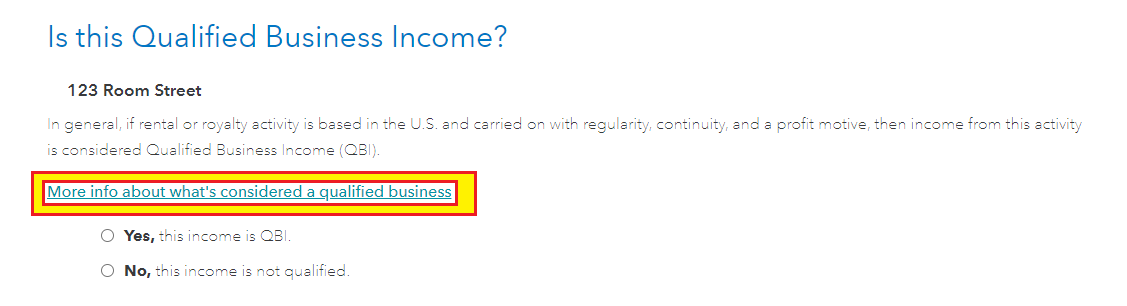

- If you do not select either safe harbor methods the next screen will ask you if this is qualified business income. If you select 'Yes' then TurboTax will do the calculations.

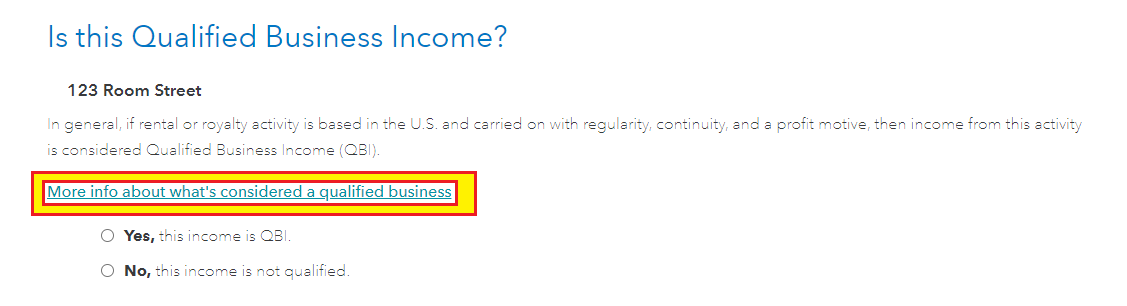

- Be sure to select and read the link "More Info about what's considered a qualified business" before you answer.

- See the images below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax experts: Please help me with the QBI deduction for rental proprites

You need to enter all three property separately. There will be different amounts of income and expenses, depreciation and amortization for each one of them. However, your income or looses will be combined together for the QBI purposes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax experts: Please help me with the QBI deduction for rental proprites

I did record each rental property individually in turbotax in terms of income, expense depreciation and etc., and actually my question was when Turbotax asked me if each rental property is qualified for the QBI deduction, can I select QBI deduction for the 1st and 2nd rental property (in one enterprise), and select NO QBI deduction for the 3rd property?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax experts: Please help me with the QBI deduction for rental proprites

It depends. If you believe one of the rental properties is somehow different and doesn't rise to the level of a trade or business as defined next, then you can make a decision to exclude one property. However, if you are making the decision to increase your qualified business income deduction (QBID) without foundation, then you should include all or none. See the information in the Revenue Procedure next.

Rental real estate does not always rise to the level necessary for the qualified business income deduction (QBID). The second notice, produced by the IRS, defines more clearly about the safe harbor on page 5 of Revenue Procedure 2019-38 and helps you to understand the required record keeping to qualify for QBID.

- Select to Edit or Review beside each rental property > Scroll to LESS COMMON SITUATIONS > Select QBI

- You see the aggregation screen if you indicated that your taxable income might exceed certain levels. Otherwise, the "aggregation" screen does not appear. (It's not necessary to aggregate)

- If you do not select either safe harbor methods the next screen will ask you if this is qualified business income. If you select 'Yes' then TurboTax will do the calculations.

- Be sure to select and read the link "More Info about what's considered a qualified business" before you answer.

