- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Matching hobby income with 1099-k from paypal

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

It seems that there is a lot of confusion on that point. I have a knife collecting hobby that got way out of hand this year...gave me something fun to do during covid. I typically purchase and resell knives...typically at a loss but a few at a large profit. So in the end I have made a slight profit, around $300 or so. So in my instance, if I have $10,000 in sales but the cost of those goods sold to my was $9700, I claim the hobby income off $300?

The TCJA says hobby expenses are not deductible. I assume that this means paypal fees, shipping, etc are not deductible, but to calculate hobby income received I can still take sales - the cost of the goods sold?

In addition, I sold some old personal property which I don't have receipts for and just want to zero those out. I sold them for much less than they were worth.

With these, how do you square it up with a 1099-K?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

No, you cannot take any expenses if the income is claimed as hobby income. For an IRS resource, see: Hobby or Business Guidance

However, you should determine how you want to treat this revenue. I could argue a hobby generating a lot of revenue could be considered a trade or business. If it is decided going forward to treat it like a business, then include expenses when reporting it as self-employed income on Schedule C. For more details, see: Am I considered self-employed?

For reporting Form 1009-K for personal items sold not associated with a trade or business, you have two options:

- Option 1 in TurboTax Premier or higher: reporting Form 1099-K as investment income

- Go to the search box and enter Investment Sales

- Select Jump to Investment Sales

- Select Other at the next screen, OK, what type of investments did you sell? and click Continue

- At Tell us more about this sale, enter in the name, such as Form 1099-K Personal Property Sales and the Payer's EIN and click Continue

- At Now we'll walk you through entering your sale details, under the first dropdown menu, What type of investment did you sell? Select Personal Items

- Answer How did you receive this investment with an option from the dropdown menu.

- Enter the Description. If you are uncertain what date you purchased the goods, select Something other than a date so that TurboTax will enter Various

- Next, enter your Sale Proceeds and an equal amount for the Total Amount Paid and click Continue. The description for the cost should include Cost of Personal Property

- Select None of these apply at Let us know if any of these situations apply to this sale and Continue

- Continue through the rest of the prompts

- Select Add another sale to add the next Form received

- Option 2 in TurboTax Deluxe or higher: reporting it via Other Miscellaneous Income is acceptable to the IRS.

- From the left menu, go to Federal and select the first tab, Wages & Income

- Add more income by scrolling down to the last option, Less Common Income, and Show more

- Scroll down to the last option, Miscellaneous Income, 1099-A, 1099-C and Start

- Choose the last option, Other reportable income and Start and Yes

- Enter the applicable description and amount and Continue

- First, enter Form 1099-K as received. It is essential that the full amount be entered.

- For a description, include Form 1099-K and Personal Property Sales

- Next, enter an adjustment to reflect the cost of these items as an offsetting, negative amount up to the amount of the income.

- For the cost description, include Form 1099-K and Cost of Personal Property

- In other words, if the goods cost you $100 and Form 1099-K was for $10 in sales, the maximum cost allowable would be $10.

- First, enter Form 1099-K as received. It is essential that the full amount be entered.

[Edited 02/06/2021 | 11:28 AM PST]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

@jeremyr3 wrote:So in my instance, if I have $10,000 in sales but the cost of those goods sold to my was $9700, I claim the hobby income off $300?

The TCJA says hobby expenses are not deductible. I assume that this means paypal fees, shipping, etc are not deductible, but to calculate hobby income received I can still take sales - the cost of the goods sold?

Yes.

Despite what the other person said, you can NOT claim a hobby is a business just because it has a better tax result.

As for the 1099-K, you could just ignore it. It is possible that the IRS would send you a notice, and then you could reply back explaining the situation and showing the $300 reported as a hobby.

Or you could enter that income as a business, then "back it out" by entering an equal amount as an "other deduction" (you could call the "other deduction" something like "hobby, reported elsewhere on return"). Doing that would likely avoid the IRS notice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

I sold misc things on Etsy and Ebay and got a 1099-K from PayPal. The amount of transaction was $682.24. Do I just report this the same way in the second option you mentioned--Misc Income? I don't have any costs to figure up. I don't keep track of those types of things because I really haven't been running it as a business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

Yes, you can follow my Option 2 for reporting Form 1099-K from PayPal particularly for used goods, such as you would sell in a garage sale.

However, if the items sold were original creations, then you must determine if it is either a hobby or a business.

- Hobbies report all income and are not allowed to deduct expenses. This is a change in the tax law and will be in effect from 2018-2025.

- Business activity is captured in the self-employed income & expenses. If there are losses more than 2 out of the last 5 years, the IRS may reclassify the business as a hobby and disallow the expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

Great. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

One more question. The majority of the $682.24 was from selling on eBay or FB marketplace. I was just cleaning out things around the house. I did not keep up with any expenses or how much the original items cost. Can I just claim it as hobby income and not put any expenses for it?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

Yes, that is allowed, as well. It will produce some tax. This would be the most conservative option.

