- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Saver's (Retirement) Credit Calculating as Single, Not Married Filed Jointly

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Saver's (Retirement) Credit Calculating as Single, Not Married Filed Jointly

Only receiving half of the saver's credit even though filing MFJ. Can override Form 8880 but then get error for electronic filing.

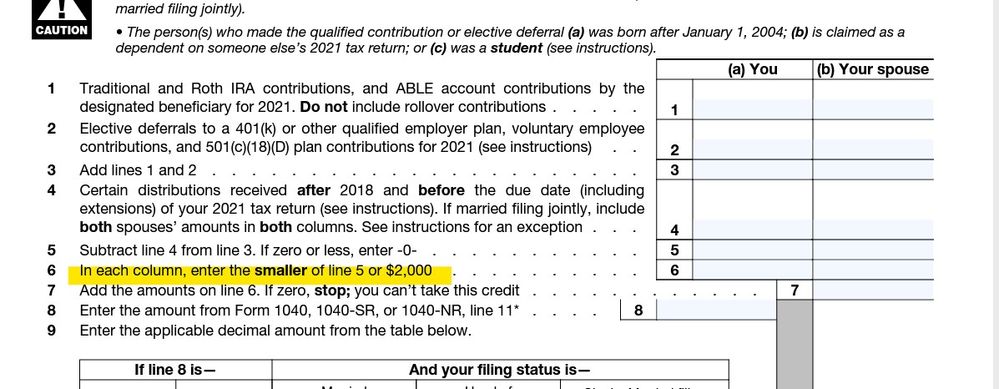

Line 5b of Form 8880 should have $2,000 for both columns but TurboTax only fills in the one for "You" and not your "Spouse." This leads to only a $200 credit and not the correct $400 one. This did not happen in 2020 under similar situation. I believe it was correctly calculated initially but then I played around with various additional contribution to look at different scenarios and it got out of whack. The "Spouse" passed away in 2021 but that should not have an impact.

Your help would be GREATLY appreciated!

Thanks,

Dan

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Saver's (Retirement) Credit Calculating as Single, Not Married Filed Jointly

Did the spouse have any retirement contributions ? Read the line instructions carefully ... you cannot have a amount on line 6 for the spouse unless there are amounts somewhere in lines 1-5 ... this is a per person credit ... you each must qualify ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Saver's (Retirement) Credit Calculating as Single, Not Married Filed Jointly

Your eligible contributions may be reduced by any recent distributions you received from a retirement plan or IRA, or from an ABLE account,

Retirement Savings Contributions Savers Credit | Internal Revenue Service (irs.gov)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Saver's (Retirement) Credit Calculating as Single, Not Married Filed Jointly

Thank you SweetieJean for answering!

There were no distributions in 2021 and only a small rollover in 2020 so this would not be the cause of the problem. The fundamental issue seems to be TurboTax not filling in the $2,000 for the spouse on line 6 of Form 8880 (sorry, original message said line 5b).

Any other ideas?

Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Saver's (Retirement) Credit Calculating as Single, Not Married Filed Jointly

Did the spouse have any retirement contributions ? Read the line instructions carefully ... you cannot have a amount on line 6 for the spouse unless there are amounts somewhere in lines 1-5 ... this is a per person credit ... you each must qualify ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Saver's (Retirement) Credit Calculating as Single, Not Married Filed Jointly

Spot on Critter, thank you!

Did not realize that this is a per person credit. No, the spouse did NOT make a contribution.

Thanks again!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

danjoh1969

Level 1

krsanborn75

New Member

lorettarichardson

New Member

romanw56

New Member

savagead82

New Member