- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Overpaid soc security How and when can i use that credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Overpaid soc security How and when can i use that credit

Im filing my 2020 now with turbo tax. My soc security overpayment credit is MORE than the tax I owe. How can i apply that credit.there is no where to put it on the software. Or do I have to wait until next year to use it

Thank you Ive used turbo tax for the last 13 years..:)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Overpaid soc security How and when can i use that credit

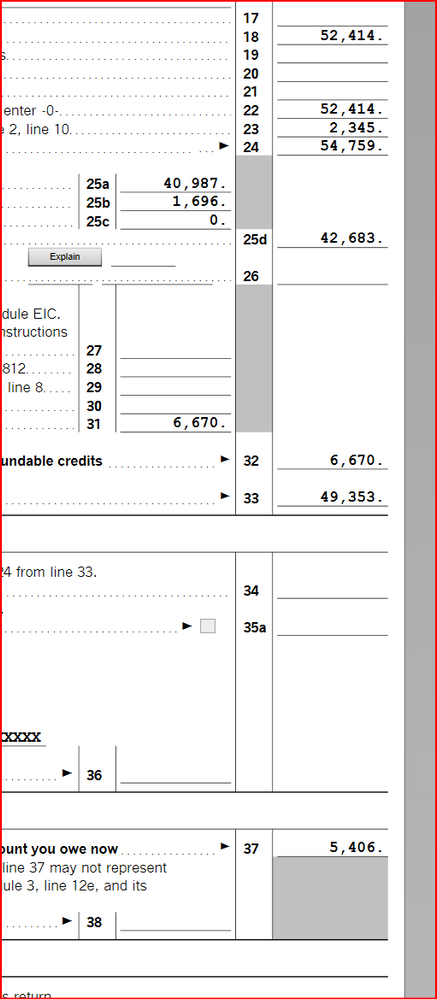

So you have more than 1 W2? Turbo Tax automatically gives it to you. See my first post where it shows up. Switch to Forms mode and open the 1040 and schedule 3. Is the overpayment there?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Overpaid soc security How and when can i use that credit

How do you have a Social Security overpayment? You mean your employer took out too much ss tax? How much is on your W2 box 3 & 4?

You only get excess SS back if one person had more than 1 employer and those employers took out more than the max of $8,537.40 (for 2020). Check 1040 Schedule 3 line 10 for it. Then Schedule 3 goes to 1040 line 31.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Overpaid soc security How and when can i use that credit

Thank you for your quick response! I worked multiple jobs from home during covid. I busted butt at night and on the weekends so with multiple jobs a LOT of soc security was taken out. The turbo Tax software correctly notified me of the soc security repayment and subsequent credit. I just don't know if I can apply it and how can I apply it. Or do I have to send all of the info in and wait for the government to apply it. I overpaid soc security by a few thousand dollars.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Overpaid soc security How and when can i use that credit

So you have more than 1 W2? Turbo Tax automatically gives it to you. See my first post where it shows up. Switch to Forms mode and open the 1040 and schedule 3. Is the overpayment there?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Overpaid soc security How and when can i use that credit

Oh I think it already might have used the credit.. thanks for telling me where to look

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Overpaid soc security How and when can i use that credit

Yes it is.. Thanks a lot

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bertkesj

New Member

calaguna

Level 2

user17581297919

New Member

blrhoden

New Member

KarenL

Employee Tax Expert