- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Let's first confirm you have answered the appropriate questions for the carryover loss(es). After your finish your rental activity you will be asked a series of questions.

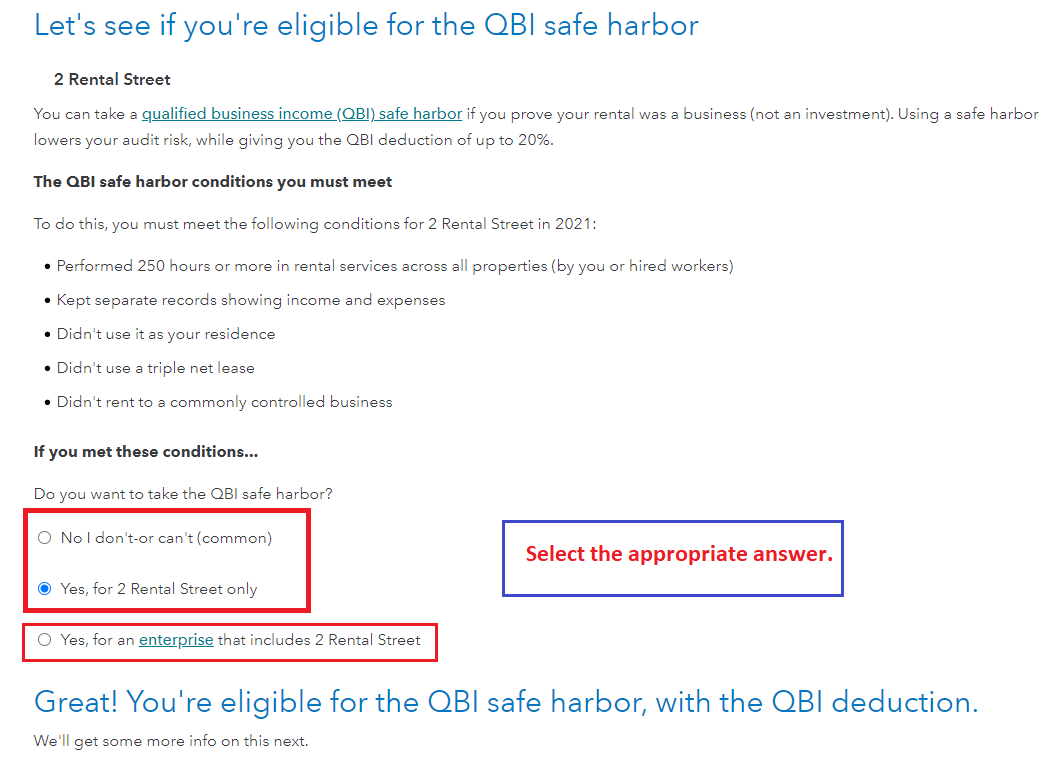

- Let's see if you're eligible for QBI safe harbor:

- Do you meet the conditions?

- Do you want to use enterprise that includes both rentals (my suggestion is yes for the QBI)

- Select the enterprise this property belongs to:

- Your first rental will be automatically selected (assuming these are both residential rental properties)

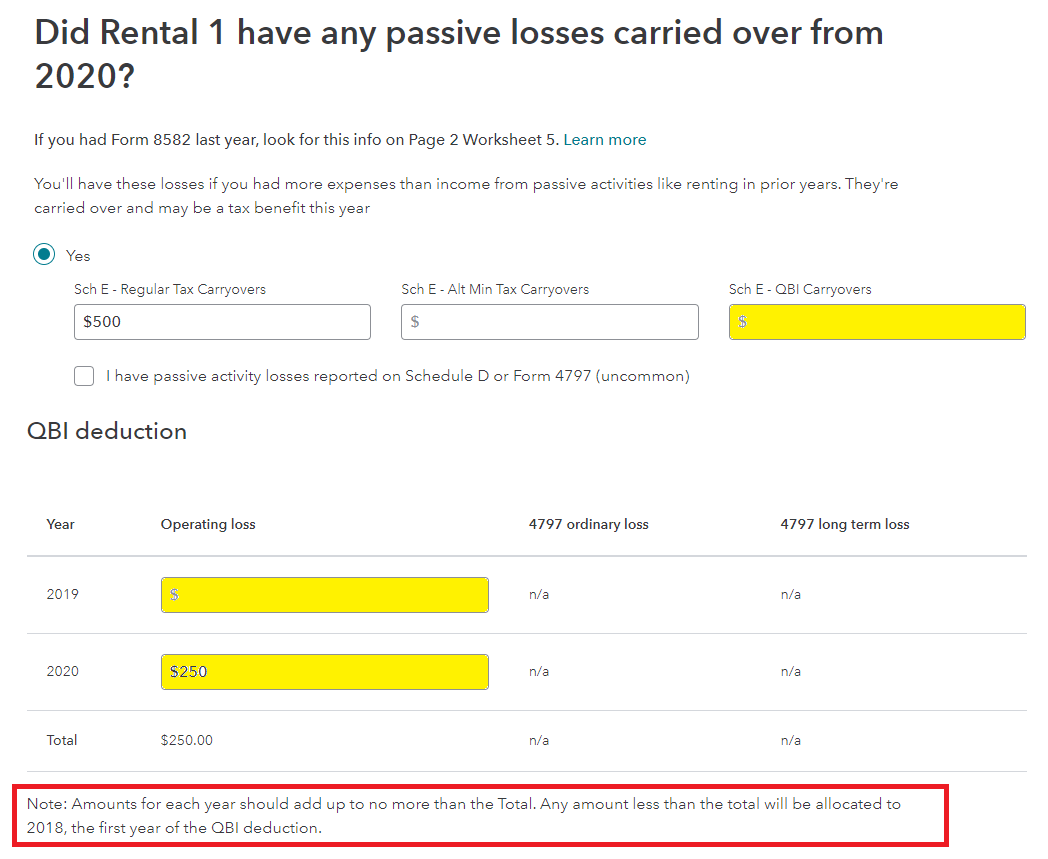

- Under the rental activity section, you must enter the carryover by selecting 'Carryovers, limitations, at risk info, etc.'

- Complete all the necessary entries to complete the QBI carryover and read all the notes carefully

- See the images below for assistance.

Solely for purposes of this safe harbor, a rental real estate enterprise is defined as an interest in real property held to generate rental or lease income. It may consist of an interest in a single property or interests in multiple properties. If you are using all properties to arrive at the 250 hours you must select to use this option for all properties. The one's selected must meet the requirements.

How is the QBI deduction calculated?

Calculating QBI itself is a different topic. To calculate the deduction, several factors are taken into consideration:

1. The QBI deduction cannot exceed 20% of the taxpayer’s taxable income less capital gains. Taxpayers begin by calculating the QBI based on this amount. Limitations apply to taxpayers that have taxable income above threshold amounts for 2021:

$329,800 for MFJ

$164,925 for MFS

$164,900 for all other taxpayers

Please update with details about the TurboTax product you are using if you need further assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"