However, if you had things around the house, at various dates, if these items were purchased at some time, then it is still conservative to claim cost. The full cost is not being applied, only up to the amount of the sale.

You're welcome @tmundy ~ we are happy to help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

OK, I see what you are doing here. It seems like there are multiple ways to do what I want. Under Other Miscellaneous Income I will have a positive and corresponding negative income. Will this raise any eyebrows at the IRS?

A couple of questions, some of the items i sold were older items that I have no receipt for and many sold for far less then what they were purchased for. Am I safe to zero that out by assuming the cost = to the price i sold for.; No loss and no gain? Or since I don't have the receipts, do I have to assume that is all income?

Concerning hobby, why is there such confusion with backing out the cost of goods sold? Some say you can reduce the income by the cost of goods sold, others say you cant.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

Hobby income (and expenses) is entered by using Other Miscellaneous Income. under Less Common Income. The full amount of your hobby income that is received should be included here. You do not need to use a minus sign for the entry of your hobby expenses.

To be clear, hobby expenses are not allowed to be used after December 31, 2017, due to the Tax Cuts and Jobs Act (TCJA). Even though you enter them they will not be used for 2020.

Personal items sold at a loss are not deductible and do not need to be reported, such as clothes, household items or other personal purchases. Keep good records of all sales (and purchases you do have available). Also keep a good record of what income you did not report that related to these items.

Personal items sold at a gain are taxable and should be reported on Schedule D. This could include your knives, however you specifically state you purchase them for resale. You must decide if you are in the business of buy and reselling knives or if this is strictly a hobby.

Backing out the cost of goods sold: This can be done if you are self-employed. If you decide this is a hobby, then the cost of goods, including shipping, etc cannot be backed out before reporting the income. The IRS is very clear on this point.

Use the guides provided by @KathrynG3 to make your determination of your status and then use the correct entry for this income.

To report this activity as self employment use the Search (upper right) > Type Schedule C > Press Enter > Click the Jump to... link, then continue to enter your information about this business. This will require TurboTax Self-employed or TurboTax Desktop version.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

@DianeW777 wrote:then the cost of goods, ... cannot be backed out before reporting the income.

The IRS is very clear on this point.

That is wrong. Yes, the IRS is very clear on the point that COGS is deductible.

Tax Code Section 183 is about hobbies ("activities not engaged for profit") and Regulation §1.183.1(e) says: The taxpayer may determine gross income from any activity by subtracting the cost of goods sold from the gross receipts so long as he consistently does so and follows generally accepted methods of accounting in determining such gross income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

I went back and looked over each transaction from PayPals 1099-k and there weren't any Etsy sales--I was mistaken. All of it but $250 was money for goods sold that I was getting rid of around the house, whether it was sold on eBay or Facebook Marketplace. The $250 was where a relative paid me to make a cake for a wedding. So the entire $682.24 needs to be accounted for under hobby income? I'm not running a business at all doing this. I didn't know if I could just put down the 250 for the cake as hobby income and not count the rest. But then there would be a discrepancy on what the IRS sees from the PayPal form.

I apologize for the confusion--this stuff is hard to understand and I don't want to do the wrong thing. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

Do report the Form 1099-K as received so that the IRS can match it in their system.

For your offset, enter two amounts:

1. Enter the amount of sales for personal goods as a negative amount.

2. Enter the cost of the cake supplies as a negative amount.

To clarify the steps more for this, try:

First, enter Form 1099-K as received. It is essential that the full amount be entered. Be sure to include in the description: Personal Property Sales and Other Income

Next, repeat this process with the cost of the items sold. The IRS allows a deduction for personal property up to the amount of the sale.

- You should be at Other Miscellaneous Income Summary with the Personal Property Sales amount listed.

- Select +Add Another Income Item on the lower left side.

- At Other Taxable Income enter Cost of Personal Property for description and the negative amount and Continue. (To continue with the example, the amount would be -100.)

- Now returned to Other Miscellaneous Income Summary, select Done.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

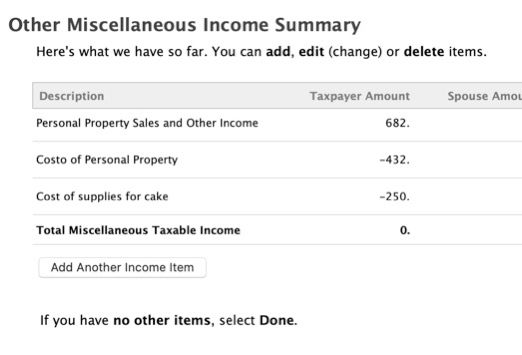

So it should look like this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

Yes, this is what your Miscellaneous Income Summary would look like if you are trying to match 1099-K proceeds with the cost of the items you sold to generate those proceeds. This would be an appropriate method of reporting casual (non-business) sales of personal property when the proceeds are reported on a 1099-K.

(Except for the cake - what is that?)

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

janainasferreira14

New Member

CluelessCamper

Level 1

Texyman

Level 1

wedajohnsons

New Member

james-charles-patterson

New Member