- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

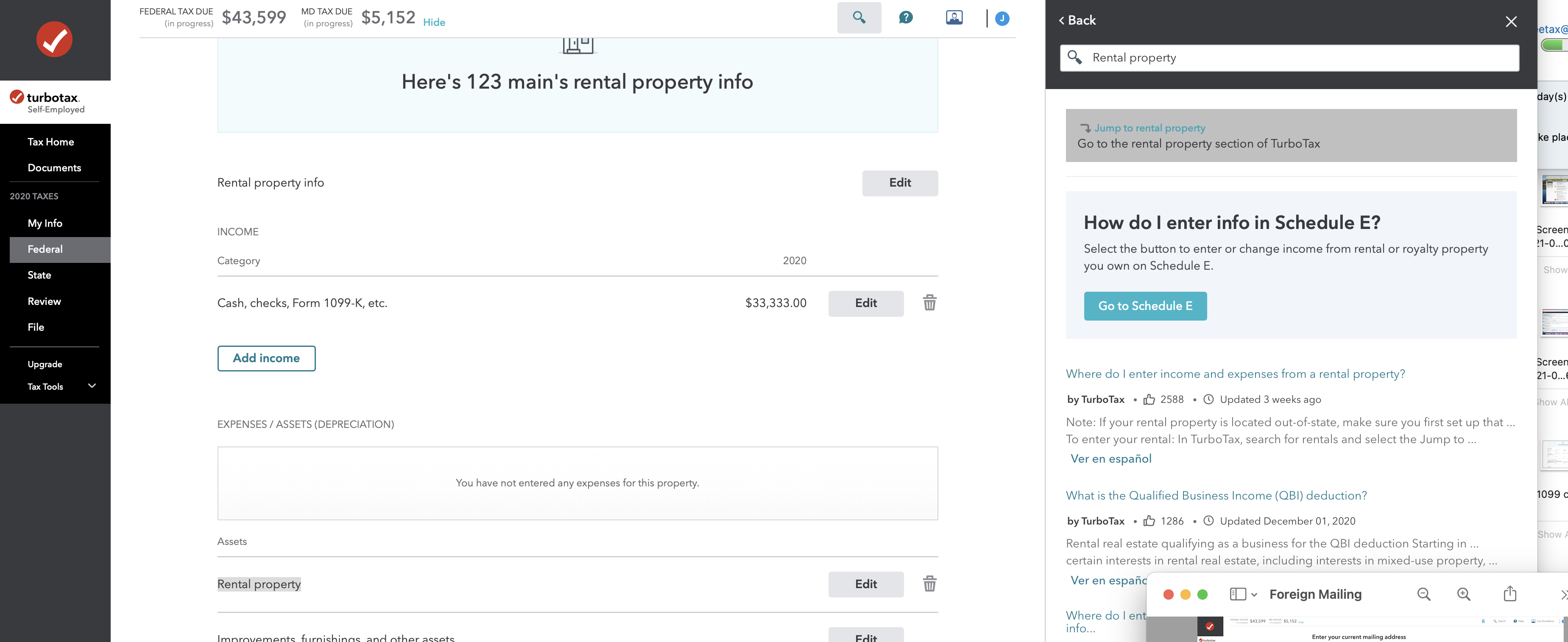

Enter both properties in the "Rental Property" interview of TurboTax Self-Employed (or desktop Home & Business). See screen shot below for aid in navigation.

Your basis in the properties would be the FMV of the properties on the date your father passed plus any "premium" you paid your brother for his interests.

By "premium", we mean if you paid him more than his half of the FMV at date of your fathers passing. Any amount you paid him above his 1/2 share would be a "premium" - an additional cost to you, added to the cost basis of the houses.

April 14, 2021

10:08 AM