- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Repayment of Premium Tax Credit and Adjusting for HRA

Hello!

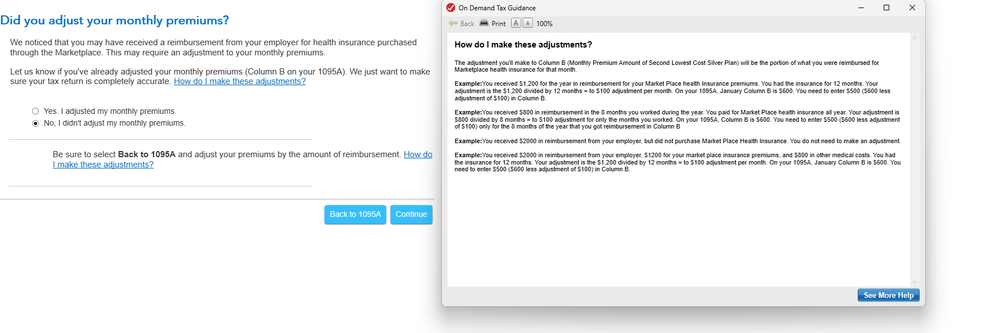

My wife and I have an HRA, marketplace plans through Healthcare.gov, and received an advance premium tax credit. It turns out that we should not have gotten the premium tax credit and now need to repay. When I enter our 1095-As, TurboTax asks me to adjust for the HRA with these instructions:

My wife and I were reimbursed for $800 a month, and column B (SLCSP) is less than $400 across the year. So, based on these instructions, I assume I would adjust our SLCSP amount to $0. But when I try to adjust to $0, I get stopped by Smart Check, which insists that the value should not be $0. I'm not sure exactly how to proceed with this scenario. Can anyone help?

Summary:

- Have HRA

- Have marketplace health insurance plans

- Received APTC, which we should not have in hindsight.

- Not sure how to factor all of that into TurboTax.

Much appreciated!