- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Should alternative vehicle refueling property credit be 0, if I DO have a tax liability, and ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should alternative vehicle refueling property credit be 0, if I DO have a tax liability, and my AMT is 0 (cuz tentative is less than real taxes paid)? Not working for me.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should alternative vehicle refueling property credit be 0, if I DO have a tax liability, and my AMT is 0 (cuz tentative is less than real taxes paid)? Not working for me.

Your credit may be coming up as zero because your tentative minimum tax is equal to your net regular tax. In that case, you would not have an alternative minimum tax (AMT) but you would still be denied the refueling property credit. Also, just because you owe money does not mean you have an income tax, as there may be other taxes such as self-employment taxes that the credit does not apply to.

You can look on your form 1040, line 16 to see if you have an income tax to apply the credit to. Also, you can look on Form 8911 Alternative Fuel Vehicle Refueling Property Credit to see how your refueling credit is being handled. If you are using the online version of TurboTax, you can see Form 8911 once you pay for the program.

To see your form 1040 while working on your program using the online version of TurboTax, follow these steps:

- Click on Tax Tools in the left menu bar

- Click on Tools

- Look under Other Helpful links….

- Choose View Tax Summary

- Look in the left menu bar and choose Preview my 1040

You can use this link to see how form 8911 works: Refueling credit

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should alternative vehicle refueling property credit be 0, if I DO have a tax liability, and my AMT is 0 (cuz tentative is less than real taxes paid)? Not working for me.

Also, check line 18 of your form 1040.

That credit gets used against the tax assessed value on line 18, and line 18 may already be a zero.....and if you are Self-Employed, the SE tax liability gets added on later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should alternative vehicle refueling property credit be 0, if I DO have a tax liability, and my AMT is 0 (cuz tentative is less than real taxes paid)? Not working for me.

Thank you for the help thus far.

So, my line 16 and 18 of my 1040 are the same, and are positive values. So there is a liability to credit for this. And for some reason, there is no 8911 form in the tax return preview (maybe because it's coming up as 0)? Is there any way to have the 8911 form show up in my tax return even though it's zero so that I can see how or why it's calculating down to zero?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should alternative vehicle refueling property credit be 0, if I DO have a tax liability, and my AMT is 0 (cuz tentative is less than real taxes paid)? Not working for me.

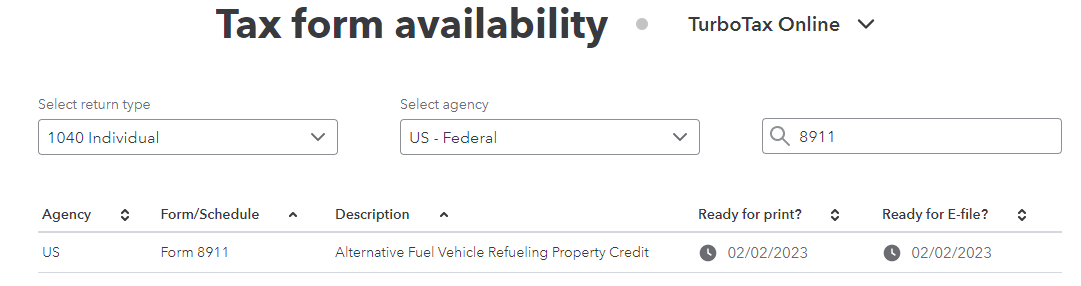

Yes, you would need Form 8911. According to Forms Availability, it is not available until 2/2/2023. So, it may not be adding correctly right now due to an unavailable form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should alternative vehicle refueling property credit be 0, if I DO have a tax liability, and my AMT is 0 (cuz tentative is less than real taxes paid)? Not working for me.

The simple preview will not directly show if the form 8911 is there or not.....you have to pay for the software and download a full copy of yoru tax return.

The only other thing I can think of is that the form 8911 is not supposed to be ready until After 2 February, and perhaps some lines are still using prior year form calculations, or don't calculate correctly until the form is finalized in the software.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mike12341234

Level 1

dillon767

New Member

mike12341234

Level 1

jay-c-erb

Level 2

Davewpena

New Member