- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Mortgage interest section does not handle re-finances correctly. Limiting my deduction becaus...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interest section does not handle re-finances correctly. Limiting my deduction because it thinks I am over the $750,000 limit due to numerous 1098s

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interest section does not handle re-finances correctly. Limiting my deduction because it thinks I am over the $750,000 limit due to numerous 1098s

The IRS instructions for completing Form 1098 state that box 2 should be the amount of outstanding principal on the mortgage as of January 1, 2021. If the loan was no longer being serviced by that company, there would be no outstanding principal on that mortgage.

This will help you to post it.

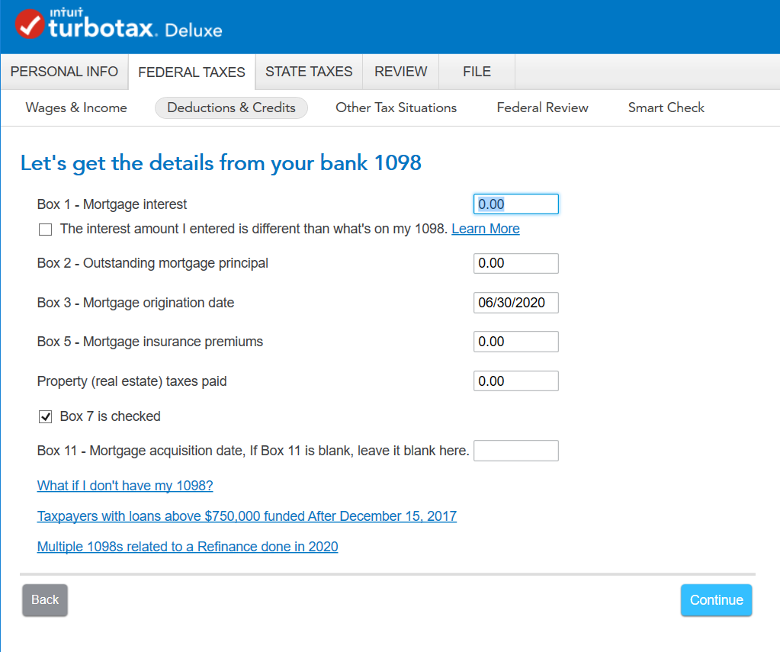

- Log into TurboTax

- Go to the federal section and choose Deductions & Credits

- On the page “Your tax breaks”, select Mortgage Interest and Refinancing (Form 1098) and Start

- Delete any Forms 1098-MTGE you have already entered in the program. Then choose the button “Add a 1098”.

- Enter the details from your FIRST Form 1098 – the one from your old mortgage company or before the refinance occurred. Be certain to enter all the information, including the amount in Box 2 of your 1098. According to the updated 2019 instructions for Form 1098, Box 2 should show an amount. For a loan prior to 01/01/19, the amount should be the balance of your loan as of 01/01/19. For the loan taken out in 2019 (including refinance loan or when the loan is sold to another mortgage company), the balance should be as of the date of the loan origination.

- Continue through the interview until you reach the screen “Was this loan paid off or refinanced with a different lender in 2019?” If you’re entering the original loan, say No.

- On the screen “Is this loan a home equity line of credit or a loan you’ve ever refinanced”, say No

- Continue to complete the first 1098.

- Add your next 1098. Be certain to enter all the information, including the amount in Box 2 of your 1098. If there is not an amount in this box, please contact your mortgage lender for the amount. It is required for an accurate calculation

- When you reach the screen “Is this loan a home equity line of credit or a loan you've ever refinanced?” say Yes. Select the correct radio buttons and Continue to complete the interview.

- Click Done. If presented with a follow-up question about the interest limitation and your loan balance is under $750,000 then your deduction is not limited - say No. If your loan is over $750,000 then the deduction is limited. Say Yes. You will need to manually calculate the adjustment. Please see Page 12 of IRS Pub. 936 for a worksheet that will help you calculate the amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interest section does not handle re-finances correctly. Limiting my deduction because it thinks I am over the $750,000 limit due to numerous 1098s

I have the same issue as justin-andes. I am a CPA. Over 2020 my home at various times had three mortgages, but only one at a time. At no point was the balance over 750,000. When I followed these instructions from the employee tax expert, the program was still summing my outstanding balances in box 2 to limit my interest deduction. I proved this out by agreeing the ratio of of (loan A box 2 +loan B box 2 + loan C box 2) / 750,000 which matched perfectly the ratio of (loan A box 1 + loan B box 1 + loan C box 1) / deduction allowed by turbotax. A second weakness in the solution proposed there is that selecting on the first loan that it was not a refi would not allow acceleration of any non-amortized points from that loan, which should all accelerate into the current year if that loan was refinanced, but the acceleration is only triggered if you select the radial button saying it was refi-ed or paid off in the current year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage interest section does not handle re-finances correctly. Limiting my deduction because it thinks I am over the $750,000 limit due to numerous 1098s

Try this.

steps to enter your mortgage information:

- Gather all of your 1098 forms related to your refinance (the form from your original lender and the form from your new lender)

- Grab a calculator and add together the box 1 amount from each form. Enter the total in TurboTax as Box 1 Mortgage interest.

- Add the Box 5 amount from each form and enter the total as Box 5 Mortgage insurance premiums. (If you weren’t required to pay mortgage interest, these boxes will be blank on your forms and you won’t enter anything.)

- Add the property tax paid from each form and enter it in the Property (real estate) taxes box.

Next, finish adding info for boxes 2, 3, 7, and 11 using Form 1098 for the original loan.

What if I have more than two 1098s?

You should combine all of the 1098s directly related to the refinance and enter it as one 1098. An example of this is if you refinanced two loans into one loan. Any 1098s not directly related to the refinance should get entered separately.

What if I paid points?

Points on Loans Paid Off in 2020: Enter the points on your 1098 you have started and mark you paid off the loan when promoted.

Points on Loans on New Loans: You will want to enter a separate 1098 to cover these points paid. When prompted, enter 0.00 for Boxes 1, 2, 5, and the Property (real estate) taxes box, and checkbox 7, as you’ve already entered the details on your first 1098. For Box 3, add the date in 2020 when the loan originated.

On the Tell us about any points paid to bank screen, answer in regards to the new loan when asked about points.

On the Tell us about any points paid to bank screen, answer in regards to the new loan when asked about points If your total home debt is under $375,000 ($250,000 for married filing separate) there is nothing new for you to do in 2020. Enter each 1098 as you normally would.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gdama001

Level 1

mikewojo

Returning Member

mc510

Level 2

Acanex

Level 2

msulimo

Level 1