- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Recovery Rebate Credit error 2021?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit error 2021?

Both myself and a friend who used TT Deluxe for preparing our 2021 taxes got nasty letters from the IRS stating there was NO allowable Recovery Rebate Credit along with penalties and daily interest rate assessments!

When I went back and looked, line 30 on 1040-RS had been populated with an $84, of which I don't recall ever entering. So I paid the $84 and fine(s). This is the first time TT has made a mistake on one of my forms. My friend's error was several hundred dollars!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit error 2021?

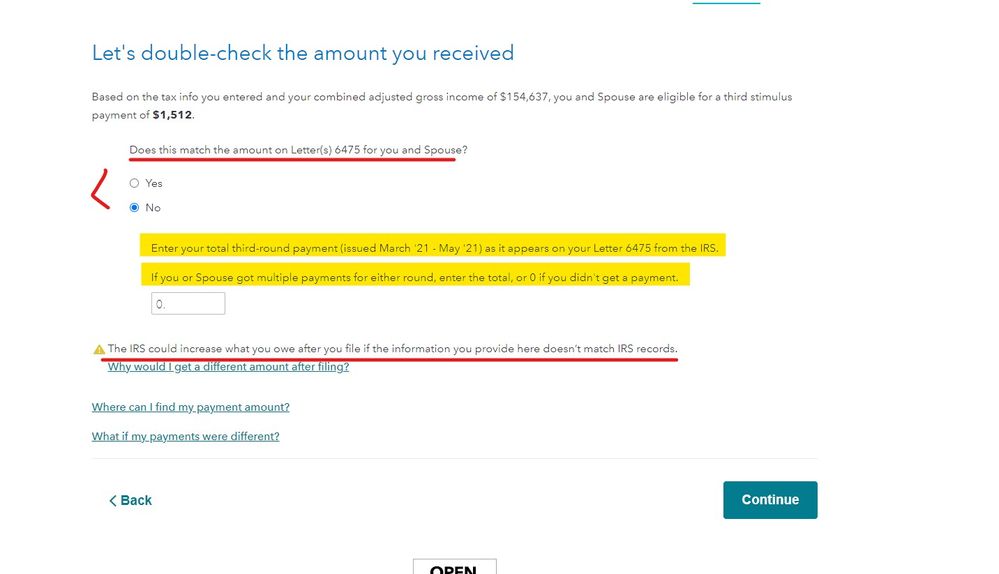

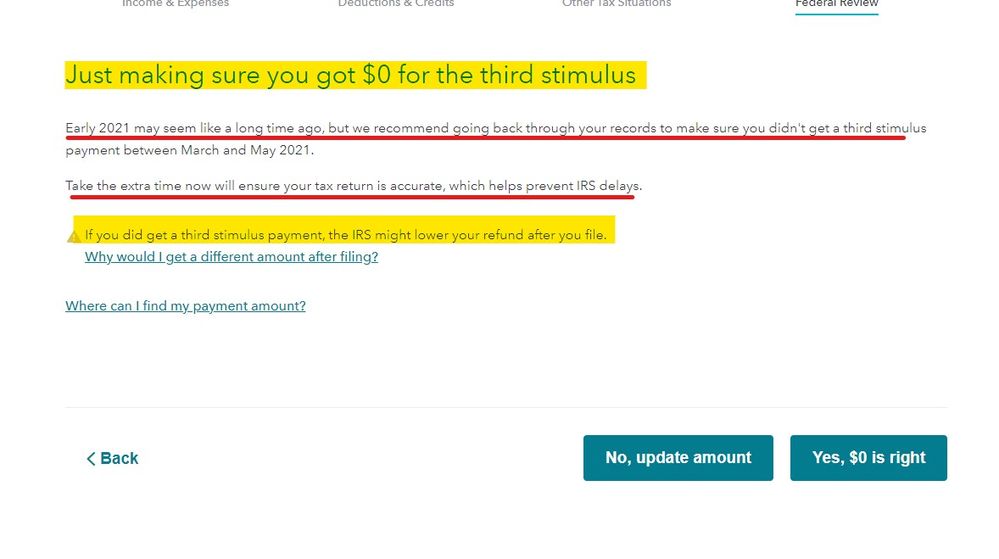

This was not a TT error ... this is a data entry error made by you. When asked how much you got in advance for the third stimulus payment (and the CTC advance payment) you had to enter all the money you got in advance from the IRS. The IRS sent out 6475 letters with that amount on it but even if you did not get it you still had to check your records to make sure of the amount you got. Here are the screens you had to complete in the program along with the warnings about making sure you entered the correct amount :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit error 2021?

This happened to me also. I filled out the TT online and followed all the prompts. The Recovery Credit I put in was what we received for the 3rd payment. When I completed the form TT said I was getting $309 back. A few weeks later I got a letter from the IRS saying I owe $1010. WOW! I don't think I will be using TT next year. This is the first time I have been able to vent - You cant call anyone. The IRS said the tax program should have handled it properly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit error 2021?

Sorry to hear about your problem. I was sure I put NO on the question of if I received a 3rd stimulus check. I even went thru all my bank records in early 2021 and NADA - no stimulus checks deposited. But still, TT put $84 in line 30 and I missed it...but the IRS caught it and I got the "letter".

I suggest (if you don't already have one) you get a login to IRS.gov. You need to go thru a lot of verification thru ID.me, but once you can get in, you can see what you owe, and different payment plans are offered. I still think it's a bug in TT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit error 2021?

Answering No on the question asking if you received a 3rd stimulus payment means you told TurboTax that you did not receive any payments @greghorn.

In that case, TurboTax would add an amount on line 30 Form 1040 because you said you never received any stimulus money.

If you never received a stimulus deposit or check—and the IRS says they paid you—then you should ask the IRS to trace your payment.

The fastest way to initiate a trace is to contact the IRS by calling us at 800-919-9835.

You can also complete Form 3911:

- Write "EIP3" on the top of the form to identify the payment you want to trace.

- Complete the form answering all refund questions as they relate to your Economic Impact Payment.

- When completing item 7 under Section 1:

- Check the box for "Individual" as the Type of return

- Enter "2021" as the Tax Period

- Do not write anything for the Date Filed

- Sign the form. If you file married filing jointly, both spouses must sign the form.

You will generally receive a response 6 weeks after we receive your request for a payment trace, but there may be delays due to limited staffing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit error 2021?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit error 2021?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit error 2021?

Same for me. Went from getting $2400 back to I owe $5600. Wow!! Never again tt.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit error 2021?

@Cross371 - there was a point in the interview process where you were to enter how much you received for a) the 3rd stimulus and b) for the advance on the child tax credit.

Literally millions - across all software packages - didn't heed this instruction correctly.

look at Line 28 and Line 30 of Form 1040. if you received all your stimulus and all your advance child tax credits properly, these two lines should be zero. I suspect they are not.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit error 2021?

@Cross371 - there was a point in the interview process where you were to enter how much you received for a) the 3rd stimulus and b) for the advance on the child tax credit.

Literally millions - across all software packages - didn't heed this instruction correctly.

look at Line 28 and Line 30 of Form 1040. if you received all your stimulus and all your advance child tax credits properly, these two lines should be zero. I suspect they are not.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Credit error 2021?

Sorry to hear. That's a huge hit. As I've suggested others do here, sign up for an account at IRS.gov. You need 2 forms of ID (i.e. drivers license and passport), but once you get your login, you can see how much your debt is and there's even ways to pay online. I believe there is an installment program too. Good luck.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kac42

Level 2

Naren_Realtor

New Member

elliottulik

New Member

Garyb3262

New Member

nalee5

New Member