- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Self Employed for 4 months, how do deductions work?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self Employed for 4 months, how do deductions work?

Hi,

I live in Az and was self employed for 4 months working from home. I heard about the simple $5 per sq ft of used space deduction for the year but to my understanding, that is if someone is self employed for the whole year.

Since I worked only 4 months, do I just take the $ value of the calculation and divide it by 3?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self Employed for 4 months, how do deductions work?

You can start using the simplified method for calculating a home office deduction if you qualify, regardless of when during the year you started the business. You can use this method to determine your home office deduction on your return by expensing $5 per square foot of your office, up to 300 square feet for a maximum of $1,500.

Generally speaking, to qualify for the home office deduction, you must meet one of these criteria:

- Exclusive and regular use: You must use a portion of your house, apartment, condominium, mobile home, boat or similar structure for your business on a regular basis. This also includes structures on your property, such as an unattached studio, barn, greenhouse or garage. It doesn't include any part of a taxpayer's property used exclusively as a hotel, motel, inn, or similar business.

- Principal place of business: Your home office must be either the principal location of your business or a place where you regularly meet with customers or clients. Some exceptions to this rule include daycare and storage facilities.

Your deduction for business use of your home may not exceed your business net income (gross income derived from the qualified business use of the home minus business deductions).

If part of your deduction exceeds your net income for this year, TurboTax will carry the excess over to next year in case you have a larger net profit and can use the rest of the deduction.

See this help article for information on entering the home office information. Answer the questions in TurboTax rather than making a calculation first.

Please see this TurboTax article and IRS Publication 587 for more information on the deduction for business use of a home.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self Employed for 4 months, how do deductions work?

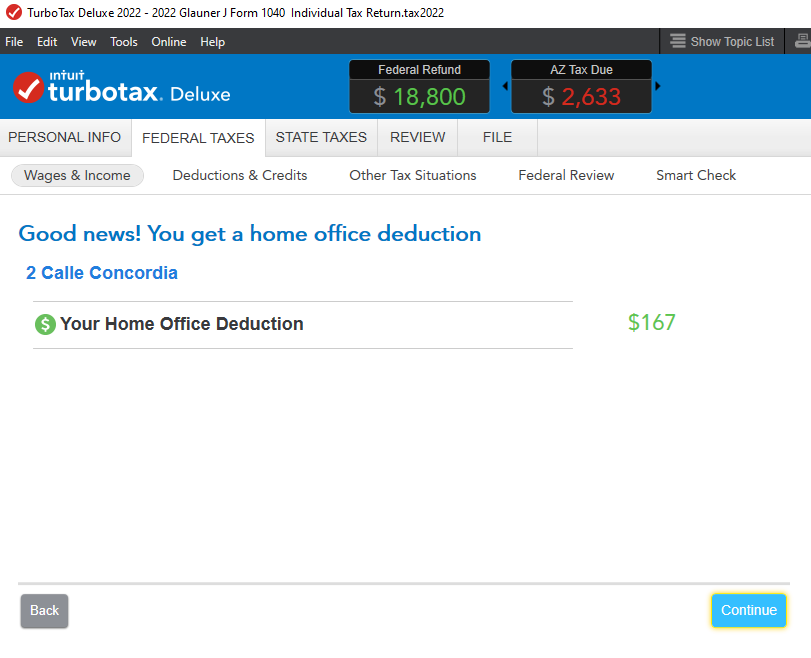

If I work used a 10 x 10 ft area of my home for self employment activities, per the $5 calculation that would be $5 x 100 = $500.

Since I only worked 4 months of 2022 as self employed, does that mean I can only take 1/3 of the $500, which is $165? Or can I claim the full $500?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self Employed for 4 months, how do deductions work?

Yes, your Home Office Deduction will be a % of the total deduction, for four months of use.

Go through the Home Office Interview questions, and indicate you used your home office 100% for Business during the period it was used.

If you indicated you used your Home Office for four months in 2022, TurboTax will calculate your deduction at the end of the section.

Here's more info on the Home Office Deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Omar80

Level 3

pivotresidential

New Member

user17549282037

New Member

xiaochong2dai

Level 3

swick

Returning Member