- See the images below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax experts: Please help me with the QBI deduction for rental proprites

@DianeW777 I have noticed that TurboTax provides two screens for the rental property QBI deduction for 2020 tax returning.

Just like you mentioned above, the first screen is about using the 2 Safe harbors to qualify for the QBI deduction. The second screenshot (also appeared in the previous year's turboxtax) is the QBI deduction w/o using the safe harbor.

If all of my three rental properties in the same nature, can I still use the 2nd screen (QBI without using the safe harbor) to determine the QBI deduction for each property individually and don't have to group them together in an enterprise ( on the 1st QBI screen using the safe harbor)?

Since I have two profitable rental properties and 1 profit-loss rental property, if I group them together in an enterprise and using the safe harbor (I was qualified for all the conditions in 2020), I found the QBI deduction is basically wiped away by the big loss from the 3rd rental property.

the 1st screen for the QBI deduction using safe harbors.

the 2nd screenshot for the QBI without using the safe harbor:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax experts: Please help me with the QBI deduction for rental proprites

Yes, you can use the second screen without the safe harbor. You should be prepared to make your case if it is ever questioned. Aggregation is not something you have to choose, and is a personal decision.

As far as selecting only the profitable properties, this is not the intent of the deduction. In other words you can't pick and choose each year based on the profit or loss of each property. The real decision is based on whether the rental properties rise to the level of a trade or business and the safe harbor provisions. The negative figure does eliminate the deduction and the loss carries over to adjust the following year's QBI.

Here are some links with information that will help you decide.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax experts: Please help me with the QBI deduction for rental proprites

@DianeW777 Carrying over the loss to the following year's QBI is based on the that profit-loss property? or on the entire enterprise? The reason I am asking this question is I sold that profit-loss property in 2020 and I am not sure whether the loss can still be carried over.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax experts: Please help me with the QBI deduction for rental proprites

If you aggregate it will be the entire enterprise however, the property that is sold will allow any passive loss in the year of sale outside of the QBID aggregation.

