- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

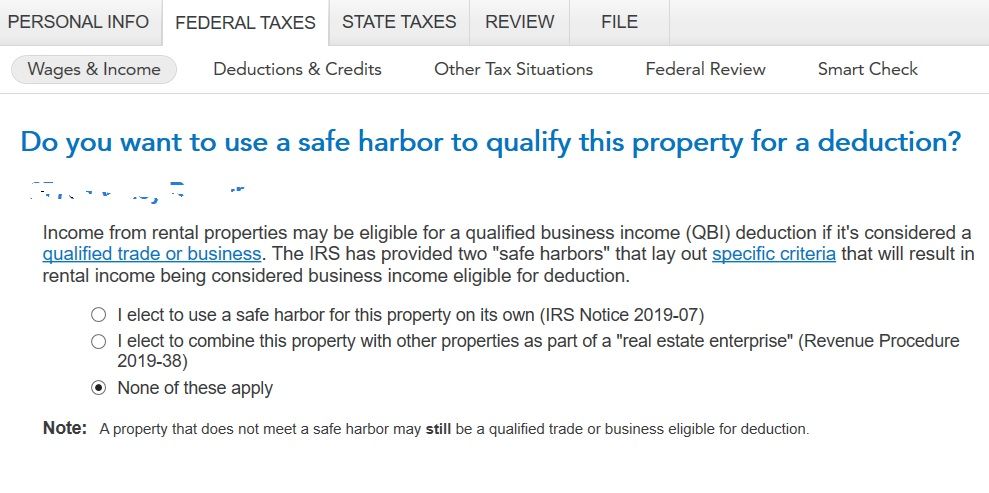

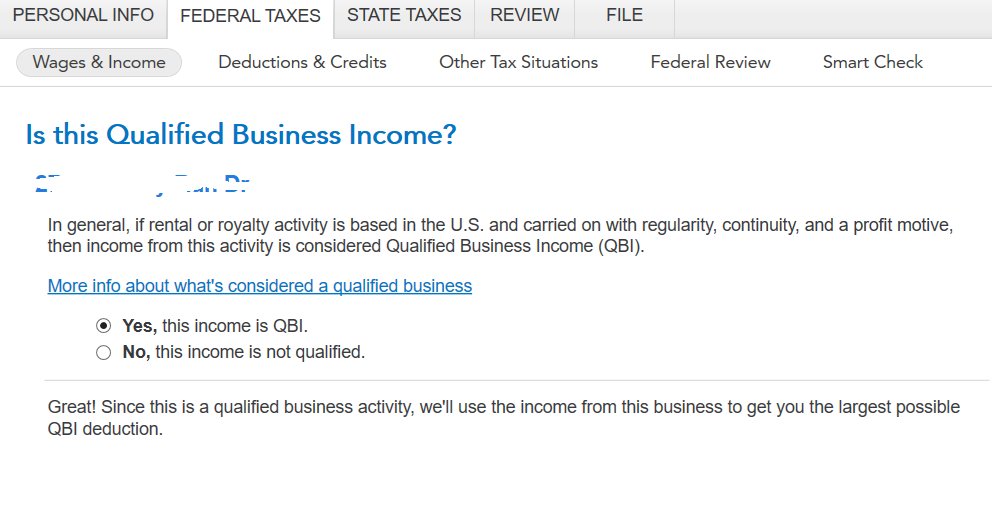

@DianeW777 I have noticed that TurboTax provides two screens for the rental property QBI deduction for 2020 tax returning.

Just like you mentioned above, the first screen is about using the 2 Safe harbors to qualify for the QBI deduction. The second screenshot (also appeared in the previous year's turboxtax) is the QBI deduction w/o using the safe harbor.

If all of my three rental properties in the same nature, can I still use the 2nd screen (QBI without using the safe harbor) to determine the QBI deduction for each property individually and don't have to group them together in an enterprise ( on the 1st QBI screen using the safe harbor)?

Since I have two profitable rental properties and 1 profit-loss rental property, if I group them together in an enterprise and using the safe harbor (I was qualified for all the conditions in 2020), I found the QBI deduction is basically wiped away by the big loss from the 3rd rental property.

the 1st screen for the QBI deduction using safe harbors.

the 2nd screenshot for the QBI without using the safe harbor: