- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Under Medicare coverage, is gross distribution in 1099-SA entirely taxable? Is there any exce...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Under Medicare coverage, is gross distribution in 1099-SA entirely taxable? Is there any exception for the contribution made before the start of Medicare coverage?

I've had HDHP & HSA from my current employer since 2017. I have enrolled Medicare Part A for 36 months due to ESRD (not by age) from Nov 2020. Sadly, the decision of "not enrolling Medicare Part B" was costly. The medical expense in 2021 was $7,500 that could have been covered by Part B.

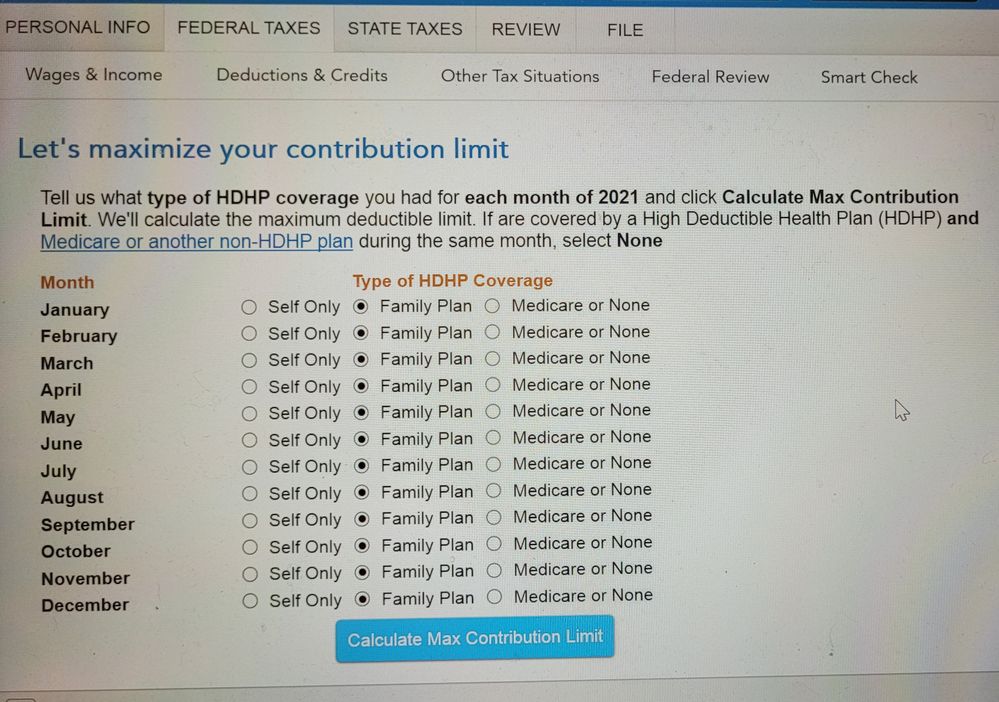

After adding 1099-SA information, TT guided me to choose "Medicare of None" (instead of Family Plan) as a "Type of HDHP Coverage" for each month and it turned the entire amount ($7,500) into taxable. Because the medical expense was paid by HSA balance contributed before Medicare coverage start, is there a way to make the spending tax deductible?

In addition, TT says the maximum HSA contribution limit for me and my wife (married joint filing) is $0. My wife (covered by my HDHP family plan but not employed) has own HSA account since March 2021. Should the contribution limit $2,700 (3,600 x 9/12)?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Under Medicare coverage, is gross distribution in 1099-SA entirely taxable? Is there any exception for the contribution made before the start of Medicare coverage?

As soon as TurboTax realizes that you have an excess for 2021, it adds that excess to Other Income on your 2021 tax return.

You will get (probably in early 2023, depending on when you asked for the withdrawal of the excess) a 1099-SA with a distribution code of "2" to add to your 2022 return. This will probably have the excess in Box 1, however, because the distribution code is "2", the excess will not be added to income again (because you have already paid tax on that in 2021), but only the earnings in box 2 will be added to your 2022 income.

In early 2023, when you enter the 1099-SA with the distribution code of "2", you will not be asked how you spent the money; it will be treated as I outlined above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Under Medicare coverage, is gross distribution in 1099-SA entirely taxable? Is there any exception for the contribution made before the start of Medicare coverage?

You cannot use HSA funds for Medical Expenses deduction on Schedule A because the HSA is already tax-free.