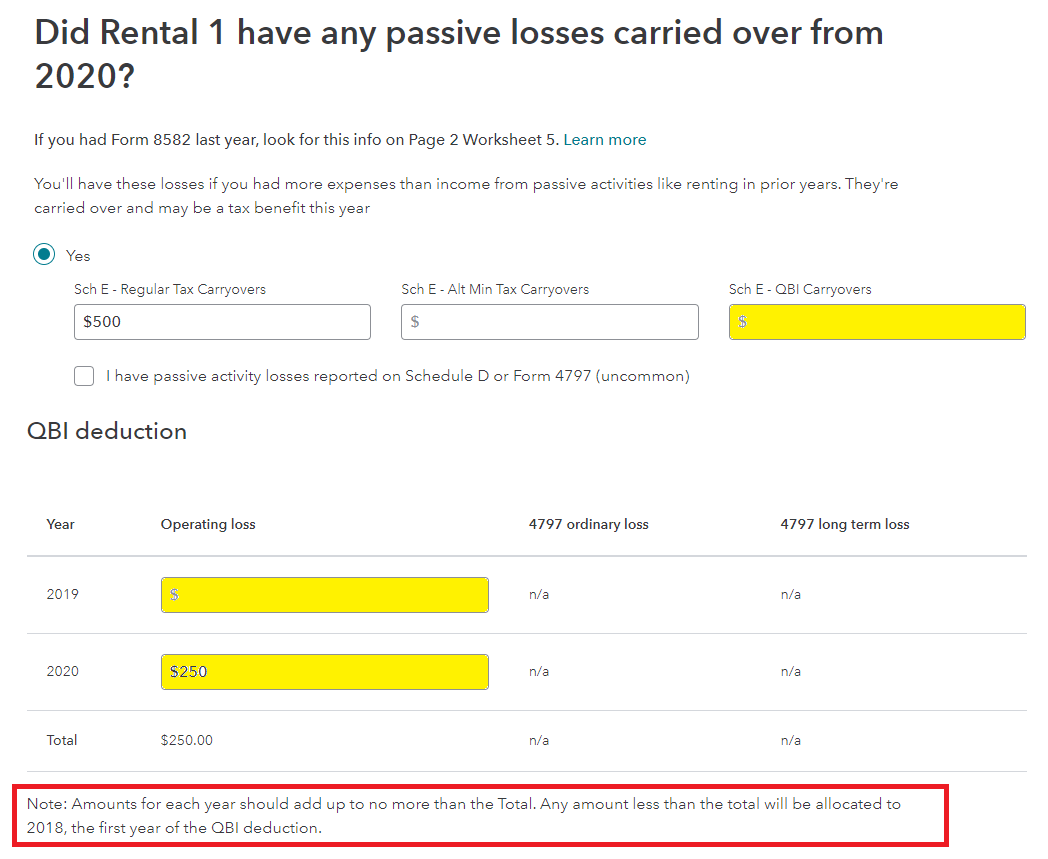

Passive losses for a QBI business (from 2018 forward) will be tracked until the year the loss is included in taxable income. This is included in the Instructions for Form 8995-A.

You can "group" (or aggregate) your rental properties (treat them as a single enterprise) for the purposes of Section 199A (the QBI deduction).

You cannot "group" (or aggregate) your rental properties to avoid the passive activity loss rules unless you qualify as a real estate professional and grouping them would allow you to meet one of the material participation tests.

See Treas. Reg. §1.469-9(g)(3)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax experts: Please help me with the QBI deduction for rental proprites

My issue is similar to this one.... I have 2 rentals but Form 8995 is only allowing PY losses from Rental #1 on line 3 of the Form 8995. It's completely ignoring the PY losses from Rental #2. It's working in my favor because I'm getting a deduction but I don't think it's incorrect. FYI: Line #2 is correctly combining the business income/loss for both rentals. Also, I have not aggregated them/made them an enterprise. They are separate (with Rental #1 on line i and Rental #2 on line ii of Form 8995). I also have not taken the safe harbor but have said "yes, they do qualify for QBI." I have also checked my Schedule E worksheets and the PY passive losses are considered passive losses in the QBI columns too. Not sure if I've incorrectly checked a box somewhere or if the TurboTax software is the issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax experts: Please help me with the QBI deduction for rental proprites

Any advice @DianeW777

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax experts: Please help me with the QBI deduction for rental proprites

