in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Standard Deduction for F-1 Student

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard Deduction for F-1 Student

Hi,

I am an international student from India on an F-1 visa in the US. I am reviewing my 2022 return and have a query about the standard deduction under the US-India income tax treaty.

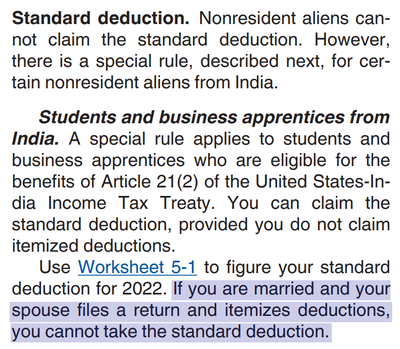

In 2022, my spouse was on an L-1 visa, and I was on an F-1 visa. Both of us were non-resident aliens for US tax purposes and filed 1040-NR. She claimed an itemized deduction on her return for the withheld state taxes. Under the US-India income tax treaty, I claimed the standard deduction. IRS Publication 519 mentions the following

I would like to understand if I was not eligible to take the standard deduction and incorrectly claimed the standard deduction on my 2022 tax return.

Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard Deduction for F-1 Student

The rules for the 1040NR can be different than the rules for the form 1040. TurboTax does not cover the form 1040NR. You could contact Sprintax.com to get a good answer on filing status and deductions as a non resident alien.

In general, for those filing a form 1040 as a US Citizen or Resident Alien, both must either itemize or take the standard deduction. One cannot itemize while the other takes the standard deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Standard Deduction for F-1 Student

@ng92 , generally agreeing with my colleague @Vanessa A , the US-India Tax treaty does allow standard deduction for students on F-1 from India but it stipulates this in a round about way -- It wants India students to be treated same as American and/or resident for tax purpose students.

Therefore it is a matter of interpretation on how to proceed i.e. America/Resident students with filing status of Married Filing Sep ( equivalent to F-1 married students form 1040-NR ) have the additional restriction of both taking the same type of deduction. My interpretation of the situation is that since one spouse is filing with itemized deduction, the other spouse must also follow suit .

Others may disagree with my strict interpretation of the intent of the law.

Is there more I can do for you? If you need more, please provide dates of both your and your spouse's entry and if this is your first entry within the last three years.

Namaste

pk

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Majk_Mom

Level 2

anonymouse1

Level 5

in Education

jbweed98

New Member

in Education

AndrewA87

Level 4

jpgarmon1

New Member

in Education