HSA contributions (including employer-provided ones) are disallowed when other coverage is in place, including Medicare Part A. Workers can still enroll in HSA-eligible plans and use funds already in HSAs for eligible expenses; they just can't contribute further once enrolled in Medicare.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Under Medicare coverage, is gross distribution in 1099-SA entirely taxable? Is there any exception for the contribution made before the start of Medicare coverage?

Thanks for your feedback. I updated my question for better clarity.

Few questions to your statement of "Workers can still enroll in HSA-eligible plans and use funds already in HSAs for eligible expenses."

What is the HSA-eligible plans?

Is the balance in my HSA contributed before Nov 2020 (first month of Medicare coverage) tax deductible? If so, how to include that in TT?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Under Medicare coverage, is gross distribution in 1099-SA entirely taxable? Is there any exception for the contribution made before the start of Medicare coverage?

An HSA-eligible plan is a High Deductible Health Plan that allows you to participate in an HSA. You can enroll in one after enrolling in Medicare, but you can't contribute to an HSA at that point.

You can still use the funds in your HSA to pay for medical expenses after you enroll in Medicare (Part A or B), but you can no longer contribute an HSA.

In fact most financial planners advise their client to stop contributing to their HSA six months before enrolling in Medicare to avoid timing problems and penalties.

If your HSA distribution is used to pay for qualified medical expenses, it is not taxable and you can't deduct the expenses on Schedule A.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Under Medicare coverage, is gross distribution in 1099-SA entirely taxable? Is there any exception for the contribution made before the start of Medicare coverage?

Thanks for your clarification.

I assume you meant "it is not taxable and you can can't deduct the expenses on Schedule A"?

Does a married couple (one under Medicare, the other under HDHP family plan) still have $3,600 HSA contribution limit for 2021 when each has own HSA account?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Under Medicare coverage, is gross distribution in 1099-SA entirely taxable? Is there any exception for the contribution made before the start of Medicare coverage?

"It turned the entire amount ($7,500) into taxable"

Are you saying that you received a 1099-SA for $7,500? If so, what did you tell TurboTax when you entered the 1099-SA and it asked you how much of it was used for qualified medical expenses? If you used it all for qualified medical expense, then none of the $7,500 should be taxable.

When you say "taxable", do you mean that $7,500 was added to Other Income on line 8 of Schedule 1 (1040)?

Did you make any contributions to your HSA since you went under Medicare? If so, when and how much?

As noted above, you cannot deduct on Schedule A any medical expenses reimbursed from your HSA. HOWEVER, TurboTax is going to subtract the HSA reimbursements from the amounts you enter on Schedule (similar to insurance reimbursement), so if you expect to be able to use medical expenses on Schedule A, you will need to enter a Miscellaneous medical expense called "HSA reimbursed expenses" with the amount of the 1099-SA at the end of the Medical and Dental interview, so that these items will zero out.

"In addition, TT says the maximum HSA contribution limit for me and my wife (married joint filing) is $0."

Because YOU went under Medicare in Nov 2020, the annual HSA contribution limit for your HSA is indeed zero. However, the annual HSA contribution limit for your spouse's HSA is $7,200 and if your spouse is 55 or above, then it's $8,200. Your spouse was under the Family HDHP plan all year, right?

Your spouse's limit is determined by the fact that your spouse had Family HDHP coverage. If your spouse changes to Self-only HDHP coverage at some point (to save on the premium), then indeed your spouse's annual HSA contribution limit would fall to $3,600 (although this is adjusted upward nearly every year). Note that the $1,000 "bonus" in the contribution limit is the same no matter which HDHP coverage you have.

NOTE: you can continue to spend from your HSA account, even though you can no longer contribute to it. Your spouse, on the other hand, can continue to contribute to your spouse's HSA.

Tell me again about this $7,500. What did you mean by "it's taxable"?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Under Medicare coverage, is gross distribution in 1099-SA entirely taxable? Is there any exception for the contribution made before the start of Medicare coverage?

Thanks for your advice Bill, I have additional questions.

You said "Because YOU went under Medicare in Nov 2020, the annual HSA contribution limit for your HSA is indeed zero. However, the annual HSA contribution limit for your spouse's HSA is $7,200"

My wife was not employed and she was under MY HDHP family plan for entire 2021. She opened her own HSA in March 2021 and contributed $25 only. Is the applicable HSA contribution limit for us (married join filing) is $5,400 ($7,200 x 9/12)?

TT regarded the entire contribution to my HSA in 2021 ($3,750) as "Other Income or Loss." I thought as long as the sum of "my contribution to my HSA" and "my wife's contribution to her HSA" is less than the limit ($5,400), it is nontaxable. Is my understanding wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Under Medicare coverage, is gross distribution in 1099-SA entirely taxable? Is there any exception for the contribution made before the start of Medicare coverage?

