- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Repayment of Premium Tax Credit and Adjusting for HRA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Repayment of Premium Tax Credit and Adjusting for HRA

Hello!

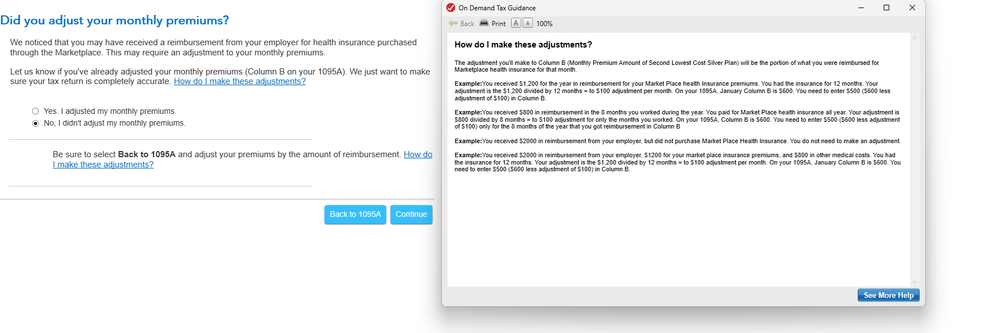

My wife and I have an HRA, marketplace plans through Healthcare.gov, and received an advance premium tax credit. It turns out that we should not have gotten the premium tax credit and now need to repay. When I enter our 1095-As, TurboTax asks me to adjust for the HRA with these instructions:

My wife and I were reimbursed for $800 a month, and column B (SLCSP) is less than $400 across the year. So, based on these instructions, I assume I would adjust our SLCSP amount to $0. But when I try to adjust to $0, I get stopped by Smart Check, which insists that the value should not be $0. I'm not sure exactly how to proceed with this scenario. Can anyone help?

Summary:

- Have HRA

- Have marketplace health insurance plans

- Received APTC, which we should not have in hindsight.

- Not sure how to factor all of that into TurboTax.

Much appreciated!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Repayment of Premium Tax Credit and Adjusting for HRA

Your screenshot shows that you marked 'no, I did not adjust my monthly premiums'.

Choose YES and continue, and you should be asked how much of Column B you were reimbursed for.

Here's an SLCSP Tool that may help you, and more info on How is the Premium Tax Credit Calculated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Repayment of Premium Tax Credit and Adjusting for HRA

Thanks! If I put in what is on my 1095-A exactly and then click "Continue," and click "Yes," on the screenshotted page, I am not asked how much we were reimbursed for. What am I doing wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Repayment of Premium Tax Credit and Adjusting for HRA

If you enter your 1095-A exactly as it has been sent to you then column C is the amount that you were reimbursed. If you were reimbursed more than column C then you would adjust your 1095-A.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mc510

Level 2

Cheshihime

New Member

SKLBI

Returning Member

n8-woodruff

New Member

Atf1

Level 2