- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Refi closing costs deductions on primary home

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refi closing costs deductions on primary home

Hi,

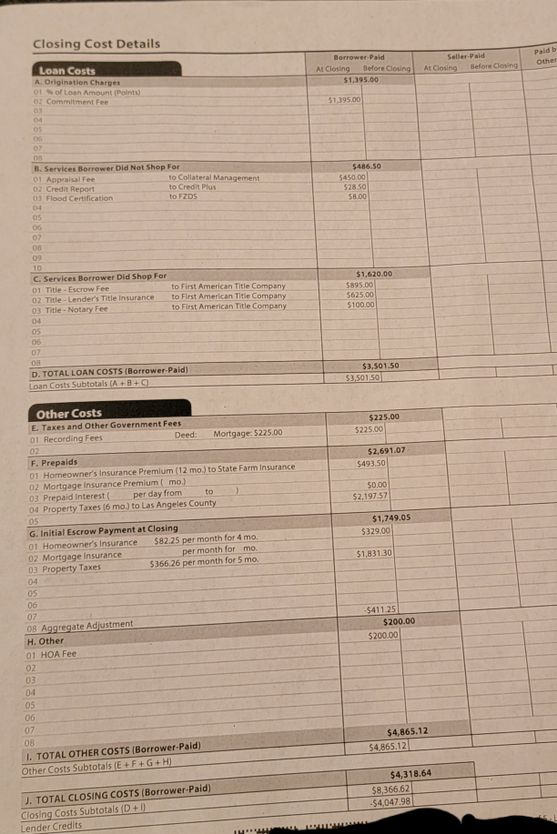

I did a refi on my primary home mortgage and I'm wondering if anything on my closing statement is deductible? I prepaid property taxes and insurance, and there are a bunch of title and lender fees, as well as a lender credit. Here's a photo of everything.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refi closing costs deductions on primary home

The deductions for your primary home are mortgage interest paid and property (real estate) taxes paid. You should get a Form 1098 from your mortgage company (one or two if applicable) which will have the amounts paid for each of these items for tax year 2020. You will enter the information as reported to you on those forms.

If the property taxes are not on the form 1098 for some reason, the amounts you show on the closing statement for "Property Taxes" can be used.

The other costs on your closing statement you keep a record of to use when you sell the property to help reduce any gain on the sale for tax purposes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refi closing costs deductions on primary home

If you own your home for 20 years, you're just supposed to remember that you had all these costs? Why wouldn't they be entered into TT now so they aren't forgotten?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refi closing costs deductions on primary home

Keep a folder (either paper or virtual) of everything having to do with your house. It should include the settlement statements from the purchase of the home, any refinances, and when you sell the home. You should also keep track of any improvements (anything that permanently increases the value: remodeling, new roof, new deck).

You will need all these to calculate the adjusted basis of the home when you sell it.

For more information see IRS Pub. 530 - Tax Information for Homeowners

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refi closing costs deductions on primary home

What-if the property taxes from the closing to the 1098 differ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refi closing costs deductions on primary home

Then you will enter your actual property taxes paid.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17524181159

Level 1

carlcam

Returning Member

rroop1

New Member

M_S2010

Level 1

geist-c28

New Member