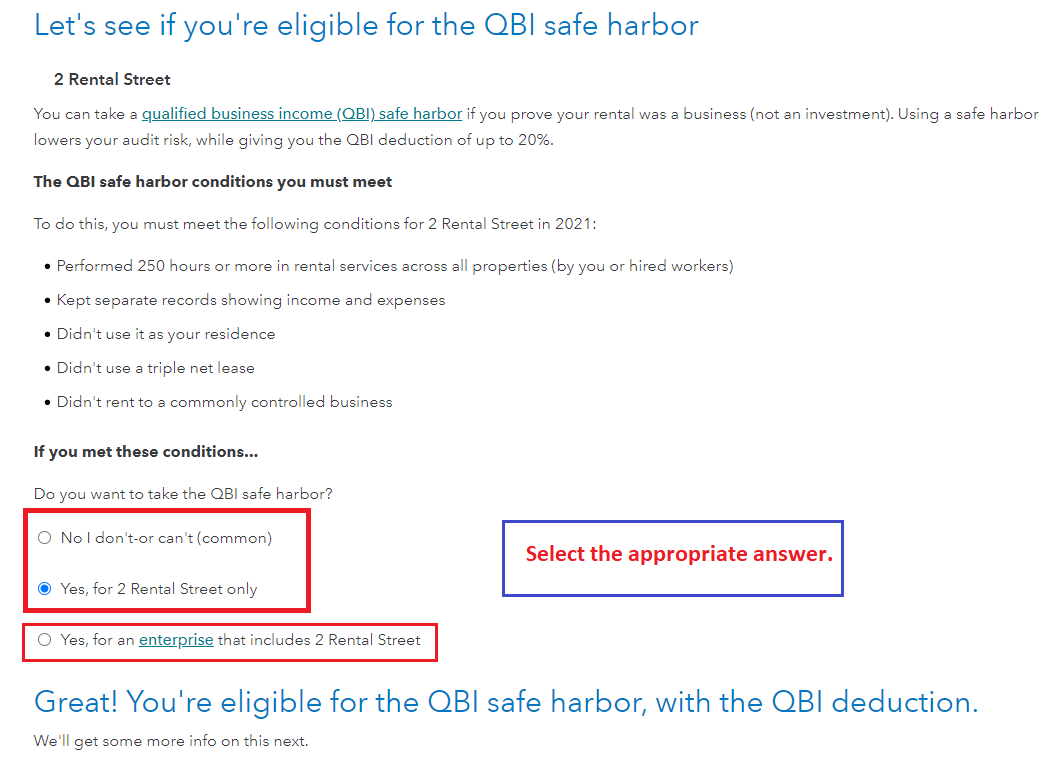

Let's first confirm you have answered the appropriate questions for the carryover loss(es). After your finish your rental activity you will be asked a series of questions.

- Let's see if you're eligible for QBI safe harbor:

- Do you meet the conditions?

- Do you want to use enterprise that includes both rentals (my suggestion is yes for the QBI)

- Select the enterprise this property belongs to:

- Your first rental will be automatically selected (assuming these are both residential rental properties)

- Under the rental activity section, you must enter the carryover by selecting 'Carryovers, limitations, at risk info, etc.'

- Complete all the necessary entries to complete the QBI carryover and read all the notes carefully

- See the images below for assistance.

Solely for purposes of this safe harbor, a rental real estate enterprise is defined as an interest in real property held to generate rental or lease income. It may consist of an interest in a single property or interests in multiple properties. If you are using all properties to arrive at the 250 hours you must select to use this option for all properties. The one's selected must meet the requirements.

How is the QBI deduction calculated?

Calculating QBI itself is a different topic. To calculate the deduction, several factors are taken into consideration:

1. The QBI deduction cannot exceed 20% of the taxpayer’s taxable income less capital gains. Taxpayers begin by calculating the QBI based on this amount. Limitations apply to taxpayers that have taxable income above threshold amounts for 2021:

$329,800 for MFJ

$164,925 for MFS

$164,900 for all other taxpayers

Please update with details about the TurboTax product you are using if you need further assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax experts: Please help me with the QBI deduction for rental proprites

I have the desktop version. Nonetheless, I made it an enterprise like you suggested and it still isn't adding the PY QBI passive losses from my second rental to the total QB net (loss) carry forward from the prior year (Line 3 of the Form 8995. Also, the option to manually enter PY QBI information (like your screenshot) isn't popping up in the desktop version. Could you contact me personally somehow to discuss this? I'd hate to have to explain this situation to someone all over again if I were to call in. @DianeW777

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax experts: Please help me with the QBI deduction for rental proprites

Under the Rental Property continue to the Rental and Royalty Summary then click Edit > click Done with Rental Property >.

Continue to the screen "Is this Qualified Business Income?" > Answer Yes > Continue to answer the questions - See the screens below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax experts: Please help me with the QBI deduction for rental proprites

My rentals are qualified businesses. They have been for years. My particular issue is that Turbo Tax is not pulling ALL of my PY losses from these qualified businesses like it should on my Form 8995. I have combined them into an enterprise to see if the problem corrects itself and it doesn't. The screenshots you sent I have been through after "Done with this Property". I do not, however, see the screenshot you show where I can manually enter PY QBI Losses. Honestly, I don't see why I would have to manually enter them because on my Schedule E worksheets the PY losses are already in the QBI columns for carryforward losses. They should automatically flow to my 8995. How can I converse with you/someone about this software issue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax experts: Please help me with the QBI deduction for rental proprites

For anyone that has been following along in this saga..... I figured it out. If you scroll all the way down in the Schedule E worksheet (in this case for my 2nd rental property) in the QBI Losses by Year Smart Worksheet - Passive Loss Carryforwards to 2022 - the QBI Column was incorrectly assigning my 2020 (line J) & 2019 (line G) operating losses to the 2018 (line D) row for some reason. Even though the Regular Tax Column was correctly assigning them. When I manually overrode those amounts to the correct years, it fixed the problem. Good luck everyone.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Raph

Community Manager

Raph

Community Manager

in Events

Raph

Community Manager

in Events

Ed-tax2024

New Member

kpareek

Level 2