- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Under Medicare coverage, is gross distribution in 1099-SA entirely taxable? Is there any exception for the contribution made before the start of Medicare coverage?

I've had HDHP & HSA from my current employer since 2017. I have enrolled Medicare Part A for 36 months due to ESRD (not by age) from Nov 2020. Sadly, the decision of "not enrolling Medicare Part B" was costly. The medical expense in 2021 was $7,500 that could have been covered by Part B.

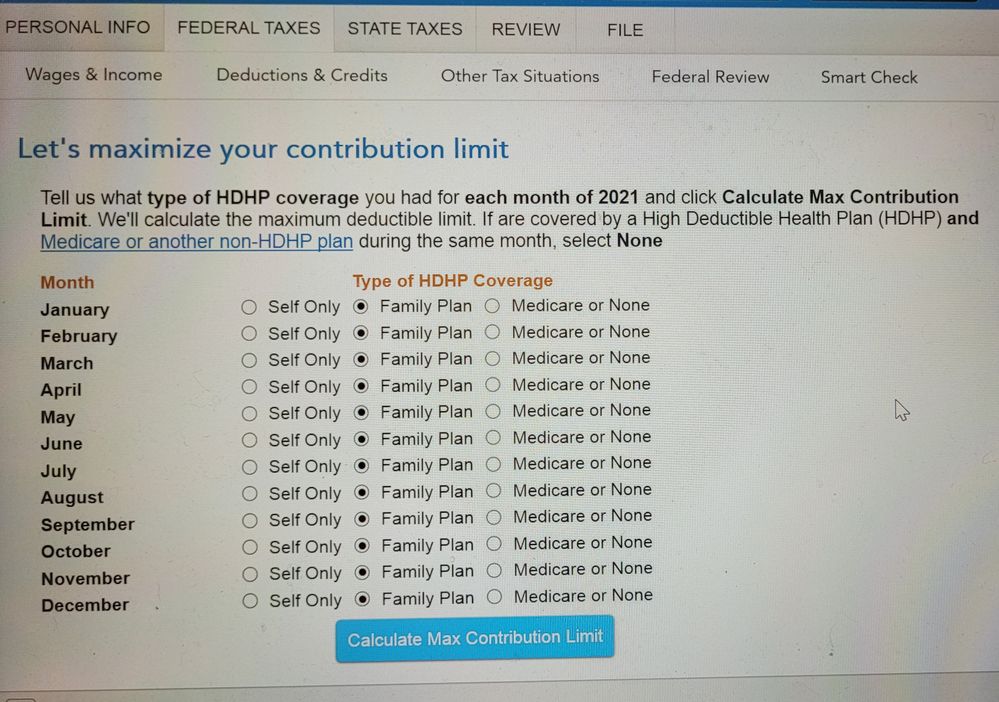

After adding 1099-SA information, TT guided me to choose "Medicare of None" (instead of Family Plan) as a "Type of HDHP Coverage" for each month and it turned the entire amount ($7,500) into taxable. Because the medical expense was paid by HSA balance contributed before Medicare coverage start, is there a way to make the spending tax deductible?

In addition, TT says the maximum HSA contribution limit for me and my wife (married joint filing) is $0. My wife (covered by my HDHP family plan but not employed) has own HSA account since March 2021. Should the contribution limit $2,700 (3,600 x 9/12)?