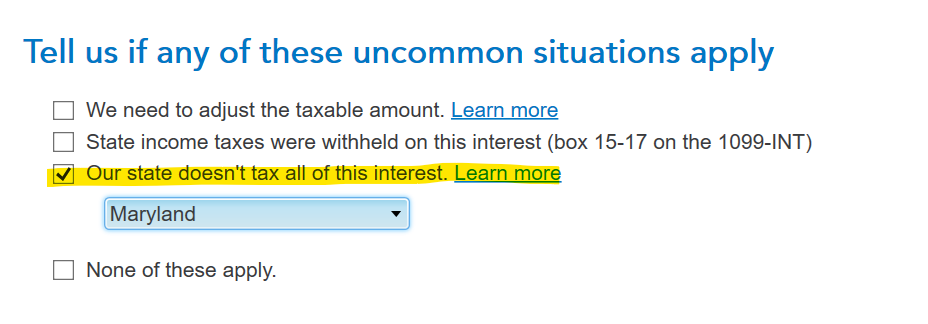

After you enter your Form 1099-INT, you will see a screen that says Tell us if any of these uncommon situations apply, to which you want to indicate that your state doesn't tax all of the interest, and choose your state from the drop down menu:

On the next screen, you need to click the box that says I earned tax-exempt interest in more than one state and then enter the interest earned in your state and the interest earned in other states:

The interest you entered for other states will be taxable on your state tax return.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"