- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: My brother and I inherited 2 properties. I paid him for his interest in the properties. I hav...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My brother and I inherited 2 properties. I paid him for his interest in the properties. I have rented the 2 properties last year. How do I enter this into Turbo tax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My brother and I inherited 2 properties. I paid him for his interest in the properties. I have rented the 2 properties last year. How do I enter this into Turbo tax?

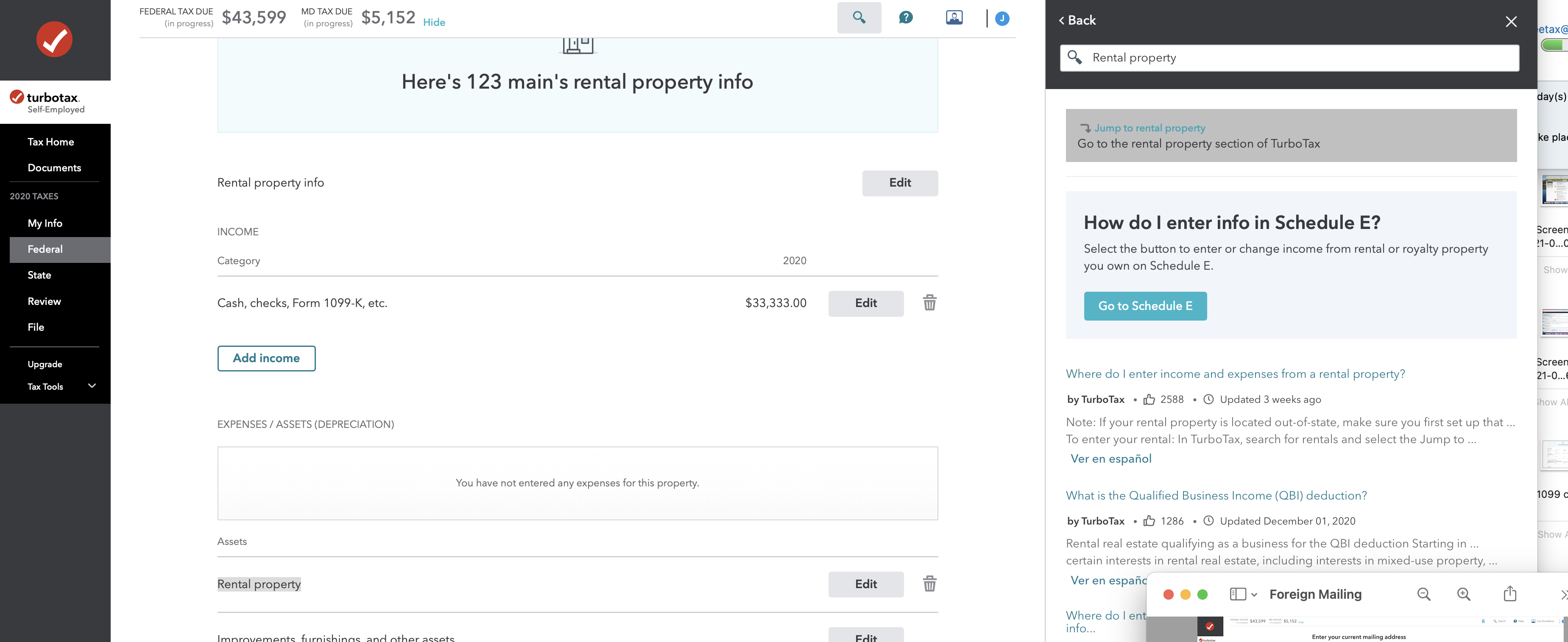

Enter both properties in the "Rental Property" interview of TurboTax Self-Employed (or desktop Home & Business). See screen shot below for aid in navigation.

Your basis in the properties would be the FMV of the properties on the date your father passed plus any "premium" you paid your brother for his interests.

By "premium", we mean if you paid him more than his half of the FMV at date of your fathers passing. Any amount you paid him above his 1/2 share would be a "premium" - an additional cost to you, added to the cost basis of the houses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My brother and I inherited 2 properties. I paid him for his interest in the properties. I have rented the 2 properties last year. How do I enter this into Turbo tax?

Thank you so much.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My brother and I inherited 2 properties. I paid him for his interest in the properties. I have rented the 2 properties last year. How do I enter this into Turbo tax?

After entering the amount of the appraisal, which is less than the tax assessment, I am prompted to enter the tax value. Should that be for the current tax year that the properties were rented or the year of the appraisal?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My brother and I inherited 2 properties. I paid him for his interest in the properties. I have rented the 2 properties last year. How do I enter this into Turbo tax?

Calculate the depreciable basis on the day your properties were available for rent. Please read below t how to calculate your depreciable basis.

Per IRS Publication 527 :Figuring the basis. The basis for depreciation is the lesser of:

- The fair market value of the property on the date you changed it to rental use, or

- Your adjusted basis on the date of the change—that is, your original cost or other basis of the property, plus the cost of permanent additions or improvements since you acquired it, minus deductions for any casualty or theft losses claimed on earlier years' income tax returns and other decreases to basis.

- For other increases and decreases to basis, see chapter 2.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

admin

New Member

kim-gundler

New Member

kemp5774

New Member

jrosarius

New Member

c0ach269

New Member