"My wife was not employed" - does not matter

"and she was under MY HDHP family plan for entire 2021." - this is what matters, that she had Family HDHP coverage, period.

"Is the applicable HSA contribution limit for us" - not US, just your spouse. Your annual HSA contribution limit for 2021 was zero because you were on Medicare the entire year. Your spouse, on the other hand, has the limit of 7,200 for 2021 because she was under the HDHP for all 12 months (it does not matter when she opened the HSA).

"TT regarded the entire contribution to my HSA in 2021 ($3,750) as "Other Income or Loss." I thought as long as the sum of "my contribution to my HSA" and "my wife's contribution to her HSA" is less than the limit ($5,400), it is nontaxable. Is my understanding wrong?" No, it does not work that way. The HSA is owned by the individual. The annual limit is for the individual HSA. The shared Family limit can be shared ONLY if both spouses are eligible, but you were not. As a result, your spouse gets it all.

So while you could not contribute anything to your HSA, your spouse could contribute the annual Family maximum to hers.

The Family annual limit is shared between the spouses (if they are both eligible), but the actual limit is per HSA.

Your wife has until April 18th to contribute to her HSA retroactively (i.e., for 2021). Since she has contributed only $25 so far, she can contribute the other 7,175 to her HSA by April 18th - but she must make sure that the HSA custodian knows that it is for 2021 and not 2022.

Make sense?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Under Medicare coverage, is gross distribution in 1099-SA entirely taxable? Is there any exception for the contribution made before the start of Medicare coverage?

Thanks for your thorough explanation. Now I understand it better.

I think if I withdraw $3,750 (my entire HSA contribution in 2021) from my HSA and deposit it to my wife's HSA before 4/18, it will make it tax exempted for 2021 tax year. Is that correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Under Medicare coverage, is gross distribution in 1099-SA entirely taxable? Is there any exception for the contribution made before the start of Medicare coverage?

"I think if I withdraw $3,750 (my entire HSA contribution in 2021) " So you contributed $3,750 to your HSA in 2021, and TurboTax told you that the entire $3,750 was in excess, right?

Yes, you can withdraw that as an excess contribution (use these words to the HSA custodian), and then turn around and make a personal/direct contribution to your wife's HSA BEFORE April 18th.

The first action (your excess) will add 3,750 to Other Income on line 8 of Schedule 1 (1040), but the second action (the contribution to your wife's HSA) will subtract it back out again on line 13 of Schedule 1 (1040).

So it seems like you understand it now.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Under Medicare coverage, is gross distribution in 1099-SA entirely taxable? Is there any exception for the contribution made before the start of Medicare coverage?

If I withdraw $3,750 from my HSA now, will next year's 1099-SA show distribution code 2 (excess contribution) in Box 3? Would it hurt my next year's tax return because it is non-medical spending?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Under Medicare coverage, is gross distribution in 1099-SA entirely taxable? Is there any exception for the contribution made before the start of Medicare coverage?

No, it should show up as a normal distribution. After you enter the 1099 HSA, it will ask the question if you spent this on Medical expenses only. If you say no, then it is a taxable distribution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Under Medicare coverage, is gross distribution in 1099-SA entirely taxable? Is there any exception for the contribution made before the start of Medicare coverage?

After withdrawing the excess contribution ($3,750) from my HSA, I assume it can be used for non-medical expense (i.e. funding my wife's HSA) because it is already taxed (1040, Other Income). Is it correct?

1) Will it ($3,750) be added to "Gross Distribution" in my next year's 1099-SA?

2) If so, will I be taxed again if I answer "no" to the question "did you spent this on Medical expenses only"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Under Medicare coverage, is gross distribution in 1099-SA entirely taxable? Is there any exception for the contribution made before the start of Medicare coverage?

As soon as TurboTax realizes that you have an excess for 2021, it adds that excess to Other Income on your 2021 tax return.

You will get (probably in early 2023, depending on when you asked for the withdrawal of the excess) a 1099-SA with a distribution code of "2" to add to your 2022 return. This will probably have the excess in Box 1, however, because the distribution code is "2", the excess will not be added to income again (because you have already paid tax on that in 2021), but only the earnings in box 2 will be added to your 2022 income.

In early 2023, when you enter the 1099-SA with the distribution code of "2", you will not be asked how you spent the money; it will be treated as I outlined above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17549435158

New Member

tianwaifeixian

Level 4

xiaochong2dai

Level 3

Smurfect

New Member

LD71

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill