- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Recovery Rebate Tax Credit - who is wrong TurboTax or IRS?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

The IRS does not seem to know it's own rules, directly from the IRS website. "Economic Impact Payments were based on your 2018 or 2019 tax year information. The Recovery Rebate Credit is similar except that the eligibility and the amount are based on 2020 information you include on your 2020 tax return." I used TurboTax to complete my taxes and it calculated a rebate credit, the IRS denied the credit! I spoke to two different IRS representatives and they both said because my 2019 income was to high I did not get the credit. Yet their own website says based on 2020 income. Obviously either TurboTax is calculating wrong or the IRS is wrong. I have already written my congressional rep. and both senators to see what the IRS tells them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

The stimulus payments were advanced payments for 2020. The IRS used 2018 and 2019 tax information for those payments because it did not have 2020 info at that point.

The Recovery Rebate Credit is designed to sync up the stimulus payments with what you are supposed to receive. It is based on 2020 information and the instructions for completing the RRC worksheet are included in the IRS’ 2020 tax instructions.

Check your RRC worksheet. You may have complete that wrong in TurboTax. To calculate the correct credit, you need the actual amount of stimulus payments you received.

If you put in the correct amounts, it’s possible that one of your payments was lost if sent by mail so your records are different from what the IRS has.

To start a payment trace:

- Call the IRS at 800-919-9835

- Mail or fax a completed Form 3911, Taxpayer Statement Regarding Refund

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

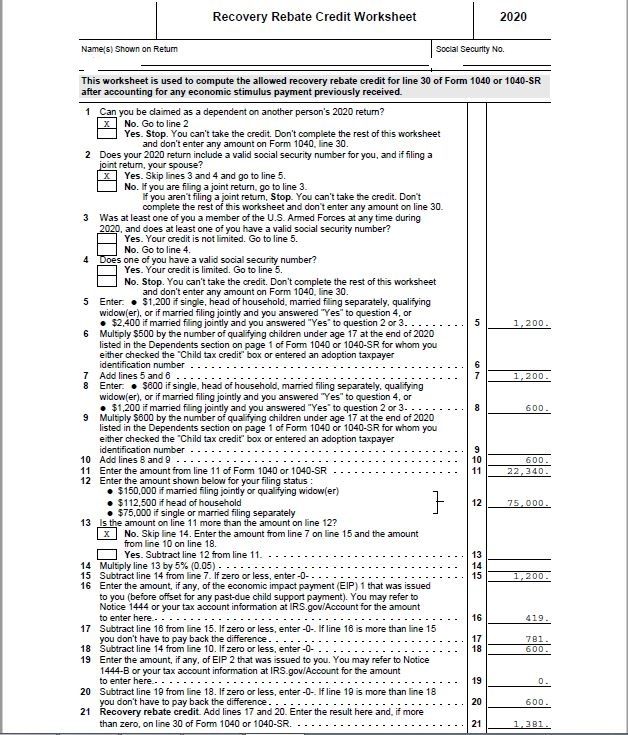

The worksheet is pretty straight forward, I received $ 418.60 for the 1st check and did not get a second check. My 2020 income went from $ 90K in 2019 to $ 22K in 2020 as noted in the worksheet. According to the worksheet I should have a credit of $ 1,381. Am I missing something? Again seems to me either TurboTax is wrong or the IRS is wrong. If I am wrong please point out where based on this information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

If your income went down in 2020 you should get the difference. Must be for something else. Did the IRS actually send you less refund? Did you get a letter saying what they changed or why? Maybe they changed something else on your return like increased your income. Did you take any IRA distributions you didn't report? Or they think you are a dependent?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

Your worksheet looks correct. Did the IRS sent you a letter explaining why your credit was denied? As @VolvoGirl said, the IRS may be denying your credit due to an issue outside the worksheet. TurboTax uses the IRS RRC worksheet, which shows you should receive a credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

The IRS said it was a calculation error on my part. There was no other issues, this is an IRS issue of not knowing their own rules. I spoke to two different IRS rep's and they both said the same thing based on my 2019 income I was not eligible not my 2020 income. I am sure I will not be the only one affected by this problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

Yes, I used TurboTax that is why I am confused. Here are the reasons listed by the IRS of why they might have changed my return. 1) SSN was missing - it was not 2)My last name did not match records - it did 3) One of my dependents was above the age - I claimed no one 4) My AGI exceed $ 75K - no it was $ 22K in 2020 5) The amount was computed incorrectly - I let TurboTax do this. This one did have a code after (683D) but I cannot find out what that means. I had $ 1,381 taken off my return that is suppose to go in tonight.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

The IRS must think they sent you the right amount. Like maybe they sent you the other Stimulus but you never got it. I guess you have to keep asking the IRS or try the Tax Advocate. Or maybe someone here knows what code 683D means.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

683D relates to first time homebuyer credit - does that ring any bells for your situation?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

No I have lived in my home for 15+ years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

I am right now sitting and waiting, figuring the IRS is going to reject my taxes. They have been in the "return received" que since Feb 15th. Looking further into what may be wrong I see line 30 has 2,300 on it. I remember TurboTax asking the amounts of our stimulus checks, which we got the full amount on, then at the end of all the questions in that section it showed that amount. I cannot remember the questions and cannot go back through it yet. The way that the questions went I thought we were just having us claim what we GOT on our taxes because we had to. Now I think is jacked us over and our taxes are wrong. Seems to be taking forever just to reject them. I have a friend sitting in the same situation, she used TurboTax too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

I see the same problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

@MaggiC and @Lynnette1 The IRS said it will fix tax returns to correct amount of the Recovery Rebate Credit. After making the correction, the IRS will continue processing your return. If a correction is needed, there may be a slight delay in processing your return and the IRS will send you a notice explaining any change made.

The IRS says to expect delays. The IRS budget and staffing is down about 20 percent during the last decade – meaning the IRS has 20,000 fewer people available to help on tax season and other issues.

If there is an issue with a tax return that requires additional review, that can add time for some taxpayers, but it varies depending on the issue. Many factors can affect the timing of a refund. Common errors the IRS is seeing this filing season include people not reporting their Economic Impact Payments accurately on the Recovery Rebate Credit line. Tax returns with an error, incomplete information or those affected by identity theft or fraud may take longer to process. If more information is needed to process the return, the IRS will send the taxpayer a letter with a request for information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

Well it is sounds like the IRS now knows it was messing up and TurboxTax was doing the calculations right. Unfortunately I can tell you that trying to make an appointment at the local IRS office is as bad as calling their help line. "We're sorry but your call cannot go through at this time". So for any of us who have received their refund albeit the lower wrong amount there is not going to be a quick fix.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

KarenL

Employee Tax Expert

Sarmis

Returning Member

ilian

Level 1

griverax

New Member

jjon12